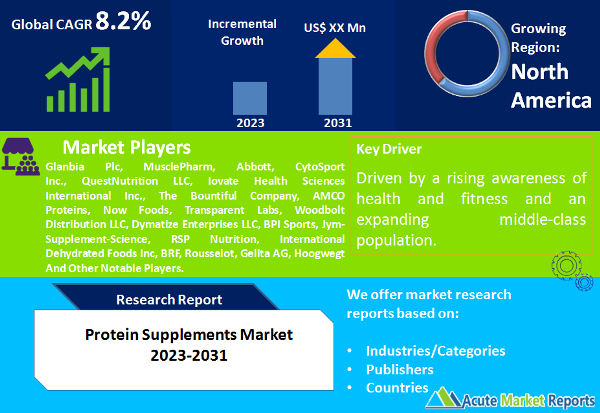

The protein supplements market is a dynamic and rapidly growing industry, catering to consumers' fitness, health, and dietary needs. The protein supplements market is expected to grow at a CAGR of 8.2% during the forecast period of 2024 to 2032, fueled by health and fitness consciousness, the plant-based nutrition trend, and the convenience of e-commerce. However, quality and safety concerns need to be addressed to ensure the market's sustainable growth. Market segmentation highlights the diverse preferences and demands of consumers, while geographic trends reveal both global and region-specific opportunities. The competitive landscape is marked by established leaders and innovative newcomers, all striving for innovation and market dominance. The market's future from 2024 to 2032 promises exciting developments and opportunities for both consumers and manufacturers.

Growing Health and Fitness Consciousness

The paramount driver of the protein supplements market is the growing consciousness regarding health and fitness. Consumers are increasingly recognizing the importance of protein in their diets to support muscle growth, recovery, and overall well-being. Fitness enthusiasts, athletes, and even health-conscious individuals are turning to protein supplements, which have become an essential part of their routines. This driver is strongly supported by the increasing number of gyms, fitness centers, and health-conscious communities.

Plant-Based Nutrition Trend

The rise of the plant-based nutrition trend is another significant driver of the protein supplements market. With the increasing popularity of vegetarianism and veganism, there is a growing demand for plant-based protein supplements. Consumers are seeking alternatives to animal-based protein, and companies have responded by offering a wide range of plant-based protein products. This trend is expected to continue its growth during the forecast period from 2024 to 2032, supported by ethical, environmental, and health-related reasons.

E-commerce and Online Retailing

The convenience of e-commerce and online retailing has played a pivotal role in propelling the protein supplements market. Consumers can easily access and purchase a variety of protein supplements through online platforms. This trend has not only expanded the market's reach but has also facilitated better product awareness and comparison. E-commerce is expected to be a crucial driver in the forecast period, providing consumers with a convenient and hassle-free shopping experience for protein supplements.

Quality and Safety Concerns

Quality and safety concerns are a significant restraint in the protein supplements market. As the market experiences rapid growth, issues related to product quality, authenticity, and safety have come to the forefront. Consumers and regulatory authorities have become increasingly vigilant about the ingredients, purity, and safety standards of protein supplements. Incidents of substandard or adulterated products have raised concerns. Manufacturers must address these concerns to maintain the market's trust and sustain its growth.

Market Segmentation by Source: Animal-based Protein Supplements Dominate the Market

The protein supplements market is segmented by source, including Animal-based Protein Supplements and Plant-based Protein Supplements. In 2023, Animal-based Protein Supplements generated the highest revenue, while Plant-based Protein Supplements exhibited the highest CAGR during the forecast period of 2024 to 2032. This duality in trends signifies a market where both animal-based and plant-based sources have their unique strengths and consumer demand.

Market Segmentation by Product: Protein Powders Dominate the Market

Further segmentation of the market is based on product categories, including Protein Powders, Protein Bars, Ready-to-Drink (RTD) protein beverages, and other specialized protein products. In 2023, Protein Powders contributed the most substantial revenue, while RTD products displayed the highest CAGR during the forecast period of 2024 to 2032. This differentiation within product categories indicates the diverse preferences and evolving demands of consumers in the protein supplements market.

North America Remains the Global Leader

Geographically, the protein supplements market exhibits regional trends, with variations in both revenue and growth rates. North America has been the region with the highest revenue in 2023, owing to the strong presence of fitness-conscious consumers and a well-established fitness culture. The Asia-Pacific region boasts the highest CAGR during the forecast period, driven by a rising awareness of health and fitness and an expanding middle-class population. These regional dynamics showcase the global and region-specific appeal of protein supplements.

Market Competition to Intensify with the Increasing New Entrants during the Forecast Period

The protein supplements market's competitive landscape is characterized by intense rivalry among key players, including renowned companies such as Glanbia Plc, MusclePharm, Abbott, CytoSport Inc., QuestNutrition LLC, Iovate Health Sciences International Inc., The Bountiful Company, AMCO Proteins, Now Foods, Transparent Labs, Woodbolt Distribution LLC, Dymatize Enterprises LLC, BPI Sports, Jym-Supplement-Science, RSP Nutrition, International Dehydrated Foods Inc, BRF, Rousselot, Gelita AG, Hoogwegt and others. These companies have maintained their market leadership by consistently investing in research and development, product innovation, and strategic partnerships. Their 2023 revenues reflect their position in the market, and they are expected to continue their growth during the forecast period from 2024 to 2032. In addition to these major players, several emerging companies have entered the protein supplements market, driven by the demand for specialized and niche protein products. These newcomers are focused on developing high-quality, innovative, and safety-compliant protein supplements to capture their share of the growing market. Partnerships and collaborations are key trends in the market, with established players working with online retailers and fitness centersto effectively distribute their protein products. These partnerships aim to enhance consumer reach and accessibility, ultimately improving consumer satisfaction.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Protein Supplements market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Source

| |

Product

| |

Application

| |

Distribution Channel

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report