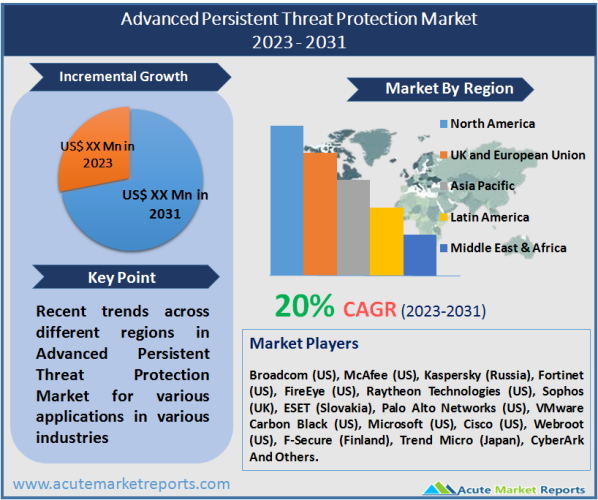

The global Advanced Persistent Threat Protection Market is expected to grow at a CAGR of 20% throughout the forecast period of 2024 to 2032. Increasing security breaches and advanced cyberattacks such as zero-day exploits, persistent threats, malware, and ransomware; stringent government regulations toward the adoption of APT protection policies; and the proliferation of cloud-based APT protection solutions and services are the major factors driving the market. In the middle of the COVID-19 pandemic problem, numerous governments and regulatory bodies need both public and commercial enterprises to adopt new remote working and social distance practices. Since then, several firms have adopted digital business practices as their new business continuity plan (BCP). With the widespread usage of BYOD devices, the work-from-home (WFH) trend, and internet penetration in every part of the globe, individuals are becoming increasingly reliant on digital technology, hence increasing the need for APT defenses. APT protection solutions enable enterprises to maintain business continuity and security postures in the face of cybercrime and malicious threat actors.

Rising Security Breaches and Cyberattacks Owing to The Pandemic Are Driving Market Dynamics

Cyber threats not only hinder the productivity of businesses but can cause damage to their vital IT infrastructure and sensitive data. There is an increase in the frequency of cybercrimes due to the rapid expansion of digital transactions across all industrial verticals. Increased enterprise data breaches and data leaks are driving demand for cybersecurity products and services. This increase is attributable to technologies like ML, which enable attackers to generate several variants of harmful code every day. In addition, since mid-January, organized crime gangs have started constructing assault infrastructure. Mark Monitor indicates that since mid-January, approximately 100,000 COVID-19-related domains have been registered, with the highest rate occurring between 11-18 March. In addition, Malwarebytes claims that cybercriminals and state-sponsored APT groups have begun employing COVID-19 lures. Included in these attacks are lure documents containing links to malicious Microsoft Office templates, malware macros, RTF exploits utilizing OLEI-related vulnerabilities, and malicious LNK files.

Technological Advancements in The Past Coupled with A Favourable Digital Infrastructure

China owns the second-largest proportion of the global advanced persistent threat protection market at 15% of the revenue share. Increasing data accessibility and dependability are driving the adoption of these services by a variety of enterprises. In addition, the market for advanced persistent threat protection has shifted from classic, unsophisticated malware attacks to advanced and zero-day attacks, creating a hospitable climate for the adoption and development of advanced persistent threat security technologies in the region.

Lack Of Enterprise Awareness on APT to Restrain the Market Growth

Advanced persistent threats are highly targeted, persistent for an extended period, and diversified in character. As the corporate environment evolves, so do the security requirements, as dozens of new zero-day threats surface. This ignorance of advanced security risks places businesses at risk and restrains the growth of the market for advanced persistent threat prevention. There is a significant knowledge gap among businesses regarding APTs and how to defend against them.

Proliferation Of Cloud-Based Solutions and Services for APT Defence to Widen Market Opportunities

With the proliferation of a trillion terabytes of sensitive data into the cloud, security concerns have increased as cyber attackers have become a serious threat. Companies that rely excessively on cloud-based models are now more vulnerable than ever to various cyber dangers. Security is an ongoing and continuous activity that tries to identify risks and uncertainties in real-time. Due to the vast volume of data created by IoT devices, data loss prevention tools, and security information (security solutions) in Industry 4.0, data breaches have become exceedingly common. Consequently, corporations are implementing advanced analytics, robust access restrictions, and technology to combat these data breaches.

Complexities Of Advanced Threats to Challenge the Market Expansion

Globally, cybercriminals are experimenting with novel methods to exploit mobile devices. Each month, multiple new kinds of mobile phone-targeting malware are discovered. APT protection and targeted threats have greatly expanded in volume, breadth, and sophistication during the past five years, becoming the most serious security challenge for any firm. Cybercriminals deploy sophisticated assault strategies to access corporations' networks and steal data, making organizations susceptible to attack. Understanding the sorts of cyberattacks has gotten difficult due to the diversity of threats. The APT protection market faces a formidable task in addressing the complexity of advanced threats.

The Large Businesses Segment Within the Market by Enterprise Size Led the Market In 2023

Large firms are businesses with more than one thousand employees. These firms make substantial investments in cutting-edge technologies to increase their overall productivity and efficiency. Large businesses are increasingly choosing APT protection solutions and are anticipated to invest heavily in advanced APT protection solutions to ensure optimal security for their firms' intensely competitive environments. APTs are more likely to target organizations and businesses that contain vast quantities of sensitive and personal information, such as those in the BFSI, government, healthcare, telecom, and education sectors. Large corporations have chosen APT protection solutions due to their extensive usage of cloud and Internet of Things (IoT) services that are especially susceptible to cyberattacks. In addition, rigorous regulatory pressure is pushing the need for APT protection solutions and increasing awareness of cyber risk. For instance, the CCPA is one of the strictest data privacy laws in the United States.

Intrusion Detection System/Intrusion Prevention System (IDS/IPS) Segment Dominates the Market by Solutions In 2023

The growth of the intrusion detection system/intrusion prevention system (IDS/IPS) sector in the advanced persistent threat protection market can be ascribed to reasons such as increased security threats, data breach fears, and a constantly changing regulatory landscape. Cyberattacks, such as malware, ransomware, and denial of service (DoS), can damage an enterprise's existing security systems.

These security breaches have negative long-term effects on firms in terms of restoring customer trust and mending broken relationships. As a result, enterprises throughout the globe have deployed enhanced security systems, driving demand in the market for intrusion detection and prevention systems. For these reasons, the intrusion detection system/intrusion prevention system (IDS/IPS) segment maintained the biggest share of 25% in the advanced persistent threat protection market by component in 2023.

Financial Segment Remains the Dominant End User Vertical in 2023

It is estimated that the finance segment will dominate the advanced persistent threat protection market with a 25% revenue share, due to factors such as the increasing adoption of online payment systems and the rising technological advancement in fin-tech companies to ensure consumer data protection, among others.

This market expansion can be attributable to several factors, including the growing acceptance of APT protection solutions and services in the BFSI and government sectors. In addition, the rising amount of cyberattacks aiming at stealing public data from government websites creates favorable conditions for the implementation of advanced persistent threat protection systems. Increasing APT Solution Deployment in the Healthcare and Banking Sectors is Fostering the Growth of the Advanced Persistent Threat Protection Market in India.

North America Remains the Global Leader, While APAC is the Growth Leader

North America is dominate the global advanced persistent threat protection market with a share of 28% in 2023. Increased investment in R&D activities, resulting in the introduction of new technologies in the APT protection market, and the presence of the majority of market players, namely IBM Corporation and McAfee LLC in the North American region are the primary factors driving the market growth of advanced persistent threat protection in the North American region.

North America's sustainable and well-established economies enable it to invest heavily in Research and Development (R&D) operations, thereby contributing to the development of new technologies in the market for APT security. The presence of the vast majority of leading industry participants in the APT protection market is anticipated to be the primary factor driving market expansion in this region. Broadcom, McAfee, Fortinet, FireEye, Raytheon Technologies, Palo Alto Networks, VMware Carbon Black, Microsoft, Cisco, Webroot, and CyberArk are the major APT prevention market vendors in the region. The dominance of APT protection market players in North America is anticipated to propel market expansion worldwide.

Asia Pacific is expected to develop at the quickest rate from 2024 to 2032, at a CAGR of 26%. This trend is influenced by increasing government laws and technological advances, as well as the expanding adoption of machine learning (ML), the Internet of Things (IoT), big data analytics, and artificial intelligence (AI) across the Asia Pacific area. Moreover, this region is home to a huge number of established small and medium-sized businesses (SMEs) that are expanding at a respectable rate to serve their extensive client base. The fact that SMEs are focusing on installing APT security solutions to manage their company data is a factor impacting market growth in the South Asia-Pacific region.

Competition to Intensify During the Forecast Period

In December 2020, Fortinet partnered with Amazon Web Services (AWS) to provide customers with enhanced security across their cloud platforms, apps, and networks.

In November 2020, Trend Micro and Amazon launched AWS Network Firewall to simplify the installation of necessary network security for Amazon Virtual Private Clouds (Amazon VPCs) on Amazon Web Services (AWS).

Broadcom (US), McAfee (US), Kaspersky (Russia), Fortinet (US), FireEye (US), Raytheon Technologies (US), Sophos (UK), ESET (Slovakia), Palo Alto Networks (US), VMware Carbon Black (US), Microsoft (US), Cisco (US), Webroot (US), F-Secure (Finland), Trend Micro (Japan), and CyberArk are among the technology vendors active in the market. The APT protection market study includes the following start-up vendors: RevBits (US), Wijungle (India), BluVector (US), Aristi Labs (India), Securden (US), Red Sift (England), ZecOps (US), and XM Cyber (US) (Israel). To increase their presence in the APT protection market, these firms have employed several growth tactics, including partnerships, agreements, collaborations, new product launches, product enhancements, and acquisitions.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Advanced Persistent Threat Protection market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Offering

| |

Solutions

| |

Services

| |

Deployment Mode

| |

Organization Size

| |

Vertical

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report