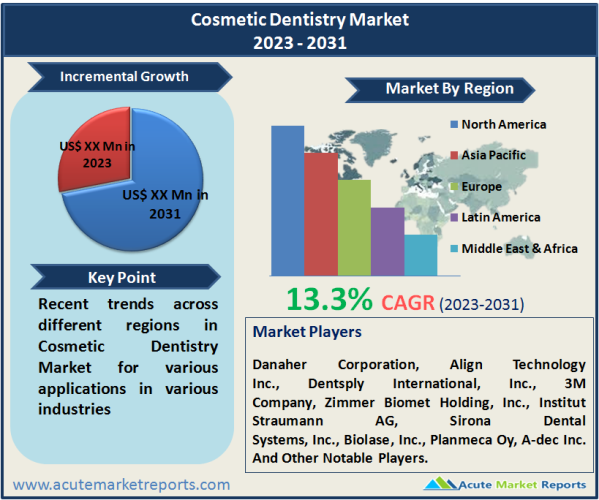

Cosmetic dentistry has emerged as one of the dynamic sectors within dental care, offering a plethora of treatments ranging from basic color correction to teeth replacement. The appeal of an enhanced smile and the advances in dental technology have ensured that cosmetic dentistry has remained in high demand. Cosmetic dentistry marketis estimated to grow at a CAGR of 13.3% from 2023 to 2032.

Rise in Cosmetic Dental Tourism

One of the prominent drivers for the cosmetic dentistry market has been the exponential rise in dental tourism. Many countries, especially in regions like Southeast Asia and Eastern Europe, have developed as hubs for dental treatments at a fraction of the cost incurred in developed countries. Travel blogs and testimonials across social media platforms provide evidence of patients recounting their experiences of combining vacation with dental treatments, highlighting both the affordability and quality of services received. Countries such as Thailand, Hungary, and Mexico have seen a surge in foreign patients seeking cosmetic dental procedures.

Increasing Affluence and Desire for Aesthetics

As global economies grow and middle-class populations burgeon, disposable incomes have risen. This increased affluence, especially in emerging economies, is tied to an enhanced focus on aesthetics and self-care. A look at popular lifestyle magazines and online articles underscores the modern emphasis on perfecting one's appearance, with a bright smile being paramount. Interviews with celebrities often bring forth their journey with cosmetic dentistry, further cementing the allure. Moreover, local community surveys in urban settings have shown a rising trend of people admitting to considering or having undergone cosmetic dental procedures to improve their smiles.

Technological Advancements in Procedures

The cosmetic dentistry sector has not remained untouched by technological evolution. The integration of digital technology, including 3D printing and laser dentistry, has revolutionized treatment methods. Digital smile design software, an innovation that allows patients to preview their post-treatment appearance, offers tangible evidence of the tech-driven transformation in the domain. Furthermore, patient testimonials indicate that advanced procedures, which are minimally invasive with reduced recovery times, have played a pivotal role in influencing their decision to opt for cosmetic dental treatments.

High Costs and Lack of Reimbursement Policies

However, the path for cosmetic dentistry hasn't been without hurdles. The primary restraint in the market has been the high cost associated with these elective procedures. For many, shelling out a significant amount without the safety net of insurance reimbursement is daunting. Evidence of this can be drawn from various health forums and insurance policy discussions where potential patients express their reservations. Many insurance companies label cosmetic dental procedures as "non-essential," refraining from covering them in their policies. This has led to potential patients either postponing their treatments or seeking cheaper, sometimes riskier, alternatives.

Market Segmentation by Product

In 2023, the cosmetic dentistry market spanned various products including Dental Systems & Equipment, Dental Implants, Dental Crowns & Bridges, Dental Veneer, Orthodontic Braces, Bonding Agents, Inlays &Onlays, and Whitening products. Dental implants, with their growing popularity and the promise of a permanent solution for missing teeth, garnered the highest revenue. This trend was backed by evidence from dental clinics' operational data that showed a surge in patients opting for implants over traditional dentures. Whitening products, riding on the wave of a booming over-the-counter market and professional in-clinic procedures, are expected to register the highest CAGR from 2024 to 2032. This anticipation is grounded in the consistent emphasis on pearly whites across media and personal grooming discussions, combined with advancements making these treatments safer and more effective.

North America Remains Dominant

The North American region, in 2023, dominated the cosmetic dentistry market in terms of revenue. This dominance was underlined by the region's emphasis on aesthetic appeal, high disposable incomes, and advanced dental infrastructure. However, the Asia-Pacific region, given its burgeoning middle class, increasing health expenditure, and the allure of dental tourism especially in countries like Thailand and India, is anticipated to exhibit the highest CAGR from 2024 to 2032. Conversations with dental practitioners in the region and data from travel agencies highlighting 'dental vacation' packages provide ample evidence of this trend.

Competitive Trends

The cosmetic dentistry landscape in 2023 was marked by fierce competition with players focusing on product innovations, mergers, acquisitions, and strategic collaborations to expand their footprints. Companies such as Danaher Corporation, Align Technology Inc., Dentsply International, Inc., 3M Company, Zimmer Biomet Holding, Inc., Institut Straumann AG, Sirona Dental Systems, Inc., Biolase, Inc., Planmeca Oy, A-dec Inc. had carved significant market shares for themselves. Their dominance was attributed not only to their expansive product portfolios but also to their proactive adoption of new technologies and patient-centric approaches. Moving forward, from 2024 to 2032, the market is expected to witness further consolidations, with top players aiming to enhance their R&D capabilities and expand in untapped regions. Strategic moves like Align Technology's partnerships with dental schools and Dentsply's focus on AI in dental solutions are indicative of the trends that are likely to shape the competitive landscape in the coming years.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Cosmetic Dentistry market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Product

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report