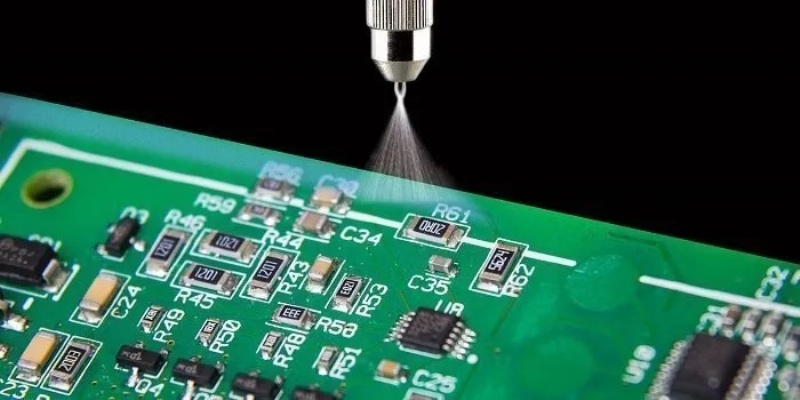

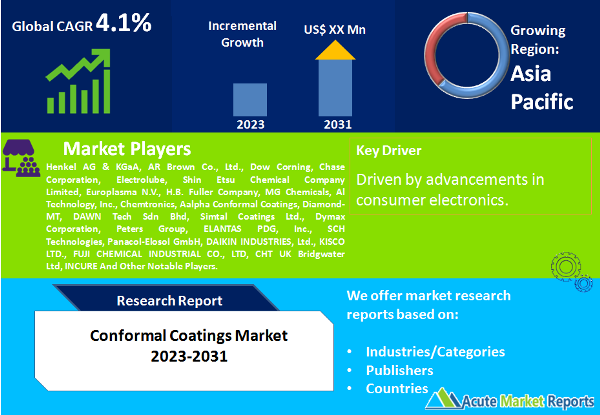

Conformal coatings are thin polymeric films applied to electronic circuit boards to protect them from environmental stressors like moisture, chemicals, and dust. These coatings safeguard the electronic components, enhancing their performance and prolonging their life. As of 2023, the demand for these coatings has surged due to the rapid growth of the electronics industry and the necessity to ensure the durability of electronic components. Conformal coatings market is expected to grow at a CAGR of 4.1% during the forecast period of 2024 to 2032, driven by advancements in consumer electronics.

Increasing Demand from Automotive Electronics

With advancements in automotive technology, cars have transformed into sophisticated machines, integrating numerous electronic components. By 2023, features such as autonomous driving, advanced infotainment systems, and electronic control units became standard in vehicles. Such integrations required protection against environmental conditions, especially in vehicles designed for rough terrains or extreme climates. Industry insiders from major automotive hubs, including Germany and Japan, frequently highlighted the role of conformal coatings in ensuring the robustness of these electronic systems.

Advancements in Consumer Electronics

Consumer electronics witnessed a revolution in design, performance, and miniaturization in 2023. As smartphones, smartwatches, and other wearable devices became compact, the need for protecting internal circuits from sweat, moisture, and other factors escalated. Insights from tech forums and conventions like the CES revealed the significance of conformal coatings in preserving the integrity of these electronic marvels.

Proliferation of Industrial Automation

Industrial sectors underwent significant transformation by 2023, with automation taking center stage. The manufacturing, logistics, and supply chain sectors heavily integrated electronic components to monitor, control, and automate processes. Sources from leading industries, such as the semiconductor sector, pinpointed the role of conformal coatings in maintaining the efficiency and longevity of these automation tools.

Environmental and Health Concerns

While conformal coatings offered immense benefits, they weren't without concerns. By 2023, environmentalists raised concerns over certain coatings, particularly those derived from VOC (volatile organic compounds), as they potentially harm the environment and human health. Regulatory bodies in regions like Europe and North America established guidelines to limit VOC emissions, compelling manufacturers to scout for alternatives, which sometimes proved costlier and less efficient.

Market Segmentation by Product

In 2023, acrylic-based conformal coatings dominated the market revenue-wise, mainly because of their easy-to-apply nature and overall efficiency in standard protection scenarios. Silicone coatings followed closely due to their flexibility and capability to withstand high temperatures, making them ideal for specific industrial applications. While epoxy and polyurethane coatings also had their share in the market pie, parylene coatings, despite their premium pricing, gained traction in specialized areas like aerospace and medical devices. From the period 2024 to 2032, fluoropolymer coatings are anticipated to showcase the highest CAGR. Their chemical-resistant properties are expected to drive demand, especially from industries handling aggressive chemicals.

Market Segmentation by Operation Method

Dip coating was the most preferred application method in 2023, largely attributed to its simplicity and efficiency for bulk processing. Spray coating followed closely, favored for its uniformity, especially in complex circuit designs. Brush coating, usually reserved for touch-ups or repairs, also witnessed demand. However, CVD (Chemical Vapor Deposition), though lesser in revenue contribution, carved a niche, particularly in advanced applications requiring ultra-thin coatings. Between 2023 and 2031, CVD is projected to exhibit the highest CAGR, propelled by the miniaturization trend in electronics and the need for precise, thin coatings.

Asia Pacific Leads in Revenue

By 2023, Asia-Pacific, driven by electronic manufacturing powerhouses like China, South Korea, and Taiwan, led in revenue generation. Europe, with its advanced automotive and industrial sectors, was also a significant contributor. In terms of future growth, between 2023 and 2031, the Latin American region is expected to show the highest CAGR, driven by budding electronic manufacturing setups and growing automotive industries.

Competitive Trends, Top Players, and Key Strategies

The competitive landscape in 2023 was characterized by stalwarts like Henkel AG & KGaA, AR Brown Co., Ltd., Dow Corning, Chase Corporation, Electrolube, Shin Etsu Chemical Company Limited, Europlasma N.V., H.B. Fuller Company, MG Chemicals, Al Technology, Inc., Chemtronics, Aalpha Conformal Coatings, Diamond-MT, DAWN Tech Sdn Bhd, Simtal Coatings Ltd., Dymax Corporation, Peters Group, ELANTAS PDG, Inc., SCH Technologies, Panacol-Elosol GmbH, DAIKIN INDUSTRIES, Ltd., KISCO LTD., FUJI CHEMICAL INDUSTRIAL CO., LTD, CHT UK Bridgwater Ltd, and INCURE. Their market dominance was a result of diversified product portfolios, rigorous R&D activities, and strategic partnerships. Key strategies involved developing environmentally friendly coatings and establishing collaborations with electronics manufacturers. Moving forward, between 2023 and 2031, companies are anticipated to ramp up their R&D investments, focusing on coatings catering to the unique needs of emerging sectors like electric vehicles and IoT devices.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Conformal Coatings market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Operation Method

| |

Technology

| |

End-Use

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report