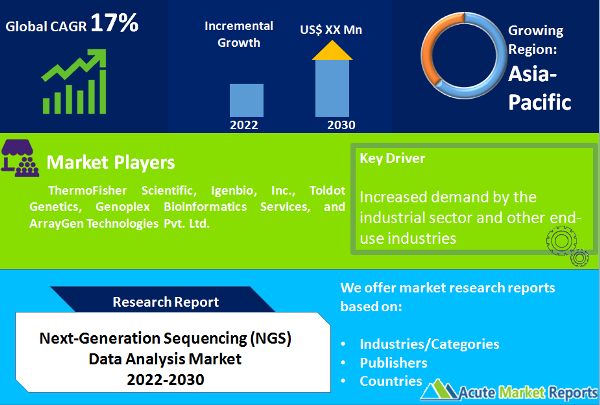

The global market for next-generation sequencing data analysis is anticipated to increase at a CAGR of 17% during the forecast period of 2025 to 2033. Using next-generation sequencing (NGS), it is now possible to analyse the genomic and epigenomic patterns connected to a variety of biological activities. However, problems with information management, access, and storage are anticipated to offer the market considerable R&D opportunities, hence promoting market expansion. Laboratory Information Management Systems (LIMSs) are required by research communities that use high-throughput sequencers for processing and storing sequencing data. When analysing NGS data, cloud-based platforms provide advantageous options for activities requiring a lot of computing. As a result, it is now simple and quick to acquire the necessary computing power to carry out large-scale NGS data processing.

Impact of Covid: The Market Growth Revised Positively

The emphasis on genome surveillance has intensified as a result of uncontrolled spread of COVID-19. Additionally, improved genome monitoring capabilities can aid in the creation of intelligent systems to monitor virus variations and mutations linked to respiratory diseases. The introduction of EpiPulse, a European surveillance platform for infectious illnesses, to collect, evaluate, and disseminate sequencing data related to infectious diseases, was announced by the European Centre for Disease Prevention and Control in June 2021.

Services segment is anticipated to increase at a CAGR of 15% during the forecast period. Following a thorough examination of the financial impact of the pandemic and the economic crisis it caused, the growth rate for the NGS Commercial Software category is revised to 13.5% CAGR during the forecast period. NGS Commercial Software held about 45 percent market share for Next Generation Sequencing (NGS) Data Analysis worldwide in 2021. With increased knowledge and rising demand for sequencing technologies, analytical software is predicted to rise rapidly over the coming years. The enormous amount of data produced by NGS necessitates management platforms and solutions, which is driving up demand for these algorithms and technologies.

Additionally, the businesses are using these surveillance platforms, which can offer a reliable platform for virus sequencing and analysis. For instance, Applied DNA Sciences, Inc. announced the introduction of the Linea Genomic Surveillance Mutation Panel for COVID-19 in March 2021 to streamline the procedure for tracking and identifying SARS-CoV-2 variants.

Drivers: Intensive Focus on Genome Sequence Remains as a Significant Driver Impacting Market Growth

The market is anticipated to grow during the forecast period due to the advent of cloud-based bioinformatics platforms and services for extensive NGS data analysis. NGS protocols have been increasingly used in oncology precision medicine, particularly for breast and lung tumours. Due to the complexity of genomic research nowadays, a higher level of comprehension is required than what is provided by traditional DNA sequencing methods. In order to meet these needs for higher levels of understanding, next generation sequencing has filled in the gaps and has evolved into a standard research tool. In order to grow their operations, companies are also concentrating on creating affordable genome sequencing options. For instance, Phase Genomics announced in October 2021 that it would introduce a cost-effective platform for genomic analysis. The scalability of next-generation sequencing makes it a digital substitute for sequence-based gene expression, allowing the level of resolution to be changed to suit experimental demands.

Increased adoption of advanced technologies such as IoT in data sequencing analysis could stimulate the growth in the global market, in the years ahead. Innovation in products, strategic initiatives, and regional expansions are important strategies that can aid in market growth. Implementation of such extensive strategic initiatives in the field of next-generation sequencing data analysis by the existing players will assist to address the unmet needs of consumers.

Fast and accurate algorithms and sequencing interpretation tools are required due to the development of NGS approaches, growing clinical diagnosis for the tailored treatment of many diseases, and genetic research, which can evaluate data more quickly. One or two of the primary reasons for the increase in the size of sequencing projects is the simultaneous decline in prices and high genetic data production. The need for sophisticated and effective solutions for complex bioinformatics pipelines is thus rising.

The introduction of NGS methods combined with their increasing adoption in clinical diagnosis, genomic research, and for personalized treatment of several diseases are bolstering the demand for precise and rapid sequencing interpretation tools and algorithms that can expedite data analysis. Moreover, the scope of sequencing projects is expected to rise due to the high genetic data output and concurrent drop in the prices of sequencing. This has led to an increased demand for elaborate bioinformatics pipelines with advanced and efficient solutions.

Restraints: Infrastructure Cost Remains as a Key Cause of Concern

It is projected that some of the market's growth would be constrained by the infrastructure costs associated with the creation of algorithms and software. Additionally, the lengthy nature of NGS data analysis is impeding the market's expansion. Commercial service providers will, however, have profitable chances to build and create innovative solutions with quicker response times.

Product Segmentation: NGS Service Segment Contributes 50% of Global Market Revenues

With a revenue share of more than 50.0 percent in 2021, the services segment commanded a hefty market share. Establishments without the necessary infrastructure for data administration, analysis, and interpretation are quick to adopt cost-effective NGS data analysis services. Services for exome interpretation, variant calling, mapping, annotation, and other services are provided by companies including ThermoFisher Scientific, Igenbio, Inc., Toldot Genetics, Genoplex Bioinformatics Services, and ArrayGen Technologies Pvt. Ltd.

Work Flow Segmentation: NGS Tertiary Data Analysis Leads in 2021 yet SDA Presents Significant Opportunities

With a revenue share of more than 45.0 percent in 2021, NGS tertiary data analysis led the market. For NGS tertiary data analysis, a variety of annotation tools are used, and businesses are implementing deliberate initiatives to broaden the reach of these tools. For instance, Verogen and Cellmark Forensic Services worked together in October 2021 to launch the first NGS-based forensic services in the United Kingdom. The agreement will incorporate the usage of the MiSeqFGx System, ForesnSeq DNA Signature Prep Kit, and Universal Analysis Software.

By Mode Segmentation: In-House Dominating with over 65% of Global Revenue Share

In-house mode generated more than 65% of the revenue in 2021. The in-house method includes businesses that use NGS for illness testing and diagnosis while carrying out their analysis utilising readily available hardware and software. Such businesses that operate in this sector are multiplying quickly. Additionally, it has been noted that numerous academic and research institutions spend more than twice as much annually on internal data analysis as they do on outsourcing. A speedy integration of cutting-edge scientific operations into bioinformatics pipelines is also made possible by in-house analysis. The segment is primarily driven by these reasons, and it's expected that it will continue to take the lead during the projected period. However, setting up an internal data analysis infrastructure requires significant time and money expenditures, as well as complicated IT architectures.

Read Length Segmentation: SRS Held Over Three Fourth of Global Market Revenues

Due to the widespread adoption of short-read sequencing and the availability of alignment tools and algorithms for the data, short-read sequencing dominated the market in 2021 with a share of over 73% of market revenues. Short-read sequencing data analysis apps are part of BaseSpace Sequence Hub, a cloud computing platform for genomics that may streamline the management of sequencing data and be used in a variety of investigations. The market for long and extremely long read sequencing segments offers abundant prospects.

End-User Segmentation: Academic Research Segment Contributed Over Half of Global Market Revenues

With a revenue share of more than 50.0 percent in 2021, the academic research sector held the market's top position. The expansion can be attributable to an increase in workflow use in academic institutions. For example, the Saphyr system from Bionano Genomics, IlluminaMiSeq, Pacbio Sequel, and 10XGenomics Chromium has been installed at Wageningen University & Research in the Netherlands for genome de novo sequencing, re-sequencing, gene expression analysis (RNA-seq), genome-wide methylation studies, and other bioinformatics analyses.

Regional Perspectives: Europe Remains as the Global Leader

In 2021, Europe accounted for the greatest revenue share of over 45.0 percent. This can be due to the presence of numerous businesses using data analysis software in this area, including a sizable number of prominent firms like Illumina, Thermo Fisher Scientific, and Agilent Technologies. The demand for NGS software tools is growing as more NGS research initiatives are carried out in European universities. The U.K. reported the highest number of published COVID-19 genomic sequences, or 38.9% of all published data, according to a study on COVID-19 genomic sequencing for countries. Such institutional endeavours increase demand for NGS technology for COVID-19, which in turn increases demand for NGS data analysis tools. Similarly, Germany is expected to grow at a CAGR of 14.5% during the forecast period.

Over the projected period, Asia Pacific is anticipated to develop at the fastest rate. This is mostly caused by the rise in funds for sequencing projects in these region's emerging nations. The second-largest economy in the world, China, is anticipated to grow at a CAGR of 15% during the forecast period. Similarly, Japan and Canada are expected to grow at a CAGR of 13% and 13.5% respectively during the forecast period. Furthermore, it is projected that the NGS data sequencing market in Asia Pacific would increase due to encouraging R&D outcomes that are supporting the use of high-throughput sequencing in clinical diagnostics. The adoption of sequencing technologies in Japan has significantly advanced our understanding of the molecular causes of cancer. Numerous cancer gene panels based on NGS technology have received approval from the Japanese Ministry of Health, Labor, and Welfare for use in clinical settings. By merging ACT Genomics' NGS database with ASUS' Intelligent Cloud Services, Kaohsiung Medical University Chung-Ho Memorial Hospital, Taiwan, and ACT Genomics will be able to focus precision cancer treatment in November 2020.

Key Companies & Competitive Analysis

The global next-generation sequencing data analysis market is highly competitive, with the presence of several prominent players. Many of these players have become successful owing to years of delivering consistent results and are expected to account for a large share in the overall market, in future. Growth strategies such as novel product launches could create revenue-generating opportunities for leading players and help gain a competitive edge over other players, in future. Collaboration with smaller players could assist well-established next-generation sequencing data analysis market players expand their market presence and increase their revenue shares.

Market leaders have acquired smaller players to reinforce their market presence. In October 2021, Bionano Genomics, Inc. acquired BioDiscovery, Inc., a software company with the analysis, interpretation, and reporting of genomic data solutions. This acquisition allowed the company to improve its capabilities to analyze and interpret sequencing data.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Next-Generation Sequencing (NGS) Data Analysis market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Workflow

| |

Mode

| |

End User

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report