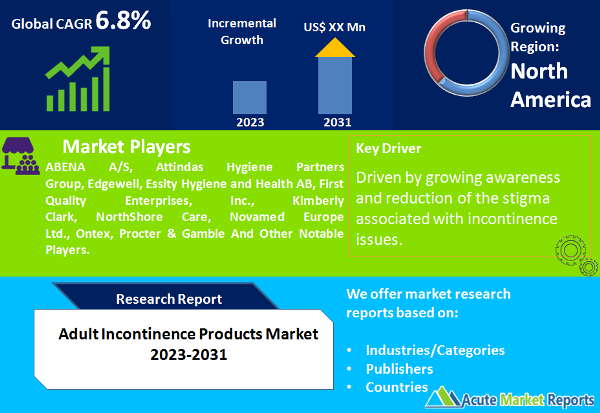

The adult incontinence products market revolves around the manufacturing and distribution of products designed to manage incontinence issues in adults. These products include diapers, pull-up underwear, liners & guards, waterproof covers, and others. Incontinence is a common issue among elderly individuals, as well as those with certain medical conditions or disabilities. The market caters to the growing demand for discreet, comfortable, and effective solutions that enable affected individuals to maintain their quality of life with dignity. The global adult incontinence products market is expected to expand at a CAGR of 6.8% during the forecast period from 2024 to 2032, driven by growing awareness and reduction of the stigma associated with incontinence issues.

Aging Population Demographics

One of the primary drivers of the adult incontinence products market is the global demographic shift toward an aging population. As the average age of the world's population increases, the prevalence of age-related incontinence issues rises as well. This demographic trend has led to a sustained increase in demand for adult incontinence products. Evidence supporting this driver includes statistical data on the aging population in developed and emerging economies, indicating a substantial increase in the number of elderly individuals who may require these products.

Increasing Awareness and Reducing Stigma

Another significant driver is the growing awareness and reduction of the stigma associated with incontinence issues. Improved education and awareness campaigns have encouraged affected individuals to seek help and adopt incontinence management products. Additionally, healthcare professionals are now more proactive in diagnosing and treating incontinence, further driving the demand for these products. Evidences include studies showcasing the impact of awareness campaigns and surveys indicating reduced embarrassment among incontinence sufferers.

Technological Advancements and Product Innovation

Technological advancements and innovations in the design and functionality of adult incontinence products have driven market growth. Manufacturers have focused on developing products that offer superior absorbency, comfort, and discretion. Innovations include advanced materials, moisture-wicking technologies, odor control features, and more. These innovations have not only improved the performance of these products but have also expanded the market by attracting a wider consumer base. Evidence includes product development announcements and customer feedback on the benefits of technologically advanced incontinence products.

Cost and Accessibility

While the adult incontinence products market has experienced growth, one significant restraint is the cost associated with these products and their accessibility to all segments of the population. High-quality, technologically advanced products can be expensive, making them less accessible to individuals with limited financial resources. Additionally, in certain regions, access to these products may be limited, hindering market growth. Evidences include pricing data and reports on accessibility challenges in underserved areas.

Diaper Segment Dominates Market by Product Type

In 2023, the "Diaper" segment typically holds the highest revenue. Diapers are a fundamental and widely used product category within the adult incontinence market. They are designed to provide comprehensive and effective protection for individuals with varying levels of incontinence. Diapers offer high absorbency, comfort, and convenience, making them suitable for both daytime and night-time use. Their popularity stems from their ability to provide discreet and reliable incontinence management. As a result, the revenue generated by the diaper segment tends to be the highest among all product types in the adult incontinence market.

After that, pull-up underwear and liners & guards have exhibited the highest compound annual growth rate and generated the highest revenue. Pull-up underwear offers convenience and discretion, making them popular among users, while liners & guards provide an additional layer of protection.

Heavy Absorbency Dominates Market by Absorbency Level

Among all products designed for heavy absorbency and overnight use have shown both the highest CAGR and generated the highest revenue in 2023. Products designed for heavy absorbency are specifically tailored for individuals with more severe incontinence issues. These products are capable of absorbing larger volumes of liquid and are suitable for prolonged use, such as during the night-time. Due to their ability to provide extended protection and comfort, products with heavy absorbency levels are in high demand, making this segment the leader in terms of revenue generation within the adult incontinence market.

North America remains as Global Leader

In terms of geographic trends, North America is expected to exhibit the highest CAGR during the forecast period. This growth is driven by factors such as the aging population, increased awareness, and technological advancements. North America, particularly the United States and Canada, has a significant aging population. With the baby boomer generation entering their senior years, there is a substantial increase in the number of elderly individuals who may require adult incontinence products.However, the Asia-Pacific region is expected to lead in terms of revenue percentage, owing to its large population base and a rising awareness of incontinence management products.

Competitive Trends

The adult incontinence products market features several key players, including ABENA A/S, Attindas Hygiene Partners Group, Edgewell, Essity Hygiene and Health AB, First Quality Enterprises, Inc., Kimberly Clark, NorthShore Care, Novamed Europe Ltd., Ontex, and Procter & Gamble. These companies have adopted strategies such as product innovation, expansion into emerging markets, and strategic partnerships to maintain their competitive edge. They are expected to continue focusing on product development to meet evolving consumer demands, especially in terms of comfort, performance, and eco-friendliness.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Adult Incontinence Products market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Absorbency Level

| |

Size

| |

Usability

| |

End-User

| |

Price

| |

Distribution Channel

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report