Industry Outlook

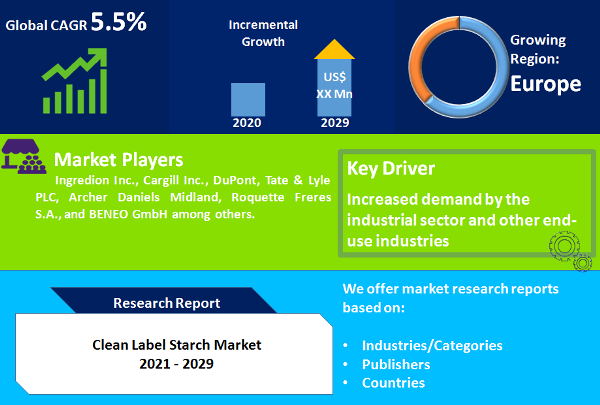

Clean Label Starch market value is projected to exhibit the CAGR of 5.5% during the forecast period from 2021 to 2029. Clean label starch is functional native starch that are added to food & beverages in place of chemically modified starches to cater the need of consumers seeking natural products. The 'Clean Label' is a consumer-driven movement that demands for natural & healthy food and transparency through authenticity. Clean label foods contain natural and simple ingredients that are easy to recognize, understand, and pronounce for consumers and have no artificial ingredients. With the surge in demand for clean label ingredients in food products, many manufacturers strategically named native starch as “Clean Label Starch” and now being an important food ingredient native starch is listed under clean label ingredient list by many foodservice and retail grocery store chains. Increasing consumer awareness regarding the ingredients present in the product has triggered the clean label products market which in turn propelling the demand for clean label ingredients such as clean label starch. Starch, free form chemical modification and derived from corn, rice, tapioca, potato and some blend of these are only considered as “clean”. Factors such as the rise in clean label product launches, increasing consumer demand for clean label food products and health issues associated with artificial food additives and food safety incidents boosting the demand for clean label starch from food & beverages industry. Consumers growing preferences towards the healthy functional foods with non-chemical sounding ingredients especially in developed economies of the world creating immense growth opportunities for non-chemically modified starches in coming years. Various end-product manufacturers are closely following and responding to this trends by introducing new products with simple/clean label further escalating the demand of the clean label starch. Starch is among the main food ingredients that offer good viscosity, texture and other aesthetic properties to food products. Clean label starch with no chemical modification possesses similar functional and physical properties as that of chemically modified starches thereby swiftly replacing its application from various food products such as dairy, baby foods, pet foods, bakery, pet foods, and so on. Starch finds very promising application in aforementioned food products as it contributes to the the textural properties of food stuff. However, the high manufacturing cost of clean label starch and it lacks the properties to withstand the harsh food processing condition projected to limit its application in end-use industries. Key players operating in the clean label starch includes Ingredion, Cargill, Tate & Lyle, Beneo, DuPont, Archer Daniels Midland Company, American Key Food Products, LLC, and Roquette Frères S.A. among others.

"Easy Availability across the World Making Corn, the Leading Source Segment of Clean Label Starch Market"

Corn led the clean label starch market by source in 2020. Associated health benefits and wide spread availability expected to drive the growth of the segment in coming years. Corn segment is closely followed by wheat and potato in terms of value and volume consumption. Wheat starch are mostly used for wheat-based products such as baby foods and has a great impact on the functionality of the product. Whereas, sorghum starch plays an important role in both the production of bakery products such as bread, cakes and biscuits. Though, sorghum starch is known for its nutritional quality, sorghum starch segment is witness gradual growth during the forecast period owing to easy availability of rice and wheat starch. Rice starch finds promising application in deserts and bakery products owing to its white color and clean odor. Owing to remarkable characteristics such as high viscosity, high paste charity, high freeze-thaw stability, cassava starch is the widely used ingredient in food and beverages industry. Since, few of these source crops cannot be grown in every region of the world and require specific latitudes, climates, and soils leading to inconsistent supply throughout the year expected to hamper the overall growth during the forecast period.

"High Demand for Food with Functional and Natural Ingredients Making Food the Leading Segment for Clean Label Starch Market"

Food held the largest share of end-use industry during 2020-2021. Healthy food demand is driven by busy lifestyles, ageing population, and health risk associated with synthetic chemicals or additives used in foods. Health conscious consumers are always looks for nutritional value and healthy & functional ingredients added in the food products owing to strong influence of clean label movement. Change in consumer preference have led to immense innovation if food category, and pushing food manufacturers to reduce the number of ingredients, particularly ingredients that are not recognized and difficult-to-pronounce with little functional benefits. Clean label starch being the native form of starch and widely accepted ingredient for food is in high demand for food application. Food segment is followed by beverages segment in 2020. Beverages expected to witness the fastest CAGR during the forecast period owing to replacement of products formulated with ingredients such as caffeine, preservatives, added sugar, aspartame, etc. with the formulation containing clean label counterparts.

"Europe to Remain Dominant Region during the Forecast Period"

Europe was the largest regional market of clean label starch in 2020, also expected to see strong gains in coming years as well, on account of on-going clean label movement and constant support by local food manufacturers responding to varying requirements of consumers. Europe is closely followed by North America in terms of value and volume consumption of clean label starch. Europe clean label starch is mainly driven by rise of awareness among people regarding health issues related to using of artificial food additives and food safety incidents has led to a sudden growth in the market of clean label ingredients. Further, rising clean label product launch in the region driving the consumption growth of clean label starch market in Europe. Asia-Pacific was identified as the fastest growing region during the forecast period on account of robust growth in manufacturing sector of Japan and China. Asia-Pacific economies such as China and Thailand are catalyzing the growth clean label products due to abundance in agricultural materials, production capacity, and rising demand. Low-cost Cassava starch, wheat and sugar cane production in South-East Asia also promoting the growth of native starch in Asia-Pacific, thereby propelling the growth of clean label starch in the region.

"New Product Development and Innovation in Exisis the Preferred Strategy Adopted by Key Players in Clean Label Starch Market"

Clean label is drifting from industry trend to norm that is spurring innovation in food & beverages industry. Shifting consumer preferences towards healthy foods containing clean and simple additives coupled with consumers’ willingness to pay extra money for products containing ingredients that are recognized and trusted motivating manufacturers and market their new products and ingredients with the help of co-branding of ingredients. For instance, Cargill introduced a new range of clean label potato starches for culinary products, meat, and meat alternatives to cater consumer preferences for food made with simple and recognizable ingredients in September, 2021. Key players operating in clean label starch market includes Ingredion Inc., Cargill Inc., DuPont, Tate & Lyle PLC, Archer Daniels Midland, Roquette Frères S.A., and BENEO GmbH among others.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Clean Label Starch market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Source

| |

Form

| |

End-use Industry

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report