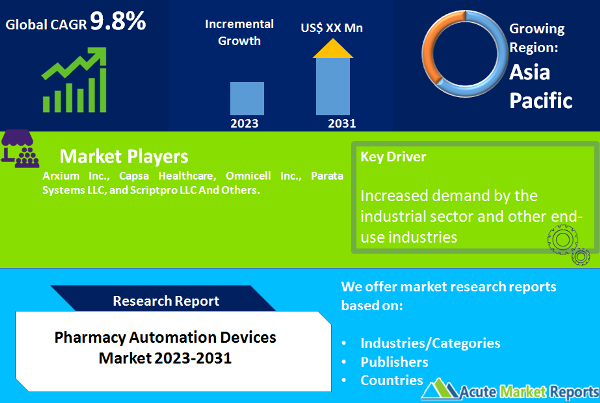

The size of the global market for pharmacy automation devices, estimated at 5.1 billion dollars in 2021, is expected to increase at a compound annual growth rate (CAGR) of 9.8% during the course of the forecast period. With the use of analytics and software, pharmacy automation devices are revolutionising the retail pharmacy industry worldwide. Automation has increased the industry's profitability while simultaneously increasing its efficiency by a factor of ten. The automation has significantly reduced the amount of medicine wasted, which has reduced the cost per dose. Additionally, it has made workflow management simple for pharmacists while putting a stronger emphasis on patient happiness. The cost of prescription and over-the-counter medications has been soaring in recent years.

The automation of routine actions and procedures carried out in pharmacies and other healthcare settings is referred to as pharmacy automation. Pharmacy Automation System handles and distributes medications in pharmacies and hospitals. Modern healthcare is significantly impacted by pharmacy automation. It involves the mechanical handling and distribution of pharmaceuticals. Any pharmacy task may be handled, including managing inventories, measuring and mixing powders and liquids for compounding, tracking and updating customer information from databases, including medical history and medication interaction risk detection.The growing need for medication that is error-free and the increased focus on infrastructure improvements for providing cutting-edge healthcare solutions in emerging nations are the main drivers propelling the market for pharmacy automation systems.

A mechanically driven method called Pharmacy Automation System handles and distributes medications in pharmacies and hospitals. The growing need for medication that is error-free and the increased focus on infrastructure improvements for providing cutting-edge healthcare solutions in emerging nations are the main drivers propelling the market for pharmacy automation systems.

Automated dispensing systems also strike a compromise between safety, usability, inventory management, and medication control. Automated dispensing systems are in high demand because of all these qualities. These devices reduce manual end-of-shift counts in the patient care area, which frees up nurse time. A rising market exists for automated solutions that support stock and inventory management. The demand for automated dispensing systems is growing as a result of reasons such as the rise in the world's geriatric population, the prevalence of numerous chronic conditions, and high hospitalisation rates.

Medical prescription errors driving the pharmacy automation systems market

Medical prescription errors are the primary cause of the rising number of injuries and fatalities, and as a result, there is ongoing pressure on the whole healthcare industry to transition to an automated system. The emphasis on providing patients with high-quality healthcare services by businesses is projected to lead to growth in the market for pharmacy automation systems globally. Due to its precision and prompt delivery of pharmaceuticals to individuals seeking treatment, products like automated medication dispensing systems are likely to be well-liked. Globally, it is acknowledged that medication and dispensing errors are the main reasons why patients return to the hospital.

Automation helps cut expenses by minimising the amount of useful and expired medication wasted

According to the American Academy of Actuaries, the cost of prescription medications alone in 2016 was estimated to be USD 3,337 billion, or staggering 17.9% of the country's GDP. The waste of pharmaceuticals in hospitals and pharmacies is another additional expense. Automation has helped the retail pharmacy industry cut expenses by minimising the amount of useful and expired medication wasted. According to a Reuters analysis, the unnecessary waste of cancer medications costs the United States $3 billion a year. According to an OECD survey, around 17,600 tonnes of unused or expired medications were discarded in France in 2018. The amount of wasted medications has been steadily rising.

Technology drives the market

In the near future, the global market for pharmacy automation systems is anticipated to rise due to a shift in interest in technology brought on by increased knowledge of its advantages. Pharmacy automation technologies are being adopted by pharmacies all around the world to automate their routine processes and minimise human interference. Both inpatient and outpatient pharmacies have adopted the system. Additionally, it maintains and updates patient data in a database, as well as measures and formulates customised drugs. The distribution, handling, and inventory management procedures are all under constant observation by the pharmacy automation system. Hospital pharmacies and retail pharmacies both have strong positions for pharmacy automation systems. Automated dispensing systems also strike a compromise between safety, usability, inventory management, and medication control. These devices reduce manual end-of-shift counts in the patient care area, which frees up nurse time. A rising market exists for automated solutions that support stock and inventory management.

Robotic dispensing helps improve prescription volumes

Automation in the retail pharmacy industry has been around for a while; robotic dispensing can improve prescription volumes while decreasing staff training expenses. Although adding automated systems may be expensive up front, the savings after streamlining the workflow are substantial. For instance, a Colorado pharmacy owner claimed that the installation of the ScriptPro dispensing robot increased his prescription output by 50%. The CEO of another pharmacy company said that the installation of the robot raised his prescription volume by 70%.

Rise in geriatric population leads to increase in the medical prescriptions

The number of elderly people has increased on a global scale. As a result, the incidence of chronic and fatal diseases increases, and the amount of medication prescribed rises. An estimated 237 million medication errors are reported to the NHS in England each year, and avoidable adverse drug reactions (ADRs) are responsible for hundreds of fatalities, according to the article "Economic analysis of the prevalence and clinical and economic burden of medication error in England," which was published in June 2021. Consequently, in order to save operating expenses while enhancing patient safety, hospitals and pharmacies are implementing innovative pharmacy automation technology.

High initial capital investments are a challenge

Although IT-based approaches to pharmacy administration have many advantages, some healthcare professionals and providers are hesitant to adopt or accept them. This is especially clear when there are cultural obstacles present, especially in developing economies. Because of this, a lot of pharmacists are reluctant to use pharmacy automation systems as part of their dispensing routine and do not want assistance. Even though automated pharmacy systems have many advantages, as seen by the widespread adoption of technology, only high-volume pharmacies and hospitals have historically been able to demonstrate the returns on investment (ROIs) received from putting these automated systems in place

Untapped emerging market are an opportunity

The pharmacy automation market is predicted to grow most rapidly in emerging economies. Developing nations have a sizable elderly population. The population of Eastern and Southeastern Asia is predicted to age twice as quickly as the rest of the world, with the number of people 65 and older estimated to rise from 260.6 million in 2019 to approximately 572.5 million by 2050, according to the UN report on World Population Ageing (2019). In several Asian nations, this demographic trend is anticipated to increase the number of patients and fuel demand for high-quality patient care and effective pharmaceutical delivery. As a result, it is anticipated that in the upcoming years, demand for pharmacy automation systems will rise in a number of Asian nations.

Strict regulatory requirements can be a challenge

The degree of regulatory scrutiny varies from one area to another and is determined by the class to which a given gadget belongs. The use of automated dispensing devices (ADDs) in medical settings is subject to a variety of state boards of pharmacy standards. These boards are state organisations in charge of overseeing and regulating pharmacy practise and issuing state licences to pharmacists. As a result, producers of automated pharmacy systems must follow a number of rules; doing so is time-consuming and might delay the release of new products.

The market is divided into inpatient pharmacies, outpatient pharmacies, retail pharmacies, pharmacy benefit management companies, and mail-order pharmacies based on the final consumers. Inpatient pharmacies held the greatest proportion of this market in 2021. This is mostly because using automated systems instead of human ones allows for speedier medicine delivery inside medical settings.

Pharmacy automation technologies are being adopted by pharmacies all around the world to automate their routine processes and minimise human interference. Both inpatient and outpatient pharmacies have adopted the system. Additionally, it maintains and updates patient data in a database, as well as measures and formulates customised drugs. The distribution, handling, and inventory management procedures are all under constant observation by the pharmacy automation system. Hospital pharmacies and retail pharmacies both have strong positions for pharmacy automation systems. The Pharmacy Automation Systems market is dominated by these two end-user categories.

Six different types of items make up pharmacy automation systems, including medicine cabinets, packing & labelling equipment, IV pharmacies, robotic dispensing equipment, carousel storage, and tablet splitters. Medication dispensing cabinets are automated cabinets that are used in outpatient pharmacies and hospitals. They are mostly employed in decentralised pharmacies, which support nurses and pharmacists by providing formularies for use across the health system.

Pharmaceutical dispensing system segment led the market

In 2021, the pharmaceutical dispensing system segment led the market and generated more than 24.5% of the total revenue. The large share can be ascribed to these systems' better safety features and precision in medication distribution, which reduce the likelihood of patients receiving the incorrect medications. Additionally, it aids in efficient inventory management and lowers costs by controlling storage. Patients who receive the wrong prescriptions not only risk harm to their health, but also face huge financial consequences. According to a study published in StatPearls, over 9,000 individuals die each year as a result of drug errors, with expenses connected with patient management exceeding USD 40 billion yearly.

Automated drug compounding systems segment is anticipated to increase at the fastest rate

Over the anticipated period, the automated drug compounding systems segment is anticipated to increase at the fastest rate. This is because errors can occur even with a precise manual compounding procedure, which can have a significant impact on how the pharmaceuticals turn out. Thus, the likelihood of these mistakes in the pharmaceutical mixing process is decreased or eliminated with an automated compounding system. As the process is carried out in an aseptic chamber, it also completely eliminates the possibility of contamination by eliminating sources of contamination. The market is primarily driven by the aforementioned elements.

Pharmacy packaging and labelling system segment is anticipated to have the highest CAGR

The pharmacy automation market is divided into automated tabletop counters, automated medicine compounding systems, automated packaging and labelling systems, and other pharmacy automation systems based on the items they produce. The market segment for pharmaceutical packaging and labelling systems is anticipated to develop at the fastest rate during the forecast period. This is primarily because clear labels and separate packaging for all prescriptions are necessary to help users avoid such confusions, increase dispensing accuracy and productivity, and reduce overall process costs.

The pharmacy automation market is predominantly driven by North America

Due to a growth in the incidence of numerous chronic diseases and the rising number of patients on the North American continent, the market for pharmacy automation maintains a sizable market share. There has been an increase in demand for medication and pharmaceuticals to be given without cross-contamination and mistakes during the COVID-19 outbreak. Thus, all of these variables have contributed to an increase in system demand.

Over 100,000 suspected pharmaceutical mistakes incidents are still reported in the US each year, according to the US FDA. Additionally, research by Johns Hopkins University found that drug errors cause more than 250,000 fatalities per year in the US. As a result, it is one of the main causes of death in the nation. The majority of drug mistakes happen during prescription and dispensing. Automated medication dispensing systems and cabinets are becoming more popular in North America as they decrease errors associated with pharmaceutical distribution while also enhancing inventory stock management, drug traceability, and dispensing speed.

Asia-Pacific is also anticipated to have considerable development during the projection period

However, due to the growing senior population and rising healthcare costs, Asia-Pacific is also anticipated to have considerable development throughout the projection period. The market demand may be influenced by the allocation of significant healthcare funds for hospitals and assisted living institutions that provide older patients with medicine.

Fragmented pharmacy automation market

The market for pharmacy automation is very slightly fragmented. Players on the market are concentrating on ongoing product development while providing goods at affordable prices, particularly in developing nations. Arxium Inc., Capsa Healthcare, Omnicell Inc., Parata Systems LLC, and Scriptpro LLC are some of the prominent competitors participating in the industry. These market leaders are focusing on product development and innovation to strengthen their brands and increase revenue.

Pharmacy automation systems market sees consolidation and investment in new productdevelopment

To increase their market position, a number of competitors in the pharmacy automation system market are heavily concentrating on acquisition strategy. For instance, Power Automation Systems (PAS), the industry leader in pallet shuttle automated storage and retrieval systems (ASRS), was bought by Swisslog Holdings AG in 2016. These players are also putting a lot of effort into R&D to create new iterations of pharmacy automation systems, which should help them grow their customer base.Additionally, these pharmaceutical suppliers use a cooperation strategy to increase their footprint across the globe. For instance, to offer a fully integrated outpatient pharmacy solution in the Middle East, Swisslog Holdings AG teamed with Parata Systems, a top provider of pharmacy technology solutions.

COVID-19 impact

The COVID-19 epidemic has created a window of opportunity for the sector to grow. The epidemic increased the need for medicines to give critically ill COVID-positive patients life-saving assistance. 15% of COVID-positive patients needed to be hospitalised and required ongoing medication dispensing from pharmacies. This necessitated and speeded up the demand for pharmacy automation. This shift in demand for automated systems compelled major firms to plan their manufacturing capacities, concentrate on the creation of new products, and look for the best supply chain solutions for COVID-19 necessities.

Robotic pharmacies became popular due to government-imposed measures to stop the virus' spread, there was a significant increase in prescription volumes, and due to social norms of staffing shortages and social segregation, automated systems and devices helped meet the rising demand during the pandemic's peak.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Pharmacy Automation Devices market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

End use

| |

Products

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report