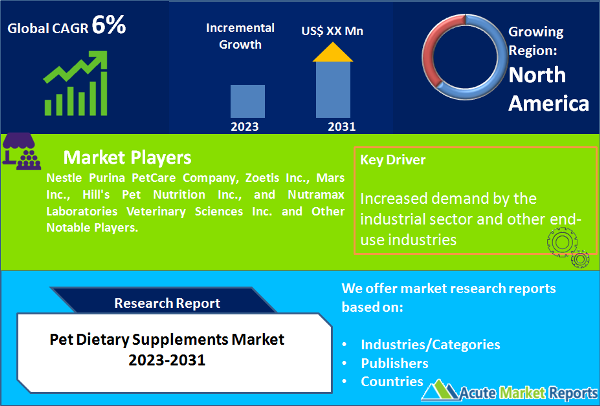

Pet dietary supplements provide essential nutrients and vitamins to pets, which help in maintaining their overall health and well-being. The pet dietary supplements market has been growing steadily in recent years, driven by factors such as increasing pet ownership, rising awareness about pet health and nutrition, and the growing trend of pet humanization. The demand for natural and organic pet dietary supplements is also increasing due to the rising awareness of pet owners about the potential health benefits of natural and organic products. The pet dietary supplements market is expected to grow at a CAGR of 6% during the forecast period of 2024 to 2032. The market revenue is driven by the increasing demand for dietary supplements for pets and the growing trend of pet humanization. According to the American Pet Products Association (APPA), the total pet spending in the U.S. was approximately USD 99 billion in 2020, with more than USD 38 billion spent on pet food and treats. This indicates a huge potential for the pet dietary supplements market, as pet owners become more aware of the importance of proper nutrition for their pets.

Increasing Pet Ownership

The increasing number of pet owners is one of the major drivers of the pet dietary supplements market. As per the American Pet Products Association (APPA), the U.S. pet industry sales increased by 6.7% in 2020, reaching USD 103.6 billion, with approximately 70% of U.S. households owning pets. The growing trend of pet humanization, where pets are treated like family members, has also led to an increase in pet spending, including spending on dietary supplements for pets.

Growing Awareness About Pet Health and Nutrition

There is a growing awareness among pet owners about the importance of pet health and nutrition, which is driving the demand for pet dietary supplements. Pet owners are increasingly seeking natural and organic products that can provide essential nutrients to their pets. Moreover, the prevalence of pet health issues such as obesity, arthritis, and digestive problems has led to an increased demand for dietary supplements to help manage these conditions.

The trend of Pet Humanization

The trend of pet humanization is driving the growth of the pet dietary supplements market. Pet owners are treating their pets like family members and are willing to spend on their well-being. This trend has led to an increase in the demand for premium pet products, including dietary supplements. According to a survey by the American Pet Products Association, more than 80% of pet owners consider their pets as family members and around 60% of pet owners are willing to pay more for natural and organic pet products.

Stringent Regulatory Requirements

One of the significant restraints of the pet dietary supplements market is the stringent regulatory requirements. The pet dietary supplements industry is heavily regulated to ensure the safety and efficacy of these products. The regulatory bodies require manufacturers to comply with various regulations and standards to ensure the quality and safety of pet dietary supplements. The regulatory requirements vary by country, making it difficult for manufacturers to comply with different regulations. For instance, in the United States, pet dietary supplements are regulated by the U.S. Food and Drug Administration (FDA) under the Federal Food, Drug, and Cosmetic Act (FD&C Act). The FDA requires pet dietary supplement manufacturers to comply with Current Good Manufacturing Practices (CGMPs), label the product accurately, and ensure that the product is safe and effective. Similarly, in Europe, pet dietary supplements are regulated by the European Food Safety Authority (EFSA) and must comply with the European Union (EU) regulations on animal feed. Meeting the regulatory requirements can be costly and time-consuming for manufacturers, and failure to comply with the regulations can result in product recalls, legal penalties, and damage to the brand's reputation.

Dogs Remain the Dominant Pet Segment

Dogs are the most commonly kept pets globally, and hence the demand for dietary supplements for dogs dominated the revenue contribution in 2023. According to a report by the American Pet Products Association, around 63.4 million U.S. households own a dog, and the expenditure on pet products is expected to reach $109.6 billion in 2021. The increasing awareness among pet owners about the health benefits of dietary supplements, such as improved immunity, joint health, skin and coat health, and digestive health, is expected to drive the demand for dietary supplements for dogs. The dog segment is expected to witness a CAGR of 5.1% during the forecast period of 2024 to 2032. The increasing prevalence of chronic diseases, such as obesity, arthritis, and diabetes, among dogs, is driving the demand for dietary supplements that can help in managing these conditions. The cat segment is expected to witness the highest CAGR of 5.7% during the forecast period. The cat segment is expected to witness significant growth during the forecast period. According to the American Pet Products Association, around 42.7 million U.S. households own a cat, and the expenditure on pet products is expected to reach $109.6 billion in 2021.

Joint Health Segment to Dominate the Growth and Revenues

The joint health segment is expected to witness significant growth during the forecast period. The highest revenue for the pet dietary supplements market was also contributed by the joint health segment in 2023. The global market for joint health supplements for pets is expected to grow at a CAGR of 6.5% from 2024 to 2032. The increasing prevalence of joint-related issues, such as osteoarthritis, among pets is driving the demand for joint health supplements. Joint health supplements help in reducing inflammation, improving mobility, and enhancing the overall joint health of pets. The skin and coat health segment is expected to witness moderate growth during the forecast period. The increasing awareness among pet owners about the benefits of dietary supplements in improving skin and coat health is driving the demand for these supplements. Skin and coat health supplements help in reducing shedding, promoting healthy skin and coat, and reduce itching and scratching in pets. The digestive health segment is also expected to witness moderate growth during the forecast period. The increasing prevalence of digestive issues, such as diarrhea, constipation, and vomiting, among pets is driving the demand for digestive health supplements. Digestive health supplements help in improving digestion, reducing inflammation, and promoting the overall digestive health of pets.

North America Remains as the Global Leader

North America currently dominates the market due to the growing trend of pet humanization and increasing awareness about pet health. However, the Asia Pacific region is expected to witness the highest CAGR during the forecast period due to the increasing demand for pet dietary supplements and the rising pet population in the region. North America is expected to maintain its dominance throughout the forecast period due to the high adoption of pets and the growing trend of pet humanization in the region. The Asia Pacific region is expected to witness the highest CAGR during the forecast period due to the rising pet population, increasing pet adoption, and growing awareness about pet health in the region. The Asia Pacific region is expected to be the fastest-growing market for pet care products, including dietary supplements, with a CAGR of 8% during the forecast period of 2024 to 2032. The highest revenue-generating countries in the region include China, Japan, and India.

Market Competition to Intensify During the Forecast Period

The global pet dietary supplements market is highly competitive, with several established and emerging players vying for market share. The global pet dietary supplements market is characterized by intense competition, innovation, and a focus on sustainability. Companies are investing in research and development, expanding their distribution networks, and focusing on sustainability to gain a competitive advantage and increase their market share. The key players operating in the market include Nestle Purina PetCare Company, Zoetis Inc., Mars Inc., Hill's Pet Nutrition Inc., and Nutramax Laboratories Veterinary Sciences Inc., among others. To gain a competitive advantage in the market, companies are focusing on strategies such as mergers and acquisitions, partnerships, product launches, and collaborations. For instance, in September 2021, Nestle Purina PetCare announced the acquisition of Heyday, a pet supplement startup that offers nutritional supplements to improve dog health. This acquisition is expected to enhance Nestle Purina's portfolio of pet supplements and boost its market share. Another example of a competitive trend in the market is the launch of new and innovative products. Companies are investing in research and development to develop new products that cater to the specific needs of pets, such as joint health, skin and coat health, and digestive health. For instance, in September 2021, Hill's Pet Nutrition launched its Prescription Diet DermDefense, a pet supplement that helps support skin health and improve the skin's natural barrier function. The market players are also focusing on sustainability and eco-friendliness by using recycled and eco-friendly packaging materials. This strategy not only helps companies reduce their carbon footprint but also appeals to environmentally conscious consumers.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Pet Dietary Supplements market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Pet

| |

Supplement

| |

Ingredient

| |

Form

| |

Application

| |

Distribution Channel

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report