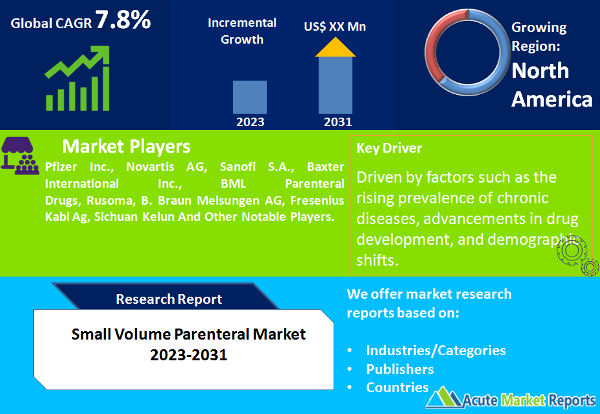

The small-volume parenteral (SVP) market is expected to grow at a CAGR of 7.8% during the forecast period of 2024 to 2032. The SVP market is poised for substantial growth, driven by factors such as the rising prevalence of chronic diseases, advancements in drug development, and demographic shifts. While regulatory challenges pose a restraint, the market is adapting to meet quality assurance requirements. The segmentation data for form and dose type, along with geographic trends, provide valuable insights for stakeholders, enabling them to navigate this dynamic market and deliver essential medications to patients worldwide in an evolving healthcare landscape.

Increasing Prevalence of Chronic Diseases

One of the primary drivers propelling the SVP market is the rising prevalence of chronic diseases worldwide. Conditions such as diabetes, cardiovascular diseases, and cancer require ongoing management through medications, many of which are administered through injections. As the global burden of chronic diseases continues to grow, so does the demand for SVP products. Evidence supporting this driver can be found in epidemiological studies and disease prevalence reports. These sources consistently highlight the increasing incidence and prevalence of chronic diseases, underscoring the sustained need for injectable medications. Healthcare providers rely on SVP products to ensure accurate dosing and effective treatment for patients with chronic conditions.

Advancements in Drug Development

The second major driver of the SVP market is the continuous advancements in drug development. Pharmaceutical companies are increasingly focusing on developing novel medications that require parenteral administration due to factors like bioavailability, stability, and targeted drug delivery. These advancements result in a growing pipeline of injectable drugs, further fueling the demand for SVP products. Evidence for this driver can be observed in the pharmaceutical industry's R&D investments and drug approvals. The expansion of the injectable drug market, including biologics and biosimilars, highlights the importance of SVP products in drug delivery. As innovative therapies continue to emerge, the market for SVP products is expected to expand.

Aging Population and Healthcare Access

The third significant driver is the aging population and improved healthcare access. As the global population ages, there is an increased need for medications, including injectables, to address age-related health conditions. Additionally, improved healthcare access, particularly in emerging markets, ensures that a larger segment of the population has access to essential healthcare services, including injectable medications. Evidence supporting this driver can be found in demographic studies and healthcare infrastructure improvements. The aging population is associated with a higher incidence of age-related diseases and conditions, leading to greater demand for SVP products. Moreover, increased healthcare access in regions with previously limited resources expands the market's reach.

Regulatory Challenges and Quality Assurance

Despite the promising growth of the SVP market, a significant restraint is the complex regulatory environment and the stringent quality assurance requirements associated with parenteral products. Manufacturing and distributing SVP products require adherence to rigorous quality standards, including Good Manufacturing Practices (GMP) and compliance with regulatory agencies. Evidence for this restraint can be observed in regulatory guidelines and quality control processes implemented by pharmaceutical companies and SVP manufacturers. Ensuring product safety and efficacy while navigating regulatory hurdles can be time-consuming and resource-intensive. Regulatory challenges can lead to delays in product approvals and market entry, impacting the market's growth potential.

Market Segmentation by Form: Liquid SVP Products Dominate the Market

The SVP market is segmented by form into Liquid and Dry. In 2023, Liquid SVP products accounted for the highest revenue, primarily due to their widespread use in intravenous (IV) therapies and ease of administration. However, during the forecast period from 2024 to 2032, the Dry form is expected to exhibit the highest Compound Annual Growth Rate (CAGR). This shift can be attributed to the growing demand for lyophilized or powder-based injectable medications, which offer extended shelf life and stability.

Market Segmentation by Dose Type: Single-dose SVP Products Dominate the Market

The market is further segmented by Dose Type into Single-dose and Multiple-dose. In 2023, Single-dose SVP products generated the highest revenue, as they are commonly used for individual patient administration, reducing the risk of contamination and ensuring accurate dosing. However, during the forecast period from 2024 to 2032, the Multiple-dose segment is expected to experience the highest CAGR. This growth reflects the increasing adoption of multidose vials and prefilled syringes for chronic disease management, providing convenience and cost-effectiveness.

North America Remains the Global Leader

Geographic trends in the SVP market indicate that North America had the highest revenue percentage in 2023, driven by a well-established healthcare infrastructure and a robust pharmaceutical industry. However, during the forecast period from 2024 to 2032, the Asia-Pacific region is expected to exhibit the highest CAGR. This growth can be attributed to the increasing healthcare investments, rising access to healthcare services, and the expanding patient population in Asia-Pacific countries.

Market Competition to Intensify during the Forecast Period

In 2023, the top players in the SVP market included pharmaceutical companies such as Pfizer Inc., Novartis AG, Sanofi S.A., Baxter International Inc., BML Parenteral Drugs, Rusoma, B. Braun Melsungen AG, Fresenius Kabi Ag and Sichuan Kelun., among others. These organizations leveraged their extensive portfolios of injectable medications and manufacturing capabilities to maintain significant market shares. During the forecast period from 2024 to 2032, these key players are expected to continue their dominance by focusing on product innovation, expanding their global reach, and ensuring compliance with evolving regulatory standards. Additionally, partnerships and collaborations with contract manufacturing organizations (CMOs) are likely to play a pivotal role in meeting the growing demand for SVP products.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Small Volume Parenteral market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Form

| |

Dose Type

| |

Packaging Type

| |

Indication Type

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report