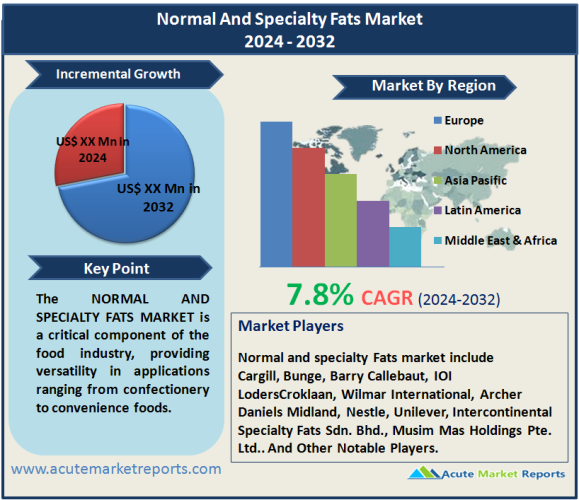

The normal and specialty fats market is a critical component of the food industry, providing versatility in applications ranging from confectionery to convenience foods. The normal and specialty fats market is at the intersection of evolving consumer preferences, industry trends, and sustainability challenges. The market is expected to grow at a CAGR of 7.8% during the forecast period of 2024 to 2032. While the demand for healthier fats and the influence of convenience foods drive growth, sustainability concerns pose challenges that the industry is actively addressing. Market dynamics vary across fat types, applications, and regions, reflecting the adaptability and innovation within the industry. As major players continue to navigate these trends, the Normal and specialty Fats market is poised to play a pivotal role in shaping the future of food production, ensuring a delicate balance between taste, health, and environmental responsibility.

Growing Consumer Preference for Healthy Fats

The increasing focus on health and wellness has driven a shift in consumer preferences towards healthier fat alternatives. Olive oil, avocado oil, and other specialty fats have gained popularity as consumers seek heart-healthy options. Major players like Cargill and Bunge have responded by expanding their portfolios to include healthier fat alternatives. The evidence lies in the rising sales of healthier fat products, with consumers actively seeking labels such as "low in saturated fats" and "rich in unsaturated fats."

Expanding Applications in Bakery and Confectionery

The bakery and confectionery industry's robust growth has been a key driver for the normal and specialty fats market. As consumers indulge in bakery treats and confectionery products, there is an increased demand for fats that enhance texture, flavor, and shelf life. Specialty fats like cocoa butter equivalents and replacers have become essential ingredients for chocolate and confectionery production. Evidence of this driver is evident in the continued expansion of bakery and confectionery businesses globally, with major players like Barry Callebaut and IOI LodersCroklaan leading innovation in specialty fats.

Rising Demand for Convenience Foods

The global trend towards convenience foods and ready-to-eat meals has propelled the demand for specialty fats. Palm oil, a versatile specialty fat, is extensively used in the production of convenience foods due to its stability and texture-enhancing properties. Companies like Wilmar International and Archer Daniels Midland have capitalized on this trend, supplying specialty fats for various convenience food applications. The evidence lies in the increasing market share of convenience foods globally and the integration of specialty fats to meet consumer expectations for taste and texture in such products.

Restraint

Despite the positive momentum, a significant restraint in the Normal and specialty Fats market is the challenge posed by environmental and sustainability concerns. In 2023, as awareness of the environmental impact of palm oil production increased, there was a growing push for sustainable and eco-friendly alternatives. Evidence of this restraint is reflected in consumer activism, with demands for transparency in the supply chain and sourcing of raw materials. Major players in the industry, such as Nestlé and Unilever, have responded by pledging to use sustainably sourced fats in their products.

Market Segmentation by Type - Cocoa Butter Equivalent Dominates the Market

The market can be segmented based on types of fats, including cocoa butter equivalents, replacers, substitutes, filling fats, milk-fat replacers, spread fats, frying fats, margarine, shortenings, butter, and others. In 2023, the highest revenue and CAGR were observed in the cocoa butter equivalent segment, driven by its versatile applications in the chocolate and confectionery industry. However, during the forecast period of 2024 to 2032, the highest CAGR is anticipated in the spread fats segment, reflecting the increasing demand for healthier alternatives in the spreadable fat category.

Market Segmentation by Application – Bakery Segment Dominates the Market

Segmenting the market by applications includes bakery, confectionery, convenience food, dairy, and others. In 2023, the highest revenue was generated in the bakery segment, as fats play a crucial role in achieving desirable textures and flavors in baked goods. However, during the forecast period of 2024 to 2032, the highest CAGR is expected in the convenience food segment, underscoring the growing influence of specialty fats in the production of ready-to-eat and on-the-go meals.

Europe Remains the Global Leader

Geographically, the normal and specialty fats market exhibited diverse trends. In 2023, Europe led in both revenue and CAGR, driven by the strong presence of chocolate and confectionery manufacturers. However, the Asia-Pacific region is expected to experience the highest CAGR during the forecast period, fueled by the increasing consumption of bakery and convenience food products in emerging markets.

Market Competition to Intensify during the Forecast Period

Top players in the Normal and specialty Fats market include Cargill, Bunge, Barry Callebaut, IOI LodersCroklaan, Wilmar International, Archer Daniels Midland, Nestle, Unilever, Intercontinental Specialty Fats Sdn. Bhd., and Musim Mas Holdings Pte. Ltd. These companies deploy diverse strategies, including sustainability initiatives, product innovation, and global expansion, to maintain their competitive edge. In 2023, their revenues reflected market leadership, with expectations of sustained growth during the forecast period.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Normal And Specialty Fats market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Type

| |

Application

| |

Distribution Channel

| |

End-Use

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report