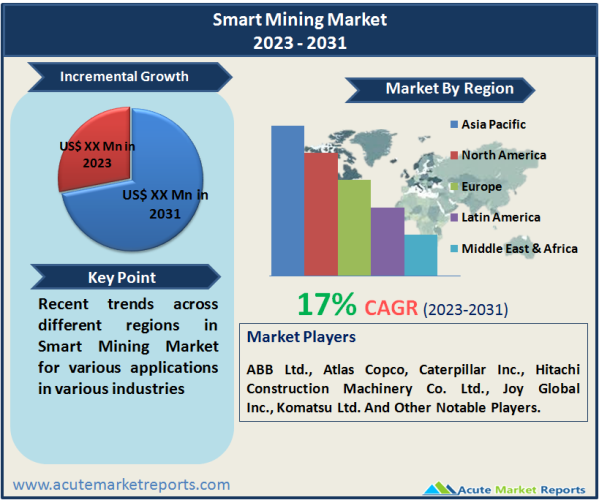

In 2021, the worldwide smart mining market is anticipated to grow at a CAGR of 17% during the forecast period of 2024 to 2032. The term "smart mining" refers to the process of automating the mining procedure by utilizing cutting-edge solutions such as cloud computing, 3D imaging, and modeling software, as well as automated equipment and hardware. It helps to provide remote and real-time awareness of equipment conditions, which in turn helps to minimize operational pressure, reduce downtime, eliminate maintenance expenses, and maximize workplace safety. It is gaining traction all over the world because, in addition to ensuring data security, it also ensures the long-term upkeep of vital assets. The smart mining market represents around 10% of the entire mining equipment market at present. Changes in mining business operations, increasing safety regulations, and perfect decision-making procedures will raise the significance of smart mining integration in the mining process in the future years.

Integrating Data Management & Analytics to Facilitate Growth in the Mining Industry

The mining business is capital-intensive and must maximize asset utilization and output. Data is one of the most valuable commodities in mining. Daily, automated drills, trucks, conveyors, ships, and trains generate enormous quantities of valuable data. By combining this data with cognitive analytics, AI, machine learning, and mining automation, a number of businesses are increasing the security and efficiency of their operations.

By collecting and leveraging big data from a variety of data sources, evaluating it with contemporary data analytics, and implementing the results, mining companies may unlock immediate value and increase their bottom line. With reliable data, the mining industry can increase production, decrease operational inefficiencies, and respond to threats more effectively.

Using big data analytics and BDM (big data management) in mining also results in the evolution of an intelligent infrastructure. Thus, analytics is projected to play a crucial role in enhancing asset utilization, boosting production, and resolving material flow bottlenecks.

Enhancements to Mineworker Safety and Health to Drive Market

There are numerous health and safety risks involved with mining, including fragile ground, UV exposure, chemical threats, dust, and noise. The risk of injury increases as the size and depth of mines increases. If these dangers are not appropriately addressed, they can result in serious fatalities, excruciating injuries, or occupational illness. Smart mining enhances miner and operator health and safety. IoT and AI have led to a low fatality rate in mining. In addition, digital technologies such as logistics software, remote-controlled equipment, and accurate GPS boost productivity.

In addition, major providers have been focusing on the development of products that ensure miner safety. For instance, in 2019, Jannatec Technologies of Canada announced the official release of the ENSO SmartHelmet, a revolutionary intelligent mining helmet designed to improve miner safety. The helmet serves as a connected device hub for hard rock miners and enables the collection of user-specific information. A 360° high visibility feature with an inbuilt programmable brim-mounted camera, LEDs, biosensors, proximity detection, and RFID are among its several innovations. Consequently, it is anticipated that these solutions given by market leaders would fuel the expansion of the global smart mining market.

Expanding Advanced Technologies to Drive Market Advancement

Smart mining requires Internet connectivity so that mine operators and management can monitor the status of equipment and personnel. In the complex mining industry, IoT technology offers opportunities for monitoring visibility, safety, and productivity. In addition to connecting personnel, machines, and things, it connects personnel. Modern digital technologies have been applied on mining sites to monitor safety controls, hence reducing operational expenses. Therefore, the usage of IoT solutions fosters the expansion of the worldwide smart mining market.

It is anticipated that the rising adoption of current technologies such as the internet of things, artificial intelligence, machine learning, and robotics in the industry will dramatically lower labor expenses, resulting in significant cost optimization. In addition, cutting-edge data analytics are employed to provide visualizations, suggestions, and insights from the raw data. The data is then transmitted in real-time to the mobile devices of mine operators and staff. In addition, firms are employing various tactics, such as corporate expansions and partnerships, to track underground mineworkers.

Inadequate Skilled and Qualified Labor and Mining Graduation Restrain Market Growth

The rising usage of modern systems in the mining sector is expected to increase the demand for experienced, trained, and qualified labor on mine sites. Moreover, access to and operation of autonomous mining equipment requires highly qualified workers. The lack of such personnel, especially in developing nations such as India, Africa, and others, limits the growth of the smart mining industry. Therefore, companies such as GEOVIA, The British Standards Institution, edX Inc., and Maptek provide specialist training programs for strengthening software skills, scheduling, mine design, and data administration.

Government and Mining Companies Offer Key Market Opportunities Initiatives to Boost Market Opportunities

Several nations provide incentives for mining businesses to transition to electric cars in an effort to reduce greenhouse gas emissions. The growth of autonomous vehicle development adds to greater sales in the heavy equipment industry. In countries such as Canada and Australia, lithium-ion battery-powered devices are replacing diesel-powered mining drills, mining loaders, and utility vehicles. This initiative aims to minimize emissions and eliminate exhaust fumes that pollute underground air and jeopardize the health of miners. Therefore, such government rules and actions by the government and major enterprises are beneficial to the smart mining sector.

Investing in Automation Facilitates the Extraction of Revenue Opportunities

Using strategic collaborations, investments, and R&D (Research & Development) operations, market participants in smart mining are intensifying their attempts to increase their income streams. Market participants are likewise focused on creating their mark in the personal care industry. Consequently, the global market is projected to be driven by the expanding effect of smart mining techniques. Additionally, R&D capabilities facilitate the development of new competitive strategies. All of these variables ultimately lead to the expansion of the smart mining market.

Numerous additional industries want to profit from automation in the smart mining business. Market participants are investigating the potential of controlled and remotely programmed software to undertake mining procedures autonomously. Automation technology plays a significant role in monitoring static and mobile assets remotely.

Market by Type – Surface Mining to Witness the Fastest Growth

Surface mining is projected to grow the fastest, with a CAGR of 17% during the forecast period of 2024 to 2032. The most prevalent method for obtaining stones, sand, coal, metal ores, and other commodities is surface mining. In addition, it includes numerous procedures, including as open-pit mining, strip mining, mountaintop removal, high-wall mining, and dredging.

Material transportation is the costliest part of surface mining. It is estimated that haulage costs account for 40 to 50% of a surface mine's operating expenses. Material transport automation systems, such as autonomous haulage system (AHS) trucks, allow, among other services, remote control of driving, speed evaluation, loading, and equipment tracking. According to Mining Technology magazine, Rio Tinto Australia's Pilbara iron ore mine introduced the automated hauling system (AHS) in 2018 with great success. Adopting automated systems such as AHS in open-pit mines is supposed to result in cost savings for mining operations. It is anticipated that this will drive the growth of the smart mining market in the surface mining industry.

Underground mining covers the extraction of minerals, metals, coal, and other materials from beneath the surface of the earth. The depth of coal mines can go up to 6,500 feet or 2 kilometers. Such depths necessitate specialized automation systems to provide sufficient ventilation, water drainage, material handling, and other amenities. Underground mine automation facilities frequently include, among other things, underground mobile fleet management, production face analytics, automated scheduling, execution management, and mine ventilation control.

Market by Component: Automated Equipment Dominates the Market

During the projection period, automated equipment held the largest revenue share in 2021 and is expected to grow at a CAGR of 16% during the forecast period. The implementation of automated machinery has boosted the productivity of mining operations and cut operational costs. Even though automated equipment requires trained personnel, a competent operation reduces the likelihood of accidents. Additionally, it minimizes the number of manual laborers required, hence reducing labor costs.

The automated equipment consists of excavators, load haul dumps, robotic trucks, drillers & breakers, and other automated equipment. Excavators are anticipated to account for the biggest proportion of automated equipment. Due to the necessity of extracting earth, excavators are a vital part of a variety of mining ventures. The automated or robotic excavators incorporate vehicle automation technologies such as remote controlling, teleoperations, and artificial intelligence control software to guide and manage the operations of several excavators. Automating excavators maximizes production, ensures operator safety, and contributes to the equipment's optimal performance.

The smart mining market consists of gear, software, and services. Integrating such components improves the efficiency and safety of mining operations. It is anticipated that hardware components will have the biggest market share, with Intelligent system hardware components accounting for the majority of this share. Intelligent systems are created by incorporating the Internet of Things (IoT), artificial intelligence, gamification, virtual reality (VR), and other tools into mining processes.

APAC to Emerge as a Global Leader

Asia-Pacific is anticipated to dominate the regional market with a CAGR of 17% during the forecast period. As a result of their massive mining activities, China and Australia occupy the largest share of the Asia-Pacific smart mining market. In addition, according to a report published in January 2020 by The Asia Miner magazine, India and other Asian nations are expected to drive the rise of the global copper mining industry over the forecast period. The majority of copper used to manufacture electronic components originates in China. Consequently, the expansion of mining activities in the Asia-Pacific region fuels the demand for intelligent mining infrastructure. With a CAGR of 16%, North America will hold the second-largest share by 2030. Due to mining companies' large investments in technical developments for mining operations, the expansion of the smart mining industry in North America has accelerated. In developed nations such as the United States and Canada, the availability of trained laborers helps the deployment of intelligent automation technology. Modernly, Canada is regarded as the foremost developed mining nation. Utilizing intelligent mining technologies, the leading mining organizations have a significant presence in Canada, thereby meeting the country's mining requirements.

The LAMEA region is anticipated to experience the highest CAGR of 18% throughout the projection period. Numerous mining companies are enticed by Africa's abundance of natural resources to implement automation technology in this region. Africa and Latin America are endowed with abundant mineral resources that are mined in large quantities. Large-scale mining activities encourage mining corporations to deploy new technology for mineral extraction with lower initial investment expenses. Despite the fact that the Middle East area is still in its infancy in terms of automation, its vibrant economic culture offers tremendous potential for the future. These variables provide enormous worldwide market opportunities in the LAMEA area.

Key Players to Focus on Mining Operations Automation

Companies in the market for smart mining are attempting to boost their revenue through R&D, strategic partnerships, and investments. Market participants in smart mining are also focused on expanding their presence in the personal care industry. Consequently, the smart mining industry will likely be driven by the increasing influence of smart mining on mining processes. Additionally, R&D operations contribute to the creation of novel formulations and tactics. Consequently, these factors finally raise the market growth rate for smart mining. Several new fields have evolved that seek to profit from automation in the intelligent mining industry. Market participants in smart mining are investigating the potential of remotely programmed and controlled software to conduct mining processes autonomously. The automation technology will provide the remote monitoring of stationary and mobile assets.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Smart Mining market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Type

| |

Component

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report