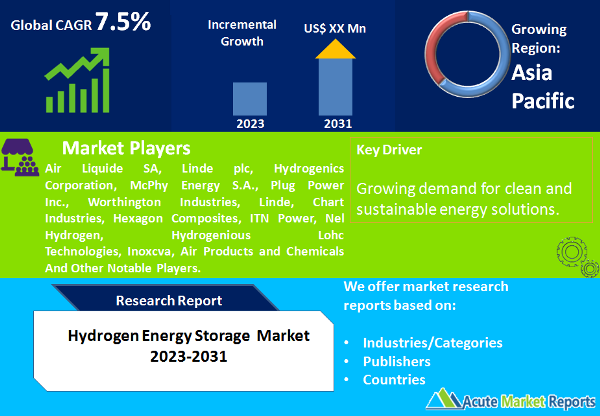

The hydrogen energy storage market is expected to witness a CAGR of 7.5% during the forecast period of 2026 to 2034, driven by the growing demand for clean and sustainable energy solutions. Hydrogen energy storage involves the conversion of electrical energy into hydrogen through electrolysis, which can then be stored and used as a versatile energy carrier. This technology enables the storage and utilization of renewable energy sources, such as solar and wind power, overcoming the intermittency challenges associated with these sources. The increasing focus on decarbonization, renewable energy integration, and grid flexibility are key drivers for the hydrogen energy storage market. As the world transitions towards a low-carbon economy, hydrogen is emerging as a promising solution for storing excess renewable energy and decarbonizing sectors such as transportation, industrial processes, and power generation. Hydrogen energy storage allows for the efficient utilization of renewable energy, providing a stable and dispatchable energy supply when needed. Moreover, the versatility of hydrogen as an energy carrier is a significant advantage in the energy transition. Hydrogen can be used in various applications, including fuel cells for electricity generation, industrial processes, and as a fuel for transportation. Its ability to be stored for long durations and transported enables greater flexibility and resilience in the energy system. Additionally, government initiatives and investments in hydrogen infrastructure and technologies have provided impetus to market growth. Many countries have set ambitious targets and implemented supportive policies to promote the development and adoption of hydrogen energy storage. Subsidies, grants, and research funding are encouraging industry players to invest in research, development, and deployment of hydrogen storage technologies.

Integration of Renewable Energy Sources

The integration of renewable energy sources is a major driver for the hydrogen energy storage market. As the world shifts towards clean and sustainable energy systems, the need to effectively store and utilize intermittent renewable energy becomes crucial. Hydrogen energy storage enables the conversion of surplus renewable electricity into hydrogen through electrolysis. The stored hydrogen can then be used for various applications, such as power generation, transportation, and industrial processes. This integration of renewable energy sources with hydrogen storage helps to address the challenge of intermittency and ensures a stable and reliable energy supply. For instance, in Germany, the WindGas project aims to integrate wind power and hydrogen storage to provide grid stability and supply renewable energy during periods of low wind activity. The HyDeploy project in the United Kingdom demonstrates the use of hydrogen blended with natural gas for heating and cooking, allowing for the utilization of excess renewable energy.

Decarbonization Initiatives and Environmental Benefits

The increasing focus on decarbonization and the urgent need to reduce greenhouse gas emissions drive the adoption of hydrogen energy storage. Hydrogen is considered a clean energy carrier as it produces only water vapor when used in fuel cells or burned as fuel. By utilizing hydrogen as an energy storage medium, carbon-intensive sectors such as transportation, industry, and power generation can transition towards low or zero-emission alternatives. The environmental benefits of hydrogen energy storage include reduced carbon emissions, improved air quality, and a pathway toward achieving climate change goals. Japan's Basic Hydrogen Strategy aims to promote the use of hydrogen as an energy carrier to achieve a carbon-neutral society. The European Union's Hydrogen Strategy sets ambitious targets for the production, distribution, and utilization of renewable hydrogen, emphasizing its role in decarbonizing various sectors.

Government Support and Policy Frameworks

Government support and policy frameworks play a vital role in driving the hydrogen energy storage market. Many countries are implementing supportive policies, incentives, and funding programs to encourage the development and deployment of hydrogen technologies. Government initiatives include research grants, subsidies, tax incentives, and regulatory frameworks that promote the use of hydrogen energy storage. These measures provide financial and regulatory support, creating a favorable market environment for industry players to invest in hydrogen storage projects and infrastructure. In the United States, the Department of Energy's Hydrogen and Fuel Cell Technologies Office provides funding and support for research, development, and demonstration projects related to hydrogen storage technologies. China's National Development and Reform Commission has included hydrogen storage as a key area in its strategic plan, providing financial support and policy incentives to accelerate the development of the hydrogen industry.

Infrastructure Development and Cost Challenges

One of the significant restraints faced by the hydrogen energy storage market is the need for infrastructure development and cost challenges. The widespread adoption of hydrogen energy storage requires a robust infrastructure for the production, storage, transportation, and distribution of hydrogen. Currently, the infrastructure for hydrogen storage and distribution is limited compared to traditional energy sources, posing challenges to the widespread implementation of hydrogen energy storage systems. Building the necessary infrastructure, including hydrogen production facilities, storage tanks, pipelines, and refueling stations, requires significant investment and coordination among various stakeholders. The cost of establishing hydrogen infrastructure is another restraint, as it can be substantial, especially in the early stages of deployment. The high capital costs associated with hydrogen production, storage, and transportation technologies can impede the scalability and cost competitiveness of hydrogen energy storage solutions. These infrastructure and cost challenges need to be addressed to facilitate the wider adoption of hydrogen energy storage systems. The International Energy Agency (IEA) highlights the need for substantial investment in infrastructure to support the deployment of hydrogen energy storage technologies. The California Hydrogen Infrastructure Panel states that the development of a hydrogen infrastructure network is critical for the growth of the hydrogen economy, but it requires significant upfront investments. Addressing infrastructure development and cost challenges is crucial for the successful implementation of hydrogen energy storage. Continued investment in infrastructure, advancements in hydrogen production and transportation technologies, and supportive policies and incentives are needed to overcome these restraints and unlock the full potential of hydrogen energy storage systems.

Liquid Form is Expected to Dominate the Market by Form

The hydrogen energy storage market can be segmented based on the form of hydrogen storage, including Gas, Liquid, and Solid forms. Among these segments, the Gas form is expected to witness the highest CAGR during the forecast period of 2026 to 2034, due to its versatility and wide range of applications. Gaseous hydrogen storage involves compressing hydrogen gas into high-pressure tanks or utilizing it in underground storage facilities. This form of storage allows for easy handling, transportation, and utilization in various sectors such as fuel cell vehicles, industrial processes, and power generation. In terms of revenue, the liquid form held a significant share in 2025. Liquid hydrogen storage involves cooling hydrogen to extremely low temperatures, resulting in its liquefaction. Liquid hydrogen has a higher energy density compared to the gaseous form, enabling efficient storage and transportation. It is commonly used in space applications, as well as in specific industries requiring high energy-density fuel, such as aerospace and rocket propulsion. The Solid form, while holding a smaller revenue share, offers advantages such as high energy density and safety. Solid hydrogen storage involves adsorbing or chemically bonding hydrogen onto solid materials. This form of storage is still in the early stages of development but shows potential for applications requiring safe and compact hydrogen storage, such as portable devices and small-scale systems.

Merchant/Bulk Storage Type Dominates the Market by Storage Type

The hydrogen energy storage market can be segmented based on the type of storage, including Cylinder, Merchant/Bulk, On-site, and On-board storage. Among these segments, the On-site storage type is expected to witness the highest during the forecast period of 2026 to 2034, due to its increasing adoption in various industries and applications. On-site hydrogen storage involves the installation of hydrogen storage facilities at the point of use, allowing for immediate access to stored hydrogen. This type of storage is particularly advantageous for industries such as power generation, chemical manufacturing, and transportation, where a localized and readily available hydrogen supply is required. In terms of revenue, the Merchant/Bulk storage type held a significant revenue share in 2025. Merchant/Bulk storage involves large-scale storage and distribution of hydrogen, typically in centralized facilities. These facilities store hydrogen in bulk quantities and supply it to multiple end-users, including industries, utilities, and transportation fleets. The Merchant/Bulk storage type benefits from economies of scale, enabling efficient storage, transportation, and delivery of hydrogen. The Cylinder storage type represents a smaller revenue share but serves specific applications such as small-scale systems, laboratories, and portable devices, where portability and convenience are essential. The On-board storage type, primarily used in the transportation sector, allows for the storage of hydrogen directly on-board vehicles, enabling the utilization of hydrogen as a fuel for fuel cell vehicles. While this segment has a lower revenue share, it exhibits growth potential driven by the increasing adoption of hydrogen fuel cell vehicles.

APAC Remains as the Global Leader

North America is expected to witness significant growth in the hydrogen energy storage market, driven by supportive government policies, investments in renewable energy, and the presence of established players in the market. The United States, in particular, has been at the forefront of hydrogen energy storage initiatives, with several projects and research programs focused on advancing hydrogen storage technologies. Asia Pacific is also a prominent region in the hydrogen energy storage market, with countries like Japan, South Korea, and China leading in terms of both CAGR and revenue percentage. These countries are investing heavily in hydrogen infrastructure, research and development, and promoting the adoption of hydrogen energy as part of their clean energy strategies. Japan, in particular, has set ambitious targets for hydrogen production and utilization, positioning itself as a global leader in hydrogen energy. Europe is another significant market for hydrogen energy storage, with countries like Germany, the Netherlands, and the United Kingdom driving market growth. These countries are investing in renewable energy sources, developing hydrogen production facilities, and implementing policies to support the adoption of hydrogen technologies. Germany's National Hydrogen Strategy aims to establish a strong domestic hydrogen industry and build a comprehensive hydrogen infrastructure.

Market Competition to Intensify during the Forecast Period

The hydrogen energy storage market is characterized by intense competition among key players striving to establish their market presence and gain a competitive edge. Some of the top players in the market include Air Liquide SA, Linde plc, Hydrogenics Corporation, McPhy Energy S.A., Plug Power Inc., Worthington Industries, Linde, Chart Industries, Hexagon Composites, ITN Power, Nel Hydrogen, Hydrogenious Lohc Technologies, Inoxcva, Air Products and Chemicals. These companies are actively engaged in product development, strategic partnerships, mergers and acquisitions, and geographical expansions to strengthen their market position. The competitive landscape of the hydrogen energy storage market is driven by several key trends. One of the prominent trends is the focus on scaling up hydrogen production and storage capabilities. Key players are investing in large-scale hydrogen production facilities and storage infrastructure to meet the increasing demand for hydrogen energy. These investments aim to enhance the availability and accessibility of hydrogen, making it a more viable energy storage solution. Technological advancements and innovation are also crucial in the competitive landscape of the hydrogen energy storage market. Companies are investing in research and development to improve the efficiency and cost-effectiveness of hydrogen production, storage, and utilization technologies. This includes advancements in electrolysis processes, the development of advanced storage materials, and optimization of fuel cell technologies. Strategic partnerships and collaborations play a vital role in the hydrogen energy storage market. Companies are engaging in alliances with other industry players, energy companies, and research institutions to leverage synergies, share expertise, and drive innovation. These partnerships facilitate the development of integrated solutions and comprehensive hydrogen energy storage systems, enabling seamless integration into existing energy infrastructure. Market players are also actively pursuing mergers and acquisitions to expand their market reach and enhance their product offerings. Strategic acquisitions enable companies to gain access to complementary technologies, intellectual property rights, and customer bases. These transactions often lead to the consolidation of market share and increased competitiveness.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Hydrogen Energy Storage market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Form

|

|

Type

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report