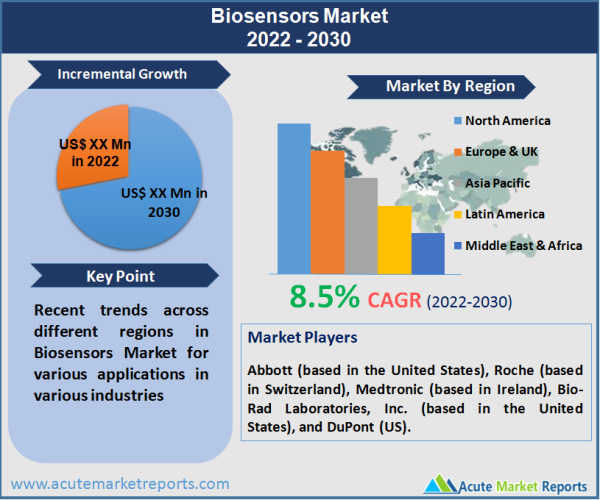

The market for biosensors is anticipated to grow at a CAGR of 8.5% during the forecast period 2025 to 2033. The need for biosensors is developing as a result of a wide variety of medical applications, an increasing number of people living with diabetes, a high demand for miniature diagnostic devices, and rapid technological advancements. It is essential for a favorable disease prognosis and patient survival that the disease is diagnosed correctly and at an early stage. In recent years, there has been a meteoric rise in the demand for one-time-use devices that are disposable, user-friendly, and have low production costs and short reaction times. The capacity of these devices to meet these criteria through an interdisciplinary combination of approaches from fields such as chemistry and nanotechnology, as well as medical research, has contributed to their rapid advancement in the realm of medicine.

Nanotechnology-Based Biosensors to Boost the Market Growth

Biosensors that are powered by nanotechnology are fabricated from nanomaterials and have diameters that range from 1 to 100 nanometers. When it comes to sensing the mechanism of biosensing technology, these biosensors are an essential component. The development of nanoelectromechanical systems can be attributed to the integration of devices made of nanomaterials with electrical systems. Several different nanomaterials have been investigated for their potential electrical and mechanical properties as a means of enhancing the biological signaling and transduction system. This improvement requires the transformation of one kind of energy into another. Nanotubes, nanowires, nanorods, nanoparticles, and thin films comprised of crystalline matter are some examples of the types of materials that fall within this category and are used extensively. Applications for these sensors include amperometric devices for the enzymatic detection of glucose, the use of quantum dots as fluorescent agents for the detection of binding, and bio-conjugated nanomaterials for the detection of biomolecular compounds.

High Price of Biosensors in a Cause of Concern

In recent years, the commercialization of biosensor technology has moved at a glacially slow pace. This is mostly attributable to the high price of biosensors as well as the demand coming solely from the healthcare business. Due to limited research and development and favorable results, industry players face a barrier when it comes to the commercialization of biosensors for use in nonmedical applications such as the military, biodefense, fermentation control, and environmental monitoring. In addition, the commercialization of the biosensors market is moving at a snail's pace. This is mostly attributable to the price sensitivity of end users, as well as acceptance from end users and concerns regarding the quality, authenticity, and dependability of the goods.

Wearable Technology to Present Significant Opportunities

Wearable biosensors are finding an expanding number of applications for the continuous monitoring of vital signs of patients, premature newborns, children, athletes or fitness buffs, and persons who live in rural places that are a significant distance from medical and health care services. Patients may be able to avoid hospitalization or leave the facility earlier thanks to remote monitoring made possible by biosensors that are both wearable and networked. Wearable biosensors have the potential to reduce the workload of medical staff and liberate hospital space for the provision of care that is more responsive to patients' needs by enabling telemedicine, which is the monitoring and transmission of physiological data from locations outside of the hospital. The use of smart textiles that include sensors in the fabric can make the monitoring of vital signs much easier and more convenient. When combined with conformal, printed electronics, biosensor patches or tattoos can significantly improve a physician's ability to collect data on a patient over an extended period of time. These sensors are compatible with the growing concept of the quantified self, which entails keeping track of one's biological data in order to improve one's health. In addition, reusable patches can be used to analyze essential biomarkers in sweat, including salt, potassium, and glucose. These biomarkers can be found in a variety of substances.

Lengthy Processes of Certification and Approvals to Remain a Significant Challenge

Despite the high demand for biosensors to be used in medical applications, manufacturers are running into a number of regulatory roadblocks as a result of the multi-layered regulations that have been mandated by the FDA as well as the laboratory regulations that have been implemented as a result of the Clinical Laboratory Improvement Amendments of 1988 (CLIA) (for the premarket approval of POC testing kits). The Food and Drug Administration (FDA) requires makers of each new point-of-care (POC) device in the United States to submit performance data before the device may be approved. Using these data, healthcare practitioners and patients should be able to demonstrate that they can use devices to generate findings that are comparable to clinical laboratory testing.

Embedded Device Segment Dominated the Market Revenues in 2021

The market for biosensors is broken down into many types, and embedded devices hold the majority of those market shares. These devices have a wide range of applications and are utilised often in a variety of contexts, including point-of-care settings, in-home diagnostics, food, and beverage production, research labs, environmental monitoring, and biodefense. There has been a significant paradigm shift in the linked healthcare applications that are available as a result of the proliferation of devices that are connected to the Internet of Things (IoT). The Internet of Things offers real-time alerting, tracking, and monitoring, which enables more hands-on treatments, increased accuracy, and appropriate intervention by doctors, leading to enhanced overall patient care. To compensate for the scarcity of medical professionals in rural areas, some healthcare facilities have begun implementing embedded solutions for medical devices that are connected with the internet of things technology. These medical devices that are enabled by the internet of things help diagnose disorders in patients and conduct various tests so that accurate and reliable therapy may be provided to patients located in remote areas. As a result, the growing popularity of embedded devices will be the primary factor propelling the expansion of the biosensors market.

Medical Segment to Dominate the Revenue While Food Toxicity Segment to Promise Growth

In 2021, the medical sector held a dominant position in the market, accounting for the greatest revenue share at approximately 67% of the total. In the medical industry, biosensors find applications in the domains of cholesterol testing, blood glucose monitoring, blood gas analyzers, pregnancy testing, drug development, and infectious disease diagnosis. It is widely recognized as an important tool for diagnosing and keeping track of a broad spectrum of medical conditions, including diabetes and cancer, amongst others. The growing number of people who have diabetes is a significant element that is contributing to the expansion of the market sector. In order to assist patients with diabetes in keeping their blood glucose levels within normal ranges, a number of technologically advanced biosensors for glucose have been developed.

During the time under consideration, it is anticipated that the revenue generated by the food toxicity segment will have a quick growth rate. Concerns about food toxicity and risks to human health are growing and have become more concerning globally as a result of an increase in the number of establishments that provide mass catering, an increase in the number of consumers who eat out or order in, and changing habits regarding food consumption. The process of determining whether or not a product is poisonous is a significant challenge in this age of rising globalization of food supply chains; as a result, numerous nations are adopting increasingly strict regulations in this area. Controlling the quality of food is also extremely important in the food industry, both for the protection of consumers and their safety. As a result, testing for the presence of pollutants in food is becoming increasingly dynamic across the food industries and is considerably contributing to the expansion of market revenue.

Wearable Biosensors to Grow at the Fastest Pace During the Forecast Period

Because of its potential to revolutionize the concepts of traditional medical diagnostics and continuous health monitoring, wearable biosensors have garnered a significant amount of attention in recent years. The applications of wearable biosensors aim to convert centralized healthcare systems centered in hospitals to home-based personal medicine, as well as minimize the cost of healthcare and the amount of time needed for diagnosis. At this point in time, it is plain to observe that wearable biosensors are ushering in a new era of innovation inside society. The ease with which they can be used and improved effectiveness can provide a new level of insight into the current state of a patient's health. The availability of data in real-time enables better clinical judgments, which in turn leads to improved health outcomes and more effective utilization of health services. Additionally, wearable biosensors are currently being integrated with innovative features such as sensors that measure glucose levels every minute and provide real-time updates and alerts. This helps to monitor critical events such as hypoglycemia or hyperglycemia, which are both potentially life-threatening conditions.

Electrochemical Technology Category Dominated the Revenue Share In 2021

In 2021, the electrochemical sector was the market leader and secured the biggest revenue share, amounting to around 70% of total sales. This is due to the widespread application of its monitoring and analytical capabilities across all biochemical and biological processes. Electrochemical biosensors provide a number of benefits, some of which include low detection limits, a large linear response range, high stability, and repeatability. The electrochemical detection method has more advantages than piezoelectric, thermal, and optical detection, which has led to greater market penetration and consumption of the electrochemical detection method. The benefits include, but are not limited to, robustness, compatibility with new microfabrication methods, ease of operation, low cost, disability, independence from sample turbidity, and low power requirements.

Optical Sensors to Grow with Highest CAGR

The optical sector is anticipated to experience the greatest rate of expansion throughout the forecast period of 2025 to 2033. Because of their extensive analytical coverage, it is anticipated that there will be a growth in demand for optical biosensors in the analysis over the duration of the projection period. Optical biosensors make it possible to conduct studies on topics such as receptor-cell interactions, fermentation monitoring, structural study, as well as concentration, kinetic, and equilibrium assessments. As a consequence of the aforementioned considerations, it is anticipated that the market for optical biosensors will expand. Compared to conventional methods of analysis, optical biosensors offer a number of benefits, the most notable of which are the removal of the prerequisite for extensive sample preparation and the availability of the option to select a particular biological sensing element.

Among the End Users Home Diagnostics to Grow the Fastest

During the forecast period, the market for applications related to home diagnostics is anticipated to expand at the fastest rate. It is possible to credit the expansion of the market to increasing innovations in the healthcare sector, a high rate of acceptance of new diagnostic procedures, and the convenience of utilizing home-based medical devices. As a result of the emergence of the new coronavirus, there has been an upsurge in the demand for home diagnostics. As a result, firms competing in the market for home diagnostics are extending their capacity for production. Additionally, there is a rise in demand across the wearable devices segment, and as lifestyle disorders grow more common, there is a significant amount of untapped potential in the biosensors market inside the home diagnostics segment.

In 2021, the point-of-care testing segment was the dominant player in the market and accounted for around 50% of the total revenue. Technological advancements in the creation of breakthrough products, such as biosensors ultrasensitive printable for point-of-care applications that help monitor or sense organic fluids like blood, urine, saliva, and perspiration, are among the key rendering drivers attributed to the growth of biosensors in the PoC testing market over the forecast period. This growth is expected to continue over the course of the next few years. The users of these systems have access to results that are both quick and accurate, which enables earlier diagnosis and more expedient treatment. Continuous research and development are leading to the creation of next-generation point-of-care biosensors. These biosensors include label-free optical techniques such as surface plasmon resonance, localized surface plasmon resonance, and improved spectroscopy techniques. It is anticipated that this will boost the demand for biosensors in point-of-care diagnostics over the course of the forecast period.

North America Dominated the Global Market in 2021

Because of the existence of key companies and the rising incidence rate of targeted diseases in the region, North America owned the greatest revenue share in 2021, which was approximately 40%. It is anticipated that technological advancements, such as the introduction of miniaturized diagnostic equipment that provides increased market penetration of Electronic Medical Records (EMR), as well as precise and speedy findings, will fuel the expansion of the market over the course of the foreseeable future. In addition, the United States has legislation known as the Clean Air Act, the Clean Water Act, and the National Environmental Policy Act, all of which are anticipated to generate desirable expansion opportunities for the market in North America during the course of the forecast period. Because of recent developments in miniaturization technology as well as the presence of important market players in the North American region, this region accounted for the largest revenue share in 2021. The rapid growth rate of the North American market can be attributed to the increasing expenditures made by governments in countries in the region for the development of healthcare sectors in those countries. Other factors that are contributing to the expansion of the North American market include increasing demand for point-of-care and at-home testing as a result of COVID-19 and an increasing need for medical diagnostics that are both more advanced and more cost-effective. Furthermore, increasing government funding for conducting research and development (R&D) of advanced biosensors for various application areas such as agriculture, biodefense, environmental monitoring, and other areas is expected to continue to support market revenue growth in countries such as the United States of America and Canada.

The market for biosensors in APAC is likely to exhibit the highest growth rate from 2025 to 2033. The expansion of the market in APAC is being driven primarily by several factors, the most important of which are the region's vast population base and the rising prevalence of a variety of lifestyle-related disorders. Both in terms of the removal of items from the National Negative List and the addition of items to the National Encouraged List, the healthcare industry in China has been steadily opening up to the participation of foreign investors. This is true both in terms of the removal of items from the National Negative List and the addition of items to the National Encouraged List. The 2019 National Encouraged List was updated to include a number of newly added raw materials 2019. These raw materials will be used in the production of vaccines and medical facilities. This suggests that China is now encouraging investments across the healthcare industry and opening the door for opportunities for international companies to receive preferential regulations and tax rates. It is anticipated that such policies will generate a number of opportunities for the biosensors market in the APAC region.

During the period covered by the forecast, the market is anticipated to expand at a rate that is highest in both the Middle East and Africa. Some of the primary factors that are driving the market in the Middle East and Africa include the presence of significant unmet medical requirements for target diseases such as diabetes, cancer, and other infectious diseases; continuously improving healthcare expenditure in the region; and increasing patient awareness. A rise in demand for point-of-care, home healthcare, and other healthcare businesses that cater to the adult population, as well as measures taken by the government to reduce the length of patients' stays in hospitals by developing outpatient care models, are likely to fuel the expansion of the market over the course of the forecast period.

Top Companies to Dominate, Competition to Intensify During the Forecast Period

Because of the dramatic increase in demand for biosensors, manufacturers all over the world are intensifying their production processes while simultaneously enhancing them by incorporating more efficient market strategies. Leading companies in the market are mandating higher product quality in order to keep up with the surge in demand that is coming from a variety of applications for biosensors. The global market for biosensors is highly competitive, with only a few companies accounting for the majority of the market's revenue. Major players are implementing a variety of strategies, as well as engaging in mergers and acquisitions, strategic partnerships and contracts, and the development, testing, and introduction of more efficient biosensors. The market for biosensors is led by companies such as Abbott (based in the United States), Roche (based in Switzerland), Medtronic (based in Ireland), Bio-Rad Laboratories, Inc. (based in the United States), and DuPont (US).

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Biosensors market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Type

| |

By Product

| |

Technology

| |

Application

| |

End-user Outlook

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report