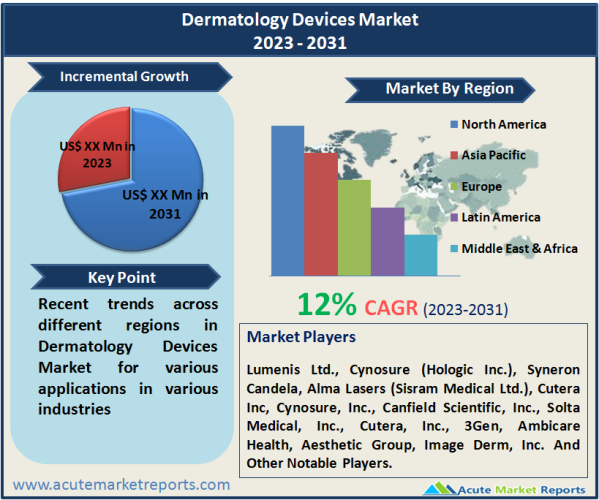

The dermatology devices market is expected to experience a CAGR of 12% during the forecast period of 2024 to 2032. Dermatology devices are used for diagnosing and treating various skin conditions, including skin cancer, acne, psoriasis, and dermatitis. These devices play a crucial role in enhancing the efficiency and accuracy of dermatological procedures, providing better patient outcomes. The market revenue of dermatology devices is driven by several factors. Firstly, the increasing prevalence of skin diseases and disorders, coupled with the growing awareness and demand for aesthetic procedures, is fueling market growth. The rise in skin cancer cases, particularly melanoma, has led to increased emphasis on early detection and treatment, driving the adoption of dermatological devices. Additionally, the growing desire for a youthful appearance and the increasing acceptance of cosmetic procedures are boosting the demand for aesthetic devices in dermatology. Furthermore, advancements in technology have significantly contributed to the market growth. Innovations such as laser technology, photodynamic therapy, radiofrequency devices, and ultrasound devices have revolutionized the field of dermatology. These technological advancements have improved the precision, effectiveness, and safety of dermatological procedures, attracting both patients and healthcare providers to invest in advanced dermatology devices. Factors such as the aging population, rising disposable income, and increasing healthcare expenditure are expected to drive market growth. Moreover, the growing trend of non-invasive and minimally invasive procedures in dermatology, which offer shorter recovery times and fewer complications, is further propelling the adoption of dermatology devices.

Increasing Prevalence of Skin Diseases and Disorders

The dermatology devices market is driven by the increasing prevalence of skin diseases and disorders worldwide. Skin conditions such as skin cancer, acne, psoriasis, dermatitis, and eczema affect a significant portion of the global population. According to a study published in the Journal of the European Academy of Dermatology and Venereology, the prevalence of skin diseases has been on the rise in recent years. Factors such as changing lifestyles, environmental factors, and genetic predispositions contribute to the growing incidence of these conditions. The need for accurate diagnosis and effective treatment of these skin diseases fuels the demand for dermatology devices.

Growing Demand for Aesthetic Procedures

The growing demand for aesthetic procedures is another key driver of the dermatology devices market. The desire for a youthful appearance, improvements in self-confidence, and the influence of social media have contributed to the increasing acceptance of cosmetic procedures. Non-surgical aesthetic treatments, including laser hair removal, facial rejuvenation, and body contouring, are in high demand. According to the American Society of Plastic Surgeons, the demand for minimally invasive cosmetic procedures has been consistently rising over the years. Dermatology devices such as lasers, intense pulsed light (IPL) devices, and radiofrequency devices play a vital role in delivering safe and effective aesthetic treatments, driving market growth.

Technological Advancements in Dermatology Devices

Technological advancements in dermatology devices are driving market growth by offering improved treatment outcomes, enhanced patient experience, and expanded treatment options. Advancements in laser technology, radiofrequency devices, photodynamic therapy, and ultrasound devices have revolutionized the field of dermatology. For example, the introduction of fractional laser technology has improved the precision and safety of laser skin resurfacing procedures. Ultrasound devices have facilitated non-invasive skin tightening procedures. These technological innovations have attracted healthcare providers and patients, leading to increased adoption of dermatology devices. Additionally, the continuous research and development efforts by manufacturers to develop more advanced and user-friendly devices contribute to market growth.

High Cost of Dermatology Devices and Procedures

The high cost of dermatology devices and procedures poses a significant restraint for the market. Dermatology devices, such as lasers, intense pulsed light (IPL) devices, and radiofrequency devices, often involve significant upfront investments for healthcare providers. These devices require specialized training, maintenance, and consumables, adding to the overall cost of ownership. Additionally, dermatological procedures can be expensive for patients, especially for cosmetic and aesthetic treatments that are often not covered by insurance. The high cost of dermatology devices and procedures can limit their accessibility, particularly in regions with limited healthcare resources and populations with lower income levels. It can also restrict the adoption of advanced dermatology technologies and treatments in smaller clinics and medical practices. The financial burden associated with dermatology devices and procedures may deter some patients from seeking the necessary treatment or opting for alternative, less costly options. Addressing the cost factor through measures such as pricing strategies, reimbursement policies, and technological advancements that reduce the cost of devices and procedures can help overcome this restraint and enhance the accessibility and affordability of dermatology devices and treatments.

Treatment Devices Segment Dominates the Market by Product Category

The dermatology devices market can be segmented into two main product categories: Diagnostic Devices and Treatment Devices. Diagnostic devices encompass various tools used for diagnosing and assessing skin conditions, while treatment devices are designed to provide therapeutic interventions for dermatological disorders. Among the two segments, the treatment devices segment held the highest revenue share in 2023 in the dermatology devices market. Treatment devices play a crucial role in delivering a wide range of therapies, including laser treatments, light therapy, cryotherapy, microdermabrasion, and electrosurgical procedures. The increasing demand for minimally invasive and non-invasive treatments for various skin conditions, such as acne, scars, wrinkles, and pigmentation disorders, drives the revenue growth of treatment devices. These devices offer precise and targeted interventions, providing effective results with minimal discomfort and downtime for patients. On the other hand, the diagnostic devices segment is expected to demonstrate the highest CAGR during the forecast period of 2024 to 2032 in the dermatology devices market. Diagnostic devices are used for the accurate diagnosis and assessment of skin conditions, aiding dermatologists in formulating appropriate treatment plans. These devices include dermatoscopes, skin biopsy tools, imaging systems, and other devices used for visual inspection, measurement, and analysis of skin lesions. The increasing incidence of skin cancer and the growing emphasis on early detection and prevention have fueled the demand for diagnostic devices in dermatology. Furthermore, advancements in imaging technologies and the integration of artificial intelligence (AI) for image analysis and diagnosis are contributing to the segment's growth.

Clinics Dominate the Market by End Use

The dermatology devices market can be segmented based on end-use, including hospitals, clinics, and others. Among these segments, clinics held the highest revenue percentage in the dermatology devices market in 2023. Clinics play a significant role in providing dermatological care, offering a wide range of services and treatments for various skin conditions and aesthetic procedures. The increasing demand for non-invasive and minimally invasive treatments has led to the growth of specialized dermatology clinics. These clinics often have advanced dermatology devices to cater to patient needs. Furthermore, the rising prevalence of skin disorders and the growing emphasis on aesthetic treatments contribute to revenue generation in the clinic segment. On the other hand, the hospital segment is expected to demonstrate the highest CAGR during the forecast period of 2024 to 2032. Hospitals serve as important healthcare facilities where dermatology services are provided, ranging from general dermatology to specialized procedures. With the availability of a wide range of healthcare services under one roof, hospitals attract patients seeking comprehensive dermatological care. Additionally, hospitals often have dedicated dermatology departments and access to advanced medical technologies, making them capable of offering a diverse range of dermatology services. The hospital segment benefits from the increasing patient footfall and the integration of dermatology services with other medical specialties. Other end-use segments, such as research institutes, academic centers, and medical spas, contribute to the overall growth of the market but hold a smaller market share compared to hospitals and clinics.

North America Remains as the Global Leader

North America held the highest revenue percentage in the market in 2023. The region benefits from a well-established healthcare infrastructure, high adoption rates of advanced dermatological technologies, and a strong presence of key market players. The United States, in particular, plays a significant role in driving the market revenue in North America due to factors such as high healthcare expenditure, a large patient population, and a favorable reimbursement framework. However, the Asia Pacific region is expected to demonstrate the highest CAGR during the forecast period of 2024 to 2032. The region is witnessing rapid growth due to several factors. Increasing disposable income, rising awareness about aesthetic procedures, and the growing prevalence of skin disorders contribute to the demand for dermatology devices in the region. Countries such as China, Japan, India, and South Korea are at the forefront of this growth, driven by advancements in healthcare infrastructure, a rising middle-class population, and a greater emphasis on dermatological care. Europe also holds a significant market share in the dermatology devices market and exhibits steady growth. The region benefits from established healthcare systems, a strong focus on research and development, and a robust presence of key market players. The European market is characterized by a growing demand for aesthetic procedures, advancements in dermatological technology, and the increasing adoption of non-invasive treatments.

Market Competition to Intensify during the Forecast Period

The dermatology devices market is highly competitive, with several key players striving to maintain their market position and drive growth. Some of the top players in the market include Lumenis Ltd., Cynosure (Hologic Inc.), Syneron Candela, Alma Lasers (Sisram Medical Ltd.), Cutera Inc, Cynosure, Inc., Canfield Scientific, Inc., Solta Medical, Inc., Cutera, Inc., 3Gen, Ambicare Health, Aesthetic Group, Image Derm, Inc. These companies employ various strategies to gain a competitive edge and expand their market presence. They focus on product development, strategic partnerships, mergers and acquisitions, and geographical expansions. Additionally, they invest in research and development to introduce innovative technologies and enhance the efficacy and safety of dermatology devices. Overall, the competitive landscape of the dermatology devices market is driven by continuous research and development, product innovation, strategic collaborations, and geographical expansions. Key players in the market aim to address the evolving needs of dermatologists and patients by offering advanced, safe, and effective solutions. As the market continues to grow, these companies are expected to invest in technological advancements and strategic initiatives to maintain their competitive positions and capitalize on the expanding opportunities in the dermatology devices market.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Dermatology Devices market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Application

| |

End-Use

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report