Industry Outlook

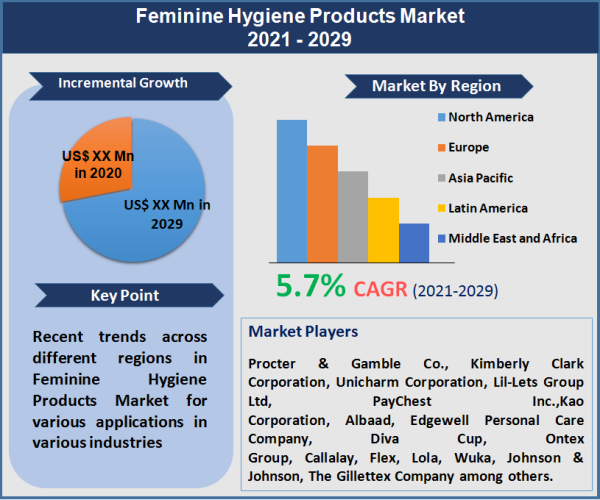

In terms of revenue, the global feminine hygiene products market was valued at US$ 28,514.08 Mn in 2020 and expected to grow at a CAGR of 5.7% from 2021 to 2029. Asia Pacific led the feminine hygiene products market in 2020 and expected to show similar trend throughout the forecast period. The region expected to be the fastest growing market during the forecast period.

Feminine hygiene products refers to the personal care products that are used by women during menstruation and other bodily functions related to the private body parts. Launch of economical products such as sanitary pads by leading manufacturers has resulted in steady growth of feminine hygiene products market over the years, and specifically targeted towards the poverty-stricken women and adolescent girls. The global feminine hygiene market expected to perceive significant revenue growth in the coming years. Rising concern about personal health and hygiene among female population is a major factor driving the market. In past few years, several NGOs and government association have initiated to reform the hygiene practices of the female by spreading awareness among them. Other factors that are promoting the growth of the market are rising living standards, per capita income, awareness campaigns, and launch of affordable feminine hygiene products. Ireland, Canada, Kenya, India are among the few countries where the sanitary pads are tax-free.

India is one of the growing markets for feminine hygiene products, with sanitary pads capturing the attention of women, as it is widely available and affordable within the country. Greater advertisements spending on feminine hygiene products and rising availability of the products across all the retail chains are some of the key factors responsible for the significant growth rate of the market in India. However, complaints from women suffering from allergies & infections due to the low quality of materials that are used to manufacture the products are leading to product recalls and is thus restraining the global feminine hygiene products market.

Moreover, demand for biodegradable and organic raw material based products is generating opportunity to the market during the forecast period. Products such as sanitary pads contain synthetic and carcinogenic materials such as rayon, dioxin, metal dyes, and highly processed wood pulp that often leads to irritation and allergy. Use of such contaminants in or near the private part areas can lead to itching, irritation, discomfort, and other complicated issues. In order to avoid such impacts on human health, women are demanding organic and biodegradable sanitary products.

Sanitary Pads Captured Major Chunk of the Market in 2020, and Expected to Display Similar Trend in Coming Years

Based on different product types, the market segmented in to sanitary pads, tampons, menstrual cups, panty liners & shields, disposable razors & blades among others. In terms of market value, sanitary pads accounted for the major share in 2020. Sanitary pads particularly famous among women in the developing economies of Asia Pacific and Middle East & Africa.

Affordability and easy availability of sanitary pads are the key factors boosting the demand for this segment. In addition to this, different patterns such as maxi pads, regular pads, thin pads and the ultra-thin pads expected to propel the growth of this segment by 2029. Companies such as Procter & Gamble and Johnson & Johnson focusses upon spreading awareness towards health and hygiene among the population across the globe. On May 2021, Procter & Gamble’s, brand ‘Always’ donated an additional one million period products in order to minimize period poverty across U.S. With the ongoing partnership with Feeding America, which is the largest hunger-relief organization in the country, the brand aims to provide greater access to period supplies for women and the adolescent girls.

Asia Pacific Dominated the Global Feminine Hygiene Products Market throughout the Forecast Period

Based on geography, Asia Pacific accounted for the major market share in 2020 and expected to display similar trend in the coming years. Feminine hygiene products gaining importance among all sections of women, which is a key factor pushing market growth. Usage of proper feminine hygiene products prevents health hazards such as fungal infections, urinary tract infections, and reproductive tract infections among others.

With the rising concerns of health of women, social institutions are taking initiatives to help women regarding better understanding of the menstrual health and hygiene. In India, Total Sanitation Campaign recognized the need to incorporate proper sanitary facilities for women and the importance of constructing toilets in every school in the rural areas. In addition to this, Indian Government removed taxes on all the sanitary pads in order to make it more accessible among adolescent girls and women in the rural areas.

However, there lies a major challenge in the removal of tax from the product as it is likely to forbid the manufacturers to gain input tax credit (return of the taxes paid on the products that are used as inputs during the manufacturing process). With this new step, the taxes paid on the inputs is likely to be passed on to the consumers. Additionally, this gives a huge advantage for the Chinese manufacturers’ who can sell larger volumes of products at low cost of production and using the tax exemption status.

Product Development is one of the Key Strategies of the Companies Operating in the Feminine Hygiene Market

The global feminine hygiene products market faces intense competition among the major players operating in this market. Market growth is attributed to free distribution of products, strategic mergers & acquisitions, partnerships and joint ventures, and geographical expansions, product innovations and development are some of the key strategies adopted by leading players in order to ensure long-term sustenance in the market. Some of the major players operating in the global feminine hygiene products market are Procter & Gamble Co., Kimberly Clark Corporation, Unicharm Corporation, Lil-Lets Group Ltd, PayChest Inc.,Kao Corporation, Albaad, Edgewell Personal Care Company, Diva Cup, Ontex Group, Callalay, Flex, Lola, Wuka, Johnson & Johnson, The Gillettex Company among others.

In 2021, start-up Company, Callaly, developed a new product that combines a panty liner and tampon, “Tampliner” thus offering the wearer extra comfort and security. The components used in manufacturing the product are 100% organic and free from perfumes, dioxins or dyes. The Tampliner is available through monthly subscription service that can also be customized in order to suit different cycles. Additionally, in order to promote the products, the company claims to donate 1 percent of the sales to the poverty stricken women from the subscription service.

With the increasing demand for products that offers proper leakage control and comfort during night, companies strive to manufacture such products that meets the consumer demands. For instance, in 2021, Kimberly Clark Australia’s, U by Kotex brand expanded their product portfolio by introducing overnight pads that has a longer back and provides ultimate comfort, and leakage control during night. These products are of 35 cm in length with an additional width thus grabbing more attention of women in recent years.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Feminine Hygiene Products market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Product Type

| |

Distribution Channel

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report