"Vehicle Automation as well as Safety and Emission Regulations to Boost the Demand for Automotive Electronics"

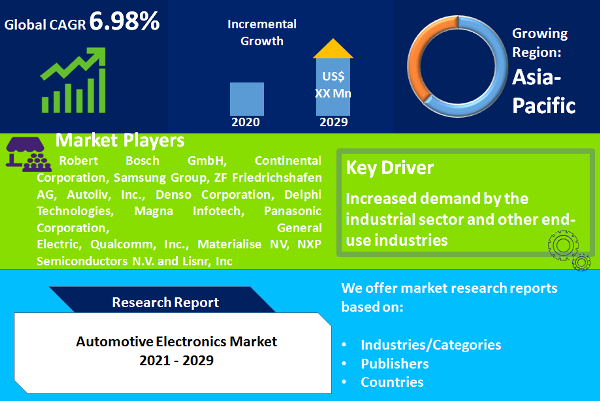

The global automotive electronics market was valued at US$ 311.3 Bn in 2020 and expected to witness a notable growth, expanding at CAGR of 6.98% during the forecast period from 2021 to 2029. Automotive electronics are specially-designed electronic systems employed in vehicles that includes ignition system, engine management system, entertainment systems in vehicle, carputers and telematics among others. Automotive electronics is capable of withstanding more extreme working temperatures as compared to commercial electronics. The primary purpose of automotive electronics in vehicles is to improve the overall performance of vehicle without affecting driver convenience. Automotive electronics system manufacturers are emphasizing more on the recent trends in automotive industry such as autonomous driving and electric & hybrid-electric vehicles. For instance, Hyundai Mobis in May 2021 announced the successful development of “Preview Air Suspension Technology” that predicts road & traffic conditions and on the basis of such upcoming navigation information, it automatically adjusts vehicle height & absorbs road shocks, providing comfortable & safe ride.

Automotive electronic systems such as ignition, transmission and engine electronics are important parts of motorcycles, trucks, buses, excavators, forklifts and off-road vehicles. Engine Control Unit (ECU) for modular transmission & engine control, sensor technology & signal processing algorithms, advanced driver assisting infotainment are among the technological advancements incorporated in automotive electronic systems of vehicles to obtain better overall performance. With the advancement in packaging sector, packaging for automotive electronic systems are being developed to withstand high temperature especially in the engine and transmission to sub-segments. Owing to such development, automotive electronics industry now aims to incorporate the engine control unit and transmission control unit on the engine and transmission systems respectively.

Growing demand for automation in vehicles for improved performance is accelerating automotive electronics market growth. Apart from this, the national and international norms for emission control, consumer awareness, fuel efficiency and other parameters have significant impact on the growth of automotive electronics market. Moreover, advent of electric and hybrid electric vehicles is expected to significantly boost automotive electronics market during the forecast period.

"Safety Systems accounted for the Largest Market Share in 2020"

Based on application, safety systems had major share in the overall revenue of automotive electronics market in 2020. Safety system is among the most essential automotive electronics systems and consists number of safety devices and accessories that ensure passenger, driver and pedestrian safety. Automotive electronics system manufacturers across the world realize the importance of safety and are constantly focusing on improving their offerings in providing fail-safe advanced systems. Increased consumer awareness along with government initiatives to implement global safety standards across the region are key factors driving the growth of safety systems in automotive electronics market.

"Asia Pacific Garnered Largest Market Share in 2020"

The global automotive electronics market, based on geography was led by Asia Pacific region in 2020 and is likely to remain dominant throughout the forecast period. Realizing the growing consumer base, increasing demand for automobiles and cost effective manufacturing, several multi-national automotive companies have shifted their production base in Asia Pacific, especially in India, China and Southeast Asia. Automotive manufacturers understand the importance of electronics systems in gaining an edge over competitors. The demand for such innovative and advanced automotive electronic components is fulfilled by electronic component manufacturing industries particularly in Malaysia, South Korea, Thailand and Taiwan.

Automotive electronics market players are adopting strategies such as new product development, mergers & acquisitions, partnerships and joint ventures to be competitive in consistently changing market dynamics and to cater the ever growing consumer demands. Key players considered in the automotive electronics market include Robert Bosch GmbH, Continental Corporation, Samsung Group, ZF Friedrichshafen AG, Autoliv, Inc., Denso Corporation, Delphi Technologies, Magna Infotech, Panasonic Corporation, General Electric, Qualcomm, Inc., Materialise NV, NXP Semiconductors N.V. and Lisnr, Inc. among others.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Electronics market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Vehicle Class

| |

Component

| |

Application

| |

Sales Channel

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report