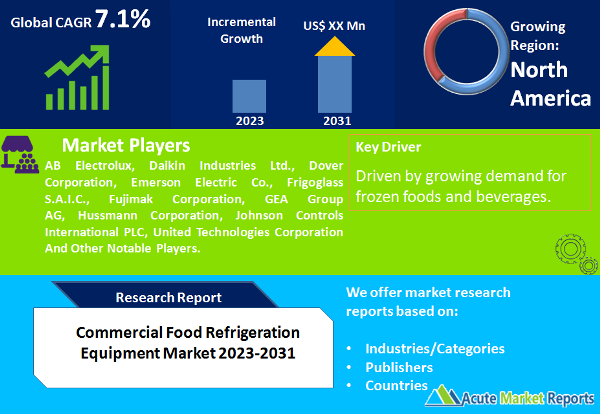

Commercial food refrigeration equipment refers to specialized cooling systems designed for commercial and industrial applications within the foodservice industry. These refrigeration units are essential for preserving perishable food items, maintaining their freshness, and ensuring food safety. Unlike household refrigerators, commercial food refrigeration equipment is built to handle larger quantities of food products and operate continuously in high-demand environments such as restaurants, grocery stores, hotels, catering businesses, and food processing facilities. The commercial food refrigeration equipment market, a cornerstone of the food industry, has experienced substantial growth in recent years. Commercial Food Refrigeration Equipment market is expected to grow at a CAGR of 7.1% from 2024 to 2032, driven by growing demand for frozen foods and beverages.

Technological Advancements and Energy Efficiency

Innovations in refrigeration technology have been pivotal in driving the commercial food refrigeration equipment market. Manufacturers have focused on developing energy-efficient solutions, evident in the advent of refrigeration systems using environmentally friendly refrigerants. In 2023, these advancements were instrumental in reducing energy consumption, cutting operational costs for businesses, and aligning the industry with global sustainability goals.

Growing Demand for Frozen Foods and Beverages

The rising demand for frozen foods and beverages, driven by changing consumer lifestyles and preferences, has significantly boosted the commercial refrigeration sector. Freezers, a fundamental product type in this market, experienced unprecedented demand. With consumers seeking convenience and an extended shelf life for perishable goods, freezers became a cornerstone in retail outlets, restaurants, and food processing units, contributing substantially to the market's revenue.

Stringent Food Safety Regulations

Stricter food safety regulations and standards mandated by governments and regulatory bodies worldwide have compelled businesses to invest in high-quality refrigeration equipment. Maintaining specific temperature requirements for various food items is crucial to prevent spoilage and ensure consumer safety. Refrigerators and display cases, designed to maintain precise temperature control, saw a surge in adoption. Compliance with these regulations became a driving force, with businesses striving to meet and exceed industry standards.

Market Saturation and Pricing Pressures

While the market experienced growth, saturation and pricing pressures posed significant challenges. Intense competition led to pricing pressures, impacting profit margins for manufacturers. In 2023, the industry grappled with finding a balance between delivering high-quality, innovative solutions and maintaining competitive pricing. This restraint prompted companies to focus on operational efficiency, streamlined supply chains, and strategic partnerships to mitigate the impact of pricing pressures.

Freezers and Refrigerators Dominates the Market by Product Type

The market, segmented by product type, witnessed diverse trends across various categories. Freezers and refrigerators, as core products, dominated both in terms of highest CAGR and revenue. Freezers, with their indispensable role in preserving frozen foods, exhibited a robust growth rate. Refrigerators, essential for storing perishable items at controlled temperatures, were equally pivotal. Refrigerated vending machines, display cases/showcases, ice cream machines, and ice machines also contributed significantly, reflecting the industry's diversity and evolving consumer demands.

Self-contained Systems Leads the Market by Category

Segmentation by category highlighted the prevalence of self-contained and remote condensing systems. Self-contained systems, where the condenser and compressor are integrated, led the market in both highest CAGR and revenue. These systems, known for their simplicity and ease of installation, appealed to small and medium-sized businesses. Remote condensing systems, on the other hand, gained traction in larger establishments due to their ability to handle higher capacities and offer flexibility in installation.

North America Remains as a Global Leader

Geographically, diverse trends emerged across regions. In North America, a robust economy and a thriving foodservice industry fueled the market. Asia-Pacific, with its expanding retail sector and growing demand for frozen and processed foods, witnessed significant market growth. Europe, driven by stringent food safety regulations, exhibited a steady demand for high-quality refrigeration solutions. Latin America and the Middle East also showed promising growth, driven by urbanization, changing consumer lifestyles, and an upsurge in food-related businesses.

Competitive Trends and Strategies

In this fiercely competitive landscape, key players adopted strategic measures to maintain their market positions. Collaborations and partnerships were prevalent, allowing companies to combine their expertise and resources for mutual benefit. Product diversification and innovation remained pivotal, with companies investing in research and development to introduce cutting-edge refrigeration solutions. Additionally, strategic acquisitions and expansions into emerging markets were common strategies to broaden market reach and enhance revenue streams. The key players in this market are AB Electrolux, Daikin Industries Ltd., Dover Corporation, Emerson Electric Co., Frigoglass S.A.I.C., Fujimak Corporation, GEA Group AG, Hussmann Corporation, Johnson Controls International PLC, United Technologies Corporation and others.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Commercial Food Refrigeration Equipment market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Category

| |

Refrigerant Type

| |

Application

| |

Distribution Channel

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report