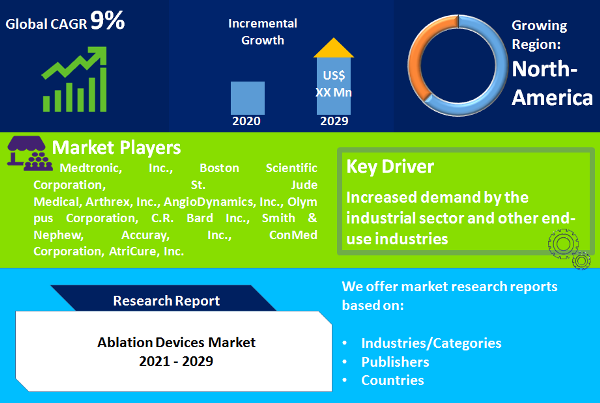

Ablation Devices Market are at present used in varied healthcare areas such as orthopedic, dermatology, cardiology, gynecology, neurology and several others. Global growth in preference for minimally invasive procedures is helping drive the demand for ablation devices. Major factors supporting the rise in ablation treatments include groping preference from senescent patients andhigh prevalence of chronic diseases. Rising awareness in patient population about availability and benefits from ablation treatments and overcoming the cost constraints of conventional treatments are further anticipated to support the growth of this market.

For the purpose of this study, the global ablation devices market is studied for segments based on device types, energy type, applications and geography. Generators, catheters and probes, and disposables and accessories are the three major device categories of this market. Ablation devices are available based on energy sources such as electrical, radiofrequency, cryoablation, radiation, laser, ultrasound, microwave and hydrothermal. The major application areas of ablation treatments are tumor management, general surgery, cardiology (cardiac rhythm management and hypertension treatment), pain management, aesthetics, gynecology and others. Market size and forecast (USD Mn) for the period 2020-2033 are provided in the report along with the respective CAGRs (Value %) for the forecast period 2025-2033.

Market size and forecast for each segmentation level are incorporated in this study for the period 2020-2025, along with respective Compounded Annual Growth Rates (CAGRs) for the forecast period 2025-2033, considering 2021 as the base year.

Along with market assessment in terms of historical, current and future market sizes, qualitative information sets such as market dynamics (drivers, challenges and opportunities), attractive investment proposition, Porter’s five forces assessment and executive summary for the global ablation devices market are included in the report. Competition assessment for major market players and attractive investment proposition tool for the geographic markets are also included in the report for overall market competition scrutiny. This study concludes with company profiles section, which includes major information about the key companies engaged in development, manufacture and sale of ablation devices.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Ablation Devices market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Devices

| |

Energy Type

| |

Applications

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report