Industry Outlook

In the U.S. the prevalence of pressure ulcers in intensive care units ranges from 16.6% to 20.7%. It is also reported that annually US$ 11 billion is spent on the treatment of pressure ulcers, with US$ 500 to US$ 70,000 spent on a single wound. In spite of availability of better assessment tools, new CMS ruling eliminating hospital reimbursement when stage 3 or 4 pressure ulcer is hospital acquired and emergence of new technologies to reduce pressure ulcers, the condition remains a significant healthcare problem. Traditionally, prevention and management of pressure ulcers remained the responsibility of nursing staff. However, today it is viewed more as a healthcare community problem with everyone ranging from the patient to the nursing staff is considered a stakeholder. The implications of pressure ulcers on the patients and healthcare system are vast and vary depending on the severity, tissue damage, patient condition, and effect on lifestyle. Growth in awareness regarding these implications will augment the understanding the need for implementation of effective prevention and management strategies for the patients.

"Wound Dressings to Dominate the Global Market"

Among the different types of treatment products used for pressure ulcers, dressings are observed to be the largest revenue-generating segment. Dressings are chosen depending on the nature of wound to be treated. None of the dressings used for treating pressure ulcers have a clear superiority, and the choice of dressing is on the physicians depending on the type of wound to be treated. Parameters considered for choice of dressing are depth, size, amount of exudate, surrounding skin condition and so on. Yet, advanced dressings products such as hydrocolloids, alginates, and foams, occupy larger market share. Their greater demand in treatment of advanced 3 and 4 stage pressure ulcers and higher prices of these products contribute to the dominance of these product types. Additionally, their greater efficacy in addressing the issue of exudates and better absorbent properties allow greater demand for advanced wound dressing products in the global market.

"Stage 3 and 4 Wound Types to Dominate the Global Market during the Forecast Period"

Currently stage 3 and 4 bedsores occupy the largest share in the global pressure ulcers treatment products market. Precise determination of stage of these wound types and requirement of longer duration to heal such wounds mainly contribute to the prominence of this segment. A typical stage 3 wound is observed to take one to four months to fully heal. Stage 4 cases may also take several months for complete healing. Therefore the consumption of wound healing agents is high in such wound stages where the possibility of moving the patient to hospital settings is significantly high. Moreover, the requirement of advanced wound healing agents such as hydrogels, hydrocolloids, alginates and antimicrobial agents is also the highest in these wound types. Higher costs of these products, therefore also contributes to the dominance of this segment in the global market.

"Hospital Settings to Remain the Largest Consumer of Pressure Ulcer Treatment Products"

Based on the types of usage areas, the global pressure ulcer treatment products market is categorized into hospitals, nursing homes and home care. Among these, hospitals comprise the largest segment for these products. Greater patient footfall, higher affordability for advanced products such as powered surfaces, and novel mattresses, and better reimbursements are the key factors settling the dominance of hospitals segment. The demand for pressure ulcer treatment products in nursing homes is anticipated to remain stable through the forecast period. Greater uptake of these products in nursing homes will be consistently observed in North America, Western Europe, and Japan. Additionally, though home care segment currently holds a small market share, increasing preference for moving chronic disease patients from hospitals to home care in order to mitigate cost constraints will render this segment the fastest market growth during the forecast period.

"Asia Pacific to Rapidly Advance due to Perpetually Growing Chronic Patient Pool"

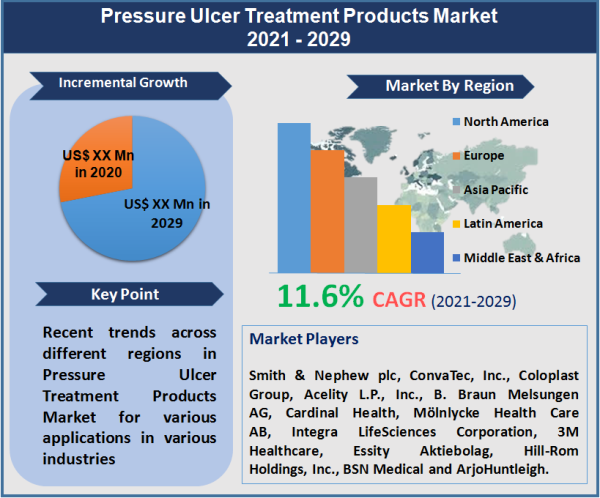

North America is the current leader in the global pressure ulcer treatment products market. Significant prevalence of chronic diseases, and obesity mainly contribute to the dominance of this region. Greater affordability and existence of better reimbursement system also play a critical role in the leading position of North America market. Asia Pacific is expected to progress at a rapid pace during the forecast period. Increasing entry of domestic companies, thriving healthcare infrastructure, and increasing disposable incomes for affording advanced treatment solutions are the key features of Asia Pacific market. Realizing the untapped opportunities in Asia Pacific, several international players having stronghold in North America and Europe have enhanced their penetration activities in the region. On the other hand, lack of awareness, and lower rates of diagnosis will restrict the growth of some parts of the African markets.

The report also includes competitive analysis of the incumbents in the global pressure ulcer treatment products market. The study also presents brief profiling of such market players in terms of their business overview, product portfolio, financial information, and key developments. Such major market players considered in this report include Smith & Nephew plc, ConvaTec, Inc., Coloplast Group, Acelity L.P., Inc., B. Braun Melsungen AG, Cardinal Health, Mölnlycke Health Care AB, Integra LifeSciences Corporation, 3M Healthcare, Essity Aktiebolag, Hill-Rom Holdings, Inc., BSN Medical and ArjoHuntleigh.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Pressure Ulcer Treatment Products market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Product

| |

Wound

| |

Usage Area

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report