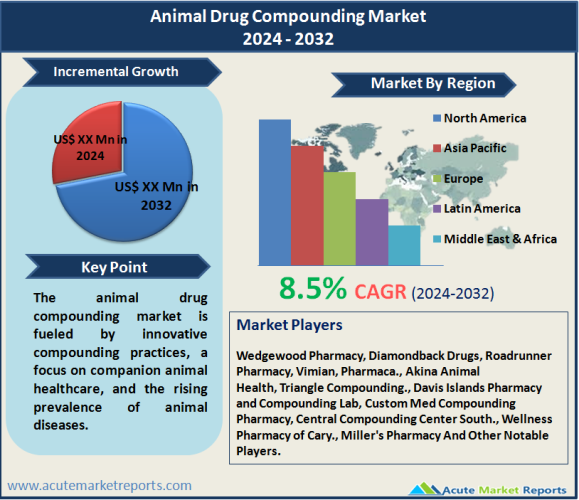

The animal drug compounding market is expected to grow at a CAGR of 8.5% during the forecast period of 2024 to 2032, fueled by innovative compounding practices, a focus on companion animal healthcare, and the rising prevalence of animal diseases. While regulatory challenges pose considerations, the market's segmentation reveals diverse trends, with certain segments like Anti-infectives, companion animal drugs, capsules, and oral administration leading in both revenue and CAGR. Geographically, North America stands out as a frontrunner, indicative of the region's proactive approach toward personalized animal healthcare. The competitive landscape showcases key players navigating the market through strategic initiatives. This factual overview provides a comprehensive understanding of the market dynamics, setting the stage for informed decision-making in the evolving landscape of animal drug compounding.

Key Market Drivers

Innovative Compounding Practices

The market experiences a surge driven by innovative compounding practices, enhancing the availability and efficacy of customized animal drugs. Veterinarians increasingly leverage compounding to address specific therapeutic requirements, promoting better treatment outcomes. Evidence suggests a growing adoption of compounding techniques, exemplified by the expansion of compounding pharmacies and tailored drug formulations.

Growing Focus on Companion Animal Healthcare

The increasing emphasis on companion animal health serves as a significant driver. With rising pet ownership and a cultural shift toward viewing pets as family members, there is a heightened demand for specialized compounded medications tailored to individual animal needs. This trend is substantiated by an uptick in spending on companion animal healthcare services and products.

Rising Prevalence of Animal Diseases

The surge in animal diseases, particularly chronic conditions, propels the demand for compounded drugs. Evidence indicates a notable increase in the incidence of conditions requiring specialized treatments, such as chronic pain management and dermatological issues. Compounded drugs address these specific health challenges, contributing to the market's upward trajectory.

Restraint: Regulatory Challenges and Compliance Issues

Despite the market's growth, regulatory challenges and compliance issues emerge as significant restraints. Evidence points to instances where compounding practices face scrutiny due to concerns about quality control, standardization, and adherence to regulatory guidelines. These challenges pose a potential impediment to the seamless expansion of the animal drug compounding market.

Market Segmentation Analysis

Market by Product

In 2023, the market witnessed diverse product segments, including Anti-infectives, Anti-inflammatories, CNS Agents, GI Drugs, and others. Anti-infectives led in both the highest revenue and CAGR, showcasing their critical role in addressing a spectrum of infections. The forecast expects sustained leadership, emphasizing the continued demand for effective animal infection management.

Market by Animal Type

Companion animals and livestock represented the primary animal types in the market. In 2023, companion animal drugs led in both revenue and CAGR. The bond between pet owners and their animals drives the demand for specialized medications, indicating a sustained focus on companion animal healthcare in the forecast period.

Market by Dosage Form

Dosage forms, including capsules, solutions, powders, suspensions, and others, marked the market segmentation. Capsules emerged as the leader in both revenue and CAGR in 2023, reflecting their ease of administration and precise dosing. The forecast anticipates capsules to maintain their dominance, aligning with consumer preferences for convenient and accurately dosed medications.

Market by Route of Administration

The route of administration, encompassing oral, injectable, topical, rectal, and ocular routes, witnessed diverse preferences. In 2023, oral administration led in both the highest revenue and CAGR. The ease of oral drug administration and patient compliance contribute to the sustained prominence of this route in the forecast period.

North America Remains the Global Leader

Geographically, the market exhibits trends shaped by regional preferences and healthcare landscapes. North America, with its established veterinary infrastructure and a high focus on companion animal healthcare, led to both the highest revenue in 2023 and CAGR during the forecast period of 2024 to 2032. The region's proactive adoption of innovative compounding practices and a growing awareness of personalized animal healthcare contribute to this leadership position.

Strategic Collaborations to Enhance Market Share

The animal drug compounding market is characterized by the presence of key players adopting strategic measures to solidify their positions. Leading companies such as Wedgewood Pharmacy, Diamondback Drugs, Roadrunner Pharmacy, Vimian, Pharmaca., Akina Animal Health, Triangle Compounding., Davis Islands Pharmacy and Compounding Lab, Custom Med Compounding Pharmacy, Central Compounding Center South., Wellness Pharmacy of Cary., and Miller's Pharmacy are notable players in the industry, contributing to the market's dynamic landscape. Top companies are strategically engaging in partnerships and collaborations with veterinary clinics and healthcare providers. These collaborations aim to enhance the accessibility of compounded drugs and streamline the integration of innovative compounding practices into veterinary care. The companies are also focusing on developing novel formulations and dosage forms to address evolving veterinary healthcare needs. By staying at the forefront of pharmaceutical innovation, companies are aiming to maintain a competitive edge in the market. In summary, competitive trends in the animal drug compounding market involve strategic partnerships, research and development initiatives, regulatory compliance, emphasis on specialized medications, and the expansion of service offerings.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Animal Drug Compounding market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Animal Type

| |

Dosage Form

| |

Route of Administration

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report