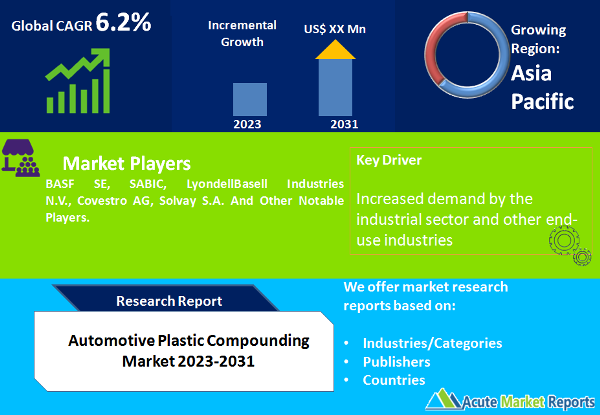

The automotive plastic compounding market is expected to witness a CAGR of 6.2% during the forecast period of 2024 to 2032, due to the increasing demand for lightweight and fuel-efficient vehicles, stringent emission regulations, and the growing adoption of electric vehicles. Automotive plastic compounding involves the process of combining different additives, fillers, and reinforcements with base polymers to enhance their mechanical, thermal, and electrical properties. This enables the production of high-performance plastic components for automotive applications. In terms of market revenue, the automotive plastic compounding market has experienced steady growth. The market is driven by the rising production of automobiles, especially in emerging economies, where the demand for affordable and efficient vehicles is high. Automotive manufacturers are increasingly turning to plastic compounds to replace traditional metal components due to their lightweight nature, cost-effectiveness, and design flexibility. Additionally, the incorporation of advanced technologies, such as electrification and autonomous driving, further fuels the demand for plastic compounds in the automotive sector. The compound annual growth rate (CAGR) of the automotive plastic compounding market has been favorable. The market is expected to continue growing at a steady pace due to several factors. The increasing need for reducing vehicle weight to improve fuel efficiency and reduce carbon emissions drives the demand for lightweight plastic components, which, in turn, boosts the market's CAGR. Additionally, the growing focus on sustainability and recyclability further supports the adoption of plastic compounds in the automotive industry.

Lightweighting Initiatives and Fuel Efficiency

One of the major drivers of the automotive plastic compounding market is the industry-wide emphasis on lightweighting initiatives and improving fuel efficiency. Plastic compounds offer a significant advantage in weight reduction compared to traditional metal components, contributing to improved fuel economy and reduced carbon emissions. Automotive manufacturers are increasingly adopting lightweight plastic compounds for various vehicle parts, including exterior body panels, interior components, and under-the-hood applications. This shift towards lightweighting is driven by stringent government regulations regarding fuel economy and emissions, as well as consumer demand for more fuel-efficient vehicles. Various automakers have implemented lightweighting strategies and increased the usage of plastic compounds in their vehicle designs. For example, Ford introduced an aluminum alloy body for its F-150 pickup truck, which significantly reduced the vehicle's weight. Additionally, BMW utilized carbon fiber reinforced plastic (CFRP) in its i3 electric vehicle to achieve a lightweight structure. These examples highlight the industry's focus on lightweighting and the role of plastic compounds in achieving this objective.

Design Flexibility and Versatility

The design flexibility and versatility offered by automotive plastic compounding drive its adoption in the industry. Plastic compounds can be molded into complex shapes, allowing for intricate and innovative designs. This flexibility enables automakers to create aerodynamic exteriors, ergonomic interiors, and unique styling elements. Furthermore, plastic compounds can be customized with different colors, textures, and finishes, enhancing the visual appeal of vehicles and providing a competitive edge in the market. The use of plastic compounds in automotive exterior and interior components showcases the design flexibility of these materials. For instance, many modern vehicles feature sleek and aerodynamic body panels, which are made possible through the use of plastic compounds that can be molded into intricate shapes. Interior components such as instrument panels, door panels, and center consoles often incorporate various textures, colors, and finishes achieved through plastic compounding processes.

Technological Advancements and Material Innovations

Technological advancements and material innovations in the field of automotive plastic compounding act as drivers for the market. Continuous research and development efforts aim to enhance the mechanical, thermal, and electrical properties of plastic compounds, making them more suitable for demanding automotive applications. The development of advanced additives, reinforcements, and fillers allows for improved heat resistance, flame retardancy, impact strength, and other desired properties. These advancements enable plastic compounds to meet the stringent performance requirements of the automotive industry. The introduction of materials like reinforced polypropylene (PP), polycarbonate (PC), and polyamide (PA) in automotive plastic compounding demonstrates the technological advancements in the field. These materials offer enhanced mechanical properties, chemical resistance, and thermal stability, making them ideal for critical automotive applications. The development of electrically conductive plastic compounds for electrical and electronic components in vehicles is another example of material innovation in the market.

Environmental Concerns and Sustainability

One significant restraint in the automotive plastic compounding market is the growing environmental concerns and the need for sustainability. The automotive industry is under pressure to reduce its environmental footprint and minimize the use of non-recyclable or non-biodegradable materials. Plastic compounds, although offering several advantages, often consist of polymers that are derived from fossil fuels and can contribute to plastic waste and pollution if not managed properly. As consumers and regulatory bodies become more conscious of environmental issues, there is a growing demand for eco-friendly alternatives and sustainable practices in the automotive sector. The shift towards sustainability in the automotive industry can be seen through various initiatives and regulations. Many countries have implemented stricter regulations regarding plastic waste management and recycling, putting pressure on automakers to adopt more sustainable materials and practices. Additionally, consumer preferences are evolving, with an increasing number of individuals favoring eco-friendly vehicles and components. Automakers are responding to these demands by exploring alternative materials, such as bio-based plastics and recycled plastics, to reduce the environmental impact of their products.

Polypropylene Dominates the Market by Product Category

The automotive plastic compounding market is segmented based on various product types, including Polypropylene, Polyethylene, Polyvinyl Chloride (PVC), Polystyrene and Expanded Polystyrene (PS/EPS), Polyethylene Terephthalate (PET), Polyurethane, Acrylonitrile Butadiene Styrene (ABS). Polypropylene held the highest revenue in the market in 2023, primarily due to its extensive usage in automotive applications. It offers excellent mechanical properties, chemical resistance, and cost-effectiveness, making it a preferred choice for interior components, such as instrument panels, door trims, and center consoles. Polyethylene, with its high strength and impact resistance, also contributes significantly to the market's revenue, finding applications in automotive fuel systems, electrical insulation, and under-the-hood components. When considering the CAGR, Polyurethane is expected to exhibit the highest potential in the automotive plastic compounding market during the forecast period of 2024 to 2032. Polyurethane offers excellent flexibility, durability, and impact resistance, making it suitable for various automotive applications, including seating, interior foams, and sound insulation. Additionally, the increasing demand for lightweight materials and enhanced passenger comfort drives the growth of Polyurethane in the market. Other product segments such as PVC, PS/EPS, PET, and ABS also contribute to the overall market revenue, each finding applications in specific automotive components, such as pipes and hoses (PVC), packaging and insulation (PS/EPS), electrical connectors (PET), and exterior body panels (ABS). With the growing focus on lightweight, sustainability, and improved performance in the automotive industry, the demand for these different plastic compounds is expected to increase, further driving the growth of the automotive plastic compounding market as a whole.

The Automotive Segment Dominates the Market in Applications

The automotive plastic compounding market is segmented based on applications into the Automotive, Electrical and Electronics, and Construction sectors. The automotive segment held the highest revenue in the market in 2023, driven by the extensive use of plastic compounds in various automotive components. These components include interior parts like dashboards, door panels, and seating systems, as well as exterior parts like bumpers, grilles, and body panels. The automotive industry's continuous focus on lightweight, fuel efficiency, and design flexibility has propelled the demand for plastic compounds in this segment. The Electrical and Electronics segment also contributes significantly to the market's revenue, with the increasing use of plastic compounds in electrical connectors, wiring harnesses, switches, and housings for electronic components. The high electrical insulation properties and lightweight nature of plastic compounds make them suitable for these applications. Furthermore, the Construction segment utilizes plastic compounds in applications such as pipes, fittings, insulation materials, and roofing. Plastic compounds offer advantages like durability, corrosion resistance, and thermal insulation, making them ideal for construction purposes. When considering the CAGR, the Electrical and Electronics segment is expected to exhibit the highest growth potential in the automotive plastic compounding market during the forecast period of 2024 to 2032. The expanding electric vehicle market, the integration of advanced electronics in vehicles, and the growing demand for smart and connected vehicles are driving the need for plastic compounds in this segment. The Automotive segment continues to dominate in terms of revenue due to its large market size and wide range of applications, followed by the Electrical and Electronics segment, which is experiencing rapid growth. The Construction segment, while holding a smaller share, is also expected to show steady growth due to infrastructure development and the adoption of plastic compounds in construction materials.

APAC Remains as the Global Leader

Asia-Pacific held the highest revenue percentage in the market in 2023, primarily driven by the presence of major automotive manufacturing hubs, such as China, Japan, and South Korea. These countries have robust automotive industries, high vehicle production rates, and significant demand for plastic compounds for lightweight, fuel efficiency, and cost-effectiveness. Additionally, the rising disposable income, urbanization, and infrastructure development in the region contribute to the growth of the automotive sector, further fuelling the demand for plastic compounds. North America is another key region in the automotive plastic compounding market, characterized by its advanced automotive industry, technological advancements, and stringent regulations. The region showcases a high adoption rate of plastic compounds for lightweight and improved fuel economy. The growing focus on electric and hybrid vehicles in North America also drives the demand for plastic compounds in the electrical and electronics applications within the automotive sector. Europe, known for its strong automotive heritage, exhibits a significant market share as well. The region emphasizes sustainability, and the automotive industry seeks to reduce carbon emissions and increase the usage of eco-friendly materials. European countries, including Germany, France, and Italy, are at the forefront of technological advancements and innovation in automotive plastic compounding. In terms of the CAGR, the Asia-Pacific region demonstrates the highest growth potential during the forecast period of 2024 to 2032. The region's expanding middle class, rapid industrialization, and favorable government initiatives support the growth of the automotive sector and, subsequently, the demand for plastic compounds. However, it is important to note that the market dynamics can vary within sub-regions or countries in each geographical segment.

Market Competition to Intensify during the Forecast Period

The automotive plastic compounding market is highly competitive, with several key players vying for market share. The top players in the market include BASF SE, SABIC, LyondellBasell Industries N.V., Covestro AG, Solvay S.A. and Other Notable Players. These companies have established a strong presence in the market through their extensive product portfolios, technological expertise, and global reach. They are actively engaged in strategic initiatives to maintain their competitive edge and capitalize on market opportunities. One of the key strategies adopted by these players is product innovation. They invest significantly in research and development activities to develop advanced plastic compounds that meet the evolving requirements of the automotive industry. This includes the development of lightweight and high-performance materials with improved mechanical, thermal, and electrical properties. The focus on sustainability is also evident, with efforts to develop bio-based and recycled plastic compounds that align with the growing demand for eco-friendly solutions. Furthermore, geographic expansion and market penetration are key strategies pursued by the top players. They aim to capitalize on the growth opportunities in emerging markets, particularly in Asia-Pacific and Latin America, where the automotive industry is rapidly expanding. By establishing production facilities and distribution networks in these regions, they can cater to the local demand and strengthen their global presence.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Plastic Compounding market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Application

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report