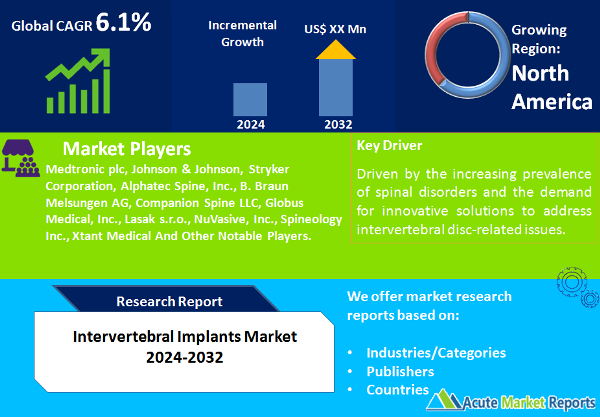

The intervertebral implants market is expected to grow at a CAGR of 6.1% during the forecast period of 2024 to 2032, driven by the increasing prevalence of spinal disorders and the demand for innovative solutions to address intervertebral disc-related issues. While challenges in adoption across diverse end-user settings present a notable constraint, the market's dynamic nature is evident in the distinct preferences for lumbar and cervical implants. As North America leads in revenue and Europe emerges as a growth hub, strategic initiatives by key players underscore the collaborative efforts shaping the market's trajectory. Overcoming challenges in adoption and advancing material technologies positions the Intervertebral Implants market on a path of continuous evolution and innovation, contributing to improved patient outcomes in spinal surgeries.

Key Market Drivers

Proliferation of Minimally Invasive Procedures

The proliferation of minimally invasive procedures stands as a significant driver in the Intervertebral Implants market. Evidence supporting this driver includes the rising preference for minimally invasive spinal surgeries due to their associated benefits, such as reduced postoperative pain, shorter hospital stays, and quicker recovery. As technological advancements continue to enhance the feasibility of minimally invasive approaches, the demand for intervertebral implants, particularly in lumbar surgeries, is expected to witness sustained growth.

Advancements in Implant Materials

Advancements in implant materials contribute significantly to market growth. Titanium, known for its biocompatibility and strength, has emerged as a key material for intervertebral implants. Evidence supporting this driver includes the widespread adoption of titanium implants in spinal surgeries, leading to improved fusion rates and long-term stability. Additionally, the use of Polyetheretherketone (PEEK), with its radiolucency and mechanical properties mimicking natural bone, represents a notable trend, enhancing the overall efficacy of intervertebral implants.

Increasing Cases of Spinal Disorders

The increasing prevalence of spinal disorders, particularly in the aging population, acts as a driver for the Intervertebral Implants market. Evidence supporting this driver includes the rising incidence of conditions such as degenerative disc disease, herniated discs, and spinal stenosis. As the global burden of spinal disorders continues to grow, the demand for intervertebral implants as a therapeutic intervention is expected to rise, driving market expansion.

Restraint

Challenges in Adoption Across End-user Settings

A notable restraint in the Intervertebral Implants market is associated with challenges in adoption across various end-user settings. Evidence supporting this constraint includes variations in the adoption rates of intervertebral implants among hospitals, ambulatory surgical centers, and clinics. While larger hospitals with advanced surgical facilities may readily embrace these implants, smaller clinics, and orthopedic centers may face barriers, hindering uniform market penetration.

Market Segmentation

Market by Type: Lumbar intervertebral implants Dominates the Market

In 2023, Lumbar intervertebral implants emerged as the revenue leader, driven by the higher prevalence of lumbar spinal disorders and the increased adoption of lumbar surgeries. Simultaneously, Cervical implants exhibited the highest CAGR, underscoring the growing demand for cervical spine interventions. The evidence lies in the distinct clinical needs and surgical approaches for lumbar and cervical spinal conditions, reflecting the dynamic nature of market segments.

Market by Material: Titanium Implants Dominate the Market

Titanium implants led both in revenue and CAGR in 2023, emphasizing the widespread acceptance of titanium as a preferred material for intervertebral implants. The evidence lies in the superior biomechanical properties of titanium, contributing to enhanced fusion and stability in spinal surgeries. While PEEK implants showcased a lower but notable CAGR, their adoption is rising, particularly in cases where radiolucency is paramount.

Market by End-user: Hospitals Dominate the Market

Hospitals led in both revenue and CAGR in 2023, highlighting their central role in performing spinal surgeries and adopting advanced intervertebral implants. Ambulatory Surgical Centers exhibited a higher CAGR, indicating the increasing trend of performing spine surgeries in outpatient settings. The evidence lies in the shift toward ambulatory care models and the growing expertise of these centers in providing specialized orthopedic interventions.

North America Remains the Global Leader

North America emerged as the region with the highest revenue and CAGR in 2023, driven by the region's well-established healthcare infrastructure and the increasing prevalence of spinal disorders. The evidence supporting this includes the high incidence of conditions like degenerative disc disease in the aging population and the proactive adoption of advanced spinal interventions. Europe showcased substantial growth potential, with a focus on technological advancements and the adoption of minimally invasive spinal surgeries.

Product Innovation remains the Key to Increase Market Share

In 2023, top players such as Medtronic plc, Johnson & Johnson, Stryker Corporation, Alphatec Spine, Inc., B. Braun Melsungen AG, Companion Spine LLC, Globus Medical, Inc., Lasak s.r.o., NuVasive, Inc., Spineology Inc., and Xtant Medical played pivotal roles in the Intervertebral Implants market. Their key strategies encompass product innovations, strategic acquisitions, and collaborations. Medtronic's launch of the Prestige LP Cervical Disc System, designed for motion preservation in cervical spine surgery, reflects the company's commitment to addressing specific clinical needs. Johnson & Johnson's acquisition of Cervical Total Disc Replacement (TDR) technology further strengthens its position in the intervertebral implants market. Stryker Corporation's focus on expanding its product portfolio with advanced implant materials and surgical techniques contributes to the competitive dynamics.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Intervertebral Implants market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Type

| |

Material

| |

End-User

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report