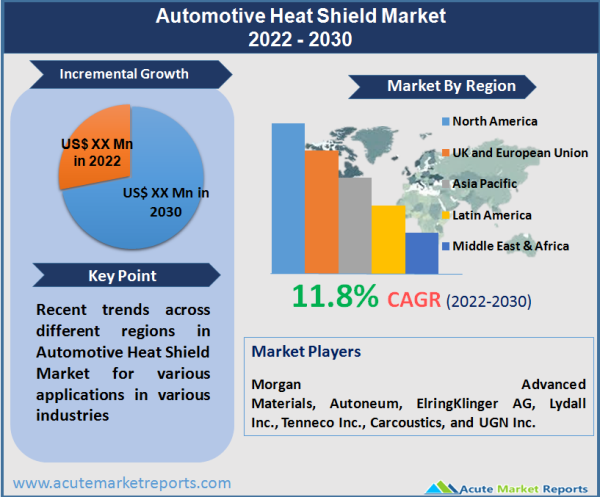

The market for automotive heat shields reached 11.8 billion US dollars in 2020, and it is anticipated to grow at a CAGR of 3.5% over the forecast period of 2023 to 2030. It is anticipated that increasing product use in the manufacturing of electric vehicles, lightweight and fuel-efficient passenger automobiles, and commercial vehicles will fuel the expansion of the market. The heat shield is an important component of a vehicle because it helps maintain ideal thermal comfort inside the car, protects delicate vehicle components from heat, and helps dissipate the excess heat that is generated by the vehicle itself. Additionally, the device aids in enhancing the power output of an engine by managing the temperature beneath the hood and reducing the temperature of the intake air. There is a possibility that the vehicle will not function to its full potential if it generates an excessive amount of heat and does not have adequate heat management. An engine that is too hot could end up producing less power and have its spark plugs fail if it gets too hot. As a result, making use of efficient heat shields is of the utmost importance in order to maintain vehicle temperatures and maximise fuel efficiency. The lithium-ion batteries that are used in battery-operated electric vehicles are the source of a considerable amount of the vehicle's generated heat. The lack of appropriate heat management and dissipation system has a significant impact on the lifespan of the battery and the driving range of the vehicle. As a result, during the course of the projected period, it is anticipated that the demand for products will be driven by the growing interest in electric vehicles.

The vast majority of the heat shields are constructed using lightweight metals like aluminium. The ores of bauxite, which are mined from the surface of the earth, are used to produce aluminium. However, the adoption of a variety of mining control legislation in different parts of the world has led to fluctuations in the price of aluminium on the global market. This has, in turn, had an impact on the profit margins enjoyed by various market participants. The pandemic caused by COVID-19 is going to have an adverse impact on the need for heat shields in the automotive industry. Since March 2020, major OEMs have halted the production of vehicles as a direct response to the worsening severity of the pandemic. The nationwide lockdowns and limitations caused a precipitous drop in the number of vehicles sold. Because of the epidemic, major original equipment manufacturers have also delayed the development of new vehicle technologies. In spite of the fact that original equipment manufacturers have resumed vehicle production in countries such as China and Japan, the initial demand for new vehicles following the shutdown is extremely low. This would be detrimental to the earnings of companies that manufacture heat shields. The producers of heat shields are coming up with unique sales methods by projecting a number of different possible future outcomes. Companies have plans to resume operations in countries in Europe, China, Europe, and Japan now that the pandemic is getting closer and closer to being contained. They are concentrating on a variety of methods relating to the engagement of their workforce, the continuity of their operations, and the management of their cash and liquidity. During the period covered by this research, these factors are anticipated to fuel growth in the market for automotive heat shields.

Increasing Emphasis on Light-Weighting and Fuel Economy Criteria Is the Primary Factor Driving the Market

Increasing fuel economy rules in the European Union, Japan, and China have prompted original equipment manufacturers to place a greater emphasis on the lightweighting of vehicles and the efficiency of their engines. In December of 2018, the European Commission introduced legislation that would establish criteria for fuel economy. It was hoped that by the year 2025, average CO2 emissions from passenger cars and vans could be reduced by 15%, and by the year 2030, by 37.5%. The authority set a goal to reduce emissions from light commercial vehicles by 15 percentage points by 2025 and 31% points by 2030. Heat shields made of a lightweight material would drastically lower the weight of the car and boost its fuel efficiency. In response to increasingly rigorous regulations on fuel efficiency, leading original equipment manufacturers (OEMs) are progressively implementing lightweight methods. Heat shield manufacturers are likewise focusing their efforts on providing lightweight and efficient heat shield solutions. For example, Tenneco, the industry leader when it comes to the production of heat shields, offers an ultra-lightweight corrugated aluminium heat shield. The firm claims that it improves thermal protection by 15–30% over aluminized steel while having up to 80% less mass than an aluminized steel heat shield. Aluminized steel heat shields are used in the comparison. In order to increase the fuel efficiency of a car, it is possible to utilise it in the catalytic converter, the exhaust manifold, and the turbocharger. As original equipment manufacturers design more fuel-efficient automobiles, more advancements of this kind are becoming apparent among makers of heat shields. Consequently, a greater emphasis on lightweighting and criteria for fuel efficiency will boost the demand for improved heat shields in the next automobiles.

The increased use of automotive heat shields is a direct result of the growing market demand for high-performance and high-mobility automobiles

The industry of automotive components has always been subject to scrutiny from regulatory authorities, and businesses in this sector are expected to conform to a variety of rules that are periodically distributed. The presence of such laws in the automotive sector compels original equipment manufacturers (OEM) to create products that are consistent with the regulatory environment that is currently in place. These requirements also call for lower carbon emissions from vehicles; as a result, manufacturers are concentrating on reducing the number of cylinders in order to keep the size of the engine to a minimum. In addition, in order to preserve the power output of the engine, a boosting device known as a turbocharger or supercharger is installed. This device requires a heat shield in order to function properly so that it does not overheat. It is anticipated that the growing use of turbochargers in spark ignition and compression ignition engines would function as a significant factor pushing the adoption of automobile heat shields. This is due to the fact that turbochargers are required to be equipped with heat shields by law.

Restrictions placed on internal combustion engine (ICE) cars by major countries Limiting Market Growth

In April 2020, 24 of the most important nations in Europe implemented new car tariffs depending on either the amount of fuel consumed or the amount of CO2 emissions. The major automotive manufacturers that operate in Europe are in the process of transitioning progressively toward the production of completely electric vehicles or mild hybrid vehicles. Instead of refining internal combustion engine (ICE) vehicles to comply with the laws, original equipment manufacturers (OEMs) are turning their focus and investing in electric propulsion. Despite the fact that the production of heat shields for electric vehicles would create new business prospects, the need for thermal management in EVs is far less than in ICE vehicles. Heat shields already in existence that were developed for ICE will not be effective. As a result, companies that make heat shields need to commit greater resources to the research, design, and development of heat shield solutions for electric vehicles (EVs). As a result, the demand for heat shields will be lower during the time period forecasted if the government places limits on internal combustion engine (ICE) cars and encourages the use of alternative power.

Environmental Goals Across Geographies is Promising Significant Opportunities

The automobile sector has always been subject to the regulations of authorities, and these regulations require strict adherence to the guidelines that are established in response to initiatives. Original Equipment Manufacturers (OEMs) are under pressure to design products that are consistent with the current regulatory environment. The regulations require that the size of the engine and the number of cylinders be decreased in order to reduce the amount of carbon emissions produced by automobiles. In order to keep the power output of engines at a high level, turbochargers or superchargers are often installed. In order to ensure efficient operation, the turbochargers have heat shields attached to them. Because heat shields are required to be placed with turbochargers by law, the market for automotive heat shields is likely to develop as the penetration of turbochargers and compression engines grow.

In addition, because environmental concerns are developing in every area of the world, the governments of various nations are working to establish more stringent rules in an effort to lower the levels of noise, vibration, and harshness (NVH) that are produced by light and heavy vehicles. Under the hood of a car, effective soundproofing shields are now being developed by original equipment manufacturers (OEMs) as well as companies in Tier I. Because of this, there will be a significant increase in the need for under-hood heat shields manufactured by companies.

An increase in the vehicle's weight due to Heat Shield is the Largest Challenge

The heat shield of an automobile contributes to an increase in the overall weight of the vehicle. The overall weight of the vehicle is affected by both the presence of metallic and non-metallic elements. Ongoing research is likely to soon contribute to the development of lightweight alternatives for shielding. Nevertheless, as of right now, the additional weight that is being added to the vehicle is being done so in order to satisfy the requirements of OEMs. A vehicle's fuel economy would suffer as a direct consequence of the additional weight it would have to carry. As a result, the added weight is one of the primary issues faced by manufacturers in the market for vehicle heat shields.

Single Shell Heat Shield Dominated the Product Segment

In 2021, the single shell heat shield held the leading position in the market and was responsible for more than 60% of the total revenue. The thickness of a single shell product ranges from 0.3 to 1.0 millimetres and is made from a single layer of aluminium foil. This heat barrier is quite effective against heat sources that have a temperature that is only moderately high. On the other hand, the larger space need is likely to act as a barrier to their widespread adoption during the course of the projected period.

Heat shields with a double shell are typically constructed using two sheets of aluminium with a thickness ranging from 0.3 to 1.0 millimetres. These items have a very low thermal expansion coefficient and can operate in temperatures ranging from very cold to around room temperature. The heat management of catalytic converters, turbochargers, and starter motors in automobiles are the primary applications for this material's utilisation.

Sandwich goods are utilised in the process of providing protection against temperatures that are exceptionally high. Because of its exceptional heat management property and relatively lower space needs, this product is utilised extensively in high-performance racing automobiles all over the world. Additionally, it is utilised as an insulating mat in electric vehicles for the purpose of providing protection for the battery packs that are mounted on the floor of the vehicle.

Over the course of the projected period, it is anticipated that the double-shell category would experience significant expansion. The majority of applications for heat management under the hood make use of these items. Their primary purpose is to assist in maintaining optimal vehicle performance by assisting in the regulation of the total temperature of the entire engine assembly.

Engine Compartment Segment Dominated the Application Market, Turbocharger to Lead the Growth

In 2021, the engine compartment segment was the most profitable and dominant in the market, accounting for more than 30.0% of the total revenue. It is common practice to make use of the heat shield when protecting the engine assembly from high temperatures. It's safe to say that an automobile's engine is the single most crucial component of the whole vehicle. It is possible for improper heat management to cause the engine to fail, which will also shorten the life of the engine assembly.

In an effort to slow the rate at which damage to the environment is accumulating, regulatory agencies all over the world are implementing increasingly strict standards for vehicle emissions. It is anticipated that the aforementioned trend will drive an increase in the demand for automotive turbochargers due to the fact that this device is kind to the environment and helps drivers achieve greater fuel economy in a variety of vehicle types. This will, in turn, drive the demand for the product.

Over the course of the forecast period, it is anticipated that the turbocharger application sector will expand at a CAGR that is the highest at 4.8%. It is anticipated that the expanding use of turbochargers in a variety of vehicles, including passenger cars, light commercial vehicles, and heavy commercial vehicles, will provide a significant boost to the expansion of the market throughout the course of the foreseeable future.

The ability of a vehicle engine assembly to effectively regulate its heat contributes to improvements in its performance, fuel efficiency, and service life. In addition, developments in production technology have made it possible to fabricate heat shields that take up less room than before. As a result, it is anticipated that the demand for this product will be driven in the foreseeable future by the growing need for fuel-efficient vehicles.

Metallic Sector Dominated the Market, Non-Metallic to Lead the Growth

In 2021, the metallic sector was the dominant player in the market and was responsible for more than 83% of the total revenue. The key driver that drove the segment was the widespread acceptance of the product across a wide variety of vehicle types. In addition, the product's malleability, durability, high-temperature resistance, and exceptional conductivity are all features that are anticipated to further boost demand for the product.

In most cases, metallic heat shields are fabricated using high-conductivity metals like aluminium, stainless steel, and others of the same ilk. Because of their equivalent conductivity, durability, and superior lightweight property, the many different types of metallic alloys are seeing increased demand as a result of the growing trend toward reducing the overall weight of the automotive assembly.

Over the course of the projected period, it is anticipated that the expansion of the non-metallic category will occur at the highest CAGR of 4.2%. Some of the major qualities that are projected to drive the market over the forecast period are superior heat dissipation property, flame resistance, and durability. The use of non-metallic heat shields in under-the-hood applications, such as protecting high-temperature hoses, is becoming increasingly common.

Because of their malleability, resistance to flame, and capacity to operate in temperatures that are exceedingly high, non-metallic materials are typically fabricated from composites or meta-aramid materials. In addition to this, the non-metallic heat shields are incredibly lightweight in comparison to their metallic counterparts. It is anticipated that as a result, throughout the course of the projection period, the segment's share will increase.

Passenger Cars Contributed to Over 75% of Revenue Share in 2021

In 2021, the market was headed by passenger cars, which also accounted for more than 75% of the total revenue worldwide. The growing demand for passenger automobiles in the Asia Pacific, the Middle East, and Africa is being driven in large part by an increase in per capita disposable income as well as an overall improvement in living standards in these regions. During the period under consideration, the light commercial vehicles (LCVs) market is anticipated to grow at a compound annual growth rate (CAGR) of 3.3%. It is anticipated that the primary factor driving the segment will be the growing demand for various types of LCVs, such as delivery vans and pickup trucks, from e-commerce and logistics companies in order to strengthen their last-mile delivery services. This will be the primary factor driving the segment.

In 2021, the electric cars market category accounted for 6% of total revenue. Materials that function as heat shields are an essential component of the assembly of electric vehicles. By removing and regulating the heat that is produced by lithium-ion batteries, they contribute significantly to the expansion of the driving range of the vehicle and the extension of the useful life of the batteries. Over the course of the forthcoming time period, it is anticipated that the heavy commercial vehicles (HCVs) market would experience significant expansion. It is anticipated that the growing use of liquefied natural gas (LNG) as an alternative to highly polluting diesel fuel will provide a significant boost to the demand for heavy commercial vehicles, which will, in turn, increase the demand for automotive heat shields in the heavy commercial vehicle (HCV) market segment.

APAC Remains as the Market Leader

In 2021, Asia Pacific was the most dominant region of the market and was responsible for approximately 35% of the total revenue. Because of the region's rapidly growing industrial sector, there is a growing demand for both light commercial vehicles and heavy commercial vehicles in order to provide efficient logistical services. In addition, the speedy development of the e-commerce industry has resulted in a considerable increase in the need for commercial cars, which has led to an increase in the demand for automotive heat shields.

In Europe, stringent vehicular pollution rules have been adopted, which has encouraged automobile manufacturers to use lightweight alloys in the fabrication of heat shield materials. One example of such an alloy is Al-Mg (Aluminum-Magnesium), which combines the elements aluminium and magnesium. Products that are lighter in weight help reduce the overall weight of the vehicle, which in turn improves the vehicle's fuel efficiency and its ability to dissipate heat.

Over the course of the projection period, it is anticipated that China would see growth at a rate of 4.5% each year. A strategy to achieve carbon neutrality in China by the year 2060 was presented by the country's President Xi Jinping in September 2020. It is anticipated that the country would foster wider adoption of electric vehicles as a result of this endeavour, which will, in turn, increase the product demand in electric vehicle applications.

In 2021, the market in North America brought in revenue equal to 2.5 billion US dollars. The key element that drove demand in the region was an increasing need for automobiles that are both lightweight and economical in their use of fuel. In addition, the existence of a highly developed automotive sector, in conjunction with the expanding use of electric vehicles, is anticipated to propel the expansion of the market throughout the period covered by the forecast.

Market Consolidation on-Way

Dana Incorporated from the United States, Morgan Advanced Materials from the United Kingdom, Autoneum from Switzerland, ElringKlinger AG from Germany, Lydall Inc. from the United Kingdom, Tenneco Inc. from the United States, Carcoustics from Germany, and UGN Inc. from the United States are just some of the leading manufacturers and suppliers in the automotive heat shield market. In order to achieve traction in the market, these organisations implemented inorganic and organic growth methods. Some examples of these strategies include the development of new products, expansions, supply contracts, collaborations, partnerships, and mergers and acquisitions. The most important companies on a worldwide scale are broadening their presence by consolidating their operations through mergers and acquisitions with other participants in the sector. Key participants in the industry are concentrating their efforts on the development of lightweight heat shield materials in order to meet the demand for lightweight components from car manufacturers. These businesses are gradually shifting their focus toward the use of cutting-edge materials, such as metal composites and materials made of meta-aramids, in order to improve the durability and flammability of their products. Companies are actively partnering with major car manufacturers in order to produce specialised heat shield materials that are suitable to meet the unique requirements of each of these manufacturers.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Heat Shield market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Billion |

| Segmentation | |

Application

| |

Material

| |

Function

| |

Product

| |

Vehicle

| |

Electric vehicle

| |

|

Region Segment (2022-2032; US$ Billion)

|

Key questions answered in this report