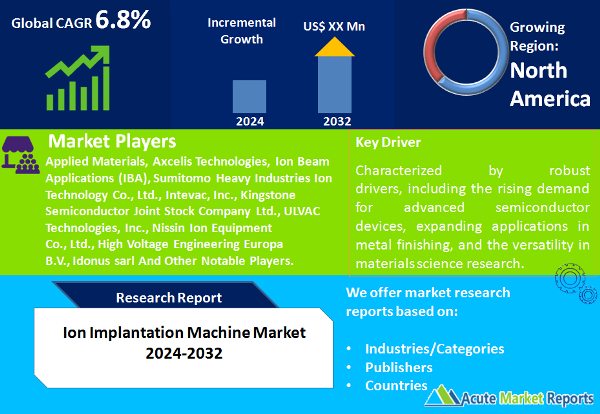

The ion implantation machine market is expected to grow at a CAGR of 6.8% during the forecast period of 2024 to 2032, characterized by robust drivers, including the rising demand for advanced semiconductor devices, expanding applications in metal finishing, and the versatility in materials science research. However, the market faces a notable restraint in the complexity of diverse product types, emphasizing the need for streamlined solutions and industry collaboration. The segmentation analysis provides a nuanced understanding of the market, with product types and applications delineating diverse dimensions of ion implantation technology. The geographic segment highlights regional dynamics, while competitive trends showcase key players and strategies shaping the industry landscape. As the market evolves from 2024 to 2032, the integration of advanced technologies, customization to meet diverse industry needs, and proactive solutions to address manufacturing challenges will be pivotal. The ion implantation machine market, with its multifaceted challenges and opportunities, stands at the forefront of driving technological advancements in semiconductor manufacturing, metal finishing, and materials science research.

Key Market Drivers

Rising Demand for Advanced Semiconductor Devices

The escalating demand for advanced semiconductor devices serves as a primary driver propelling the ion implantation machine market. Evidenced by the growing prevalence of smartphones, tablets, and other electronic devices incorporating cutting-edge semiconductor technologies, the semiconductor industry is witnessing increased production requirements. Leading semiconductor manufacturers such as Intel, Samsung, and TSMC are investing significantly in ion implantation technology to enhance semiconductor performance. The trajectory from 2024 to 2032 anticipates sustained growth as the semiconductor industry continues to evolve, necessitating advanced ion implantation solutions to meet the demand for high-performance and energy-efficient semiconductor devices.

Expanding Applications in Metal Finishing

The expanding applications of ion implantation in metal finishing processes emerge as a crucial driver influencing market growth. Evidenced by the adoption of ion implantation machines in metal finishing for enhancing surface properties, such as hardness, wear resistance, and corrosion resistance, industries like aerospace, automotive, and medical devices are increasingly leveraging this technology. Companies like Ion Beam Applications (IBA) and Axcelis Technologies are at the forefront of providing ion implantation solutions for diverse metal finishing applications. The trajectory from 2024 to 2032 anticipates continuous growth as the demand for improved material properties in metal finishing processes drives the adoption of ion implantation technology across various industrial sectors.

Versatility in Materials Science Research

The versatility of ion implantation machines in materials science research acts as a significant driver shaping market dynamics. Evidenced by their utilization in materials modification, surface engineering, and doping processes for research purposes, ion implantation machines play a pivotal role in advancing materials science. Academic institutions, research laboratories, and materials science-focused industries are increasingly adopting ion implantation technology for its precision in manipulating material properties at the atomic level. Leading research institutions and laboratories, including Lawrence Berkeley National Laboratory and CERN, contribute to the advancement of ion implantation applications in materials science. The trajectory from 2024 to 2032 anticipates sustained growth as materials science researchers explore new frontiers, driving the demand for advanced ion implantation solutions.

Restraint

Despite the positive growth drivers, a notable restraint in the ion implantation machine market is the challenge posed by the complexity of diverse product types. As evidenced by the existence of High Current Implanters, High Energy Implanters, Medium Current Implanters, and other specialized categories like Plasma Immersion Implanters and Implanters for Photovoltaic Cell Doping, the market faces challenges in standardization and adaptability. Integrating diverse product types into various manufacturing processes requires tailored solutions, and the complexity of selecting the most suitable implant for specific applications poses a restraint. The evidence suggests that achieving a balance between specialized functionalities and user-friendly interfaces is crucial to addressing this challenge. As industries diversify their applications, the need for versatile ion implantation machines that cater to various product types becomes paramount. This restraint emphasizes the importance of industry collaboration and continuous innovation to streamline ion implantation processes across different domains.

Key Market Segmentation

Market by Product Type: High Energy Implanters Dominate the Market

The market segmentation based on product types differentiates between High Current Implanters, High Energy Implanters, Medium Current Implanters, and others like Plasma Immersion Implanters and Implanters for Photovoltaic Cell Doping. In 2023, High Energy Implanters led in terms of revenue, emphasizing their widespread use in semiconductor manufacturing. Simultaneously, Medium Current Implanters exhibited the highest CAGR during the forecast period, indicating their growing adoption in diverse applications beyond semiconductors. This nuanced segmentation caters to the evolving needs of various industries, with a focus on both high-energy applications and medium-current applications of ion implantation technology.

Market by Application: Semiconductors Dominate the Market

The segmentation based on applications delineates the demand for ion implantation machines across Semiconductors, Metal Finishing, and others like Materials Science Research. In 2023, Semiconductors led in terms of revenue, reflecting the traditional stronghold of ion implantation in semiconductor manufacturing. Simultaneously, Metal Finishing showcased the highest CAGR during the forecast period, indicating the expanding applications of ion implantation in enhancing material properties for various industrial purposes. This segmentation recognizes the diverse applications of ion implantation technology across different sectors, with a focus on both established and emerging application areas.

North America Remains the Global Leader

The geographic segment analyzes trends, identifying regions with the highest CAGR and revenue percentage in the ion implantation machine market. In the forecast period from 2024 to 2032, Asia-Pacific is expected to exhibit the highest CAGR, driven by the burgeoning semiconductor industry in countries like China, Taiwan, and South Korea. North America is anticipated to maintain the highest revenue percentage, owing to the established semiconductor manufacturing infrastructure in the region. These geographic trends underscore the global nature of the ion implantation market, with varying regional dynamics shaping market growth.

Market Competition to Intensify during the Forecast Period

The competitive trends in the ion implantation machine market encompass key players and their strategies, providing an overarching outlook on the industry. In 2023, companies like Applied Materials, Axcelis Technologies, Ion Beam Applications (IBA), Sumitomo Heavy Industries Ion Technology Co., Ltd., Intevac, Inc., Kingstone Semiconductor Joint Stock Company Ltd., ULVAC Technologies, Inc., Nissin Ion Equipment Co., Ltd., High Voltage Engineering Europa B.V., and Idonus sarl emerged as industry leaders, contributing significantly to market revenues. The strategies employed by these players include continuous innovation in ion implantation technology, strategic collaborations with semiconductor manufacturers, and a strong focus on research and development. As the market progresses from 2024 to 2032, the expected trends include an increased emphasis on customization to meet diverse industry needs, partnerships with emerging technology companies, and a proactive approach to addressing evolving manufacturing requirements. These competitive trends highlight the dynamic nature of the ion implantation machine market, with key players adapting to emerging industry demands and technological advancements.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Ion Implantation Machine market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Application

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report