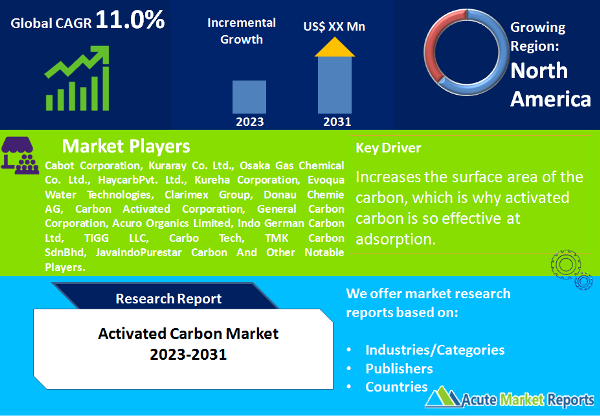

Activated carbon, also known as activated charcoal, is a highly porous form of carbon with a large surface area that is specially treated or "activated" to make it highly adsorbent. It is commonly used for a wide range of applications due to its ability to capture and remove impurities, contaminants, and unwanted substances from gases, liquids, and solids. The activation process involves heating carbonaceous materials such as wood, coconut shells, coal, or peat to high temperatures in the presence of an oxidizing gas (usually steam or air). This process creates numerous small pores and increases the surface area of the carbon, which is why activated carbon is so effective at adsorption. Activated carbonmarket is projected to advance at a CAGR of 11.0% from 2024 to 2032.

Environmental Regulations and Water Purification

Environmental regulations and the growing concern for water purification have been significant drivers of the activated carbon market. Activated carbon is widely used to treat water and wastewater to remove contaminants, odors, and impurities. With increasing environmental awareness and stringent water quality standards, both governmental and industrial entities are investing in water treatment solutions. Activated carbon's exceptional adsorption capabilities make it a preferred choice for removing organic and inorganic pollutants, disinfection byproducts, and heavy metals from drinking water and industrial wastewater. As governments worldwide implement stricter regulations to safeguard water resources and public health, the demand for activated carbon in water treatment applications is expected to rise. Amendments to water quality standards and environmental protection laws often drive the adoption of activated carbon in water treatment processes. Reports of successful water treatment projects using activated carbon underscore its efficacy in addressing water quality challenges.

Air Pollution Control and Gas Purification

The need for air pollution control and gas purification in industrial and environmental contexts has propelled the growth of the activated carbon market. Activated carbon is employed to capture and remove volatile organic compounds (VOCs), hazardous air pollutants (HAPs), and other harmful gases from industrial emissions, exhaust gases, and indoor air quality control systems. The escalating concerns related to air quality and health, along with the expansion of industries such as petrochemicals, pharmaceuticals, and automotive manufacturing, have led to increased adoption of activated carbon as an effective solution for gas-phase purification. As air pollution control measures become more stringent, the demand for activated carbon in gas treatment applications is expected to surge. Case studies and industry reports frequently highlight the role of activated carbon in mitigating air pollution and improving indoor air quality. Evidence of reduced emissions and improved workplace safety underscores its effectiveness.

Rising Focus on Mercury Removal

The rising focus on mercury removal from various industrial processes and emissions has been a significant driver of the activated carbon market. Mercury is a highly toxic heavy metal that poses environmental and health risks when released into the atmosphere or water bodies. Activated carbon is a recognized adsorbent for mercury capture and removal, offering a cost-effective and reliable solution. As awareness of mercury's harmful effects grows, industries such as coal-fired power plants, cement manufacturing, and waste incineration are increasingly adopting activated carbon-based solutions for mercury control. Furthermore, the Minamata Convention on Mercury, a global treaty aimed at reducing mercury emissions, has further accelerated the demand for activated carbon in mercury removal applications. Regulatory compliance and industry reports often emphasize the importance of mercury removal, with activated carbon solutions being a preferred method. Success stories and research studies demonstrate the effectiveness of activated carbon in reducing mercury emissions.

Price Volatility of Raw Materials

A notable restraint in the activated carbon market is the price volatility of raw materials used in its production. The primary raw materials for activated carbon production include coal, coconut shells, wood, and other organic sources. Fluctuations in the prices of these raw materials can impact the overall production cost of activated carbon. Factors such as changes in supply, global economic conditions, and geopolitical events can lead to price volatility. This, in turn, affects the pricing of activated carbon products, making it challenging for manufacturers and end-users to predict costs accurately and plan long-term investments. Additionally, price fluctuations may influence the competitiveness of activated carbon compared to alternative solutions, impacting market dynamics.

Coal-Based Activated Carbon Is Anticipated to Lead the Market by Raw Material

The activated carbon market can be segmented by raw material source, with coconut shell-based activated carbon expected to exhibit the highest CAGR. Coconut shell-based activated carbon is prized for its high adsorption capacity and sustainability, making it increasingly preferred in various applications.In terms of revenue, coal-based activated carbon is anticipated to lead the market. Coal-based activated carbon remains widely used in gas purification, air pollution control, and water treatment applications due to its cost-effectiveness and well-established production processes.

PowderedActivated Carbon Dominates the Market by Form

The market segmentation by form reveals that granular/crushed activated carbon is expected to have the highest CAGR. Granular activated carbon is versatile and widely used in water treatment and gas-phase applications, providing excellent adsorption properties.In terms of revenue percentage, powdered activated carbon is likely to dominate the market. Powdered activated carbon is favored for its fine particle size, which allows for greater surface area exposure and efficient adsorption, particularly in water and liquid phase treatment.

North America Remains as a Global Leader

Geographically, Asia-Pacific is expected to experience the highest CAGR in the activated carbon market. Rapid industrialization, urbanization, and stringent environmental regulations in countries like China and India are driving the demand for activated carbon in various applications.In terms of revenue percentage, North America is projected to lead the market. The region has well-established industrial and environmental sectors, contributing to a steady demand for activated carbon in air and water treatment.

Competitive Trends

The activated carbon market features several key players, including Cabot Corporation, Kuraray Co. Ltd., Osaka Gas Chemical Co. Ltd., HaycarbPvt. Ltd., Kureha Corporation, Evoqua Water Technologies, Clarimex Group, Donau Chemie AG, Carbon Activated Corporation, General Carbon Corporation, Acuro Organics Limited, Indo German Carbon Ltd, TIGG LLC, Carbo Tech, TMK Carbon SdnBhd, and JavaindoPurestar Carbon, among others. These companies compete by offering a range of activated carbon products tailored to specific applications. Key strategies in the market include product diversification, research and development of advanced activated carbon formulations, and expanding market presence through strategic partnerships.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Activated Carbon market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Raw Material

| |

Form

| |

End-Use

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report