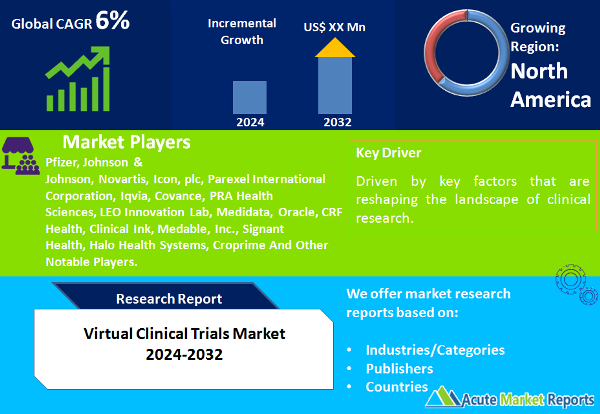

The virtual clinical trials market is poised for significant growth, driven by key factors that are reshaping the landscape of clinical research. The industry has witnessed a paradigm shift, marked by advancements in technology and a growing emphasis on patient-centric approaches. The virtual clinical trials market is expected to grow at a CAGR of 6% during the forecast period of 2024 to 2032, driven by technological advancements, patient-centric approaches, and cost-efficiency. While regulatory challenges present a notable restraint, the market is poised for dynamic changes in study design, indication, phase, and geographic trends. The competitive landscape, marked by strategic initiatives from top players, sets the stage for a transformative period in clinical research. The dynamic nature of the market ensures that different therapeutic areas and trial phases take center stage at various points in time, creating a diverse and evolving landscape. As the industry navigates challenges and embraces opportunities, virtual clinical trials are set to play a pivotal role in shaping the future of drug development and clinical research.

Drivers Shaping the Virtual Clinical Trials Market

Technological Advancements and Digital Transformation

The virtual clinical trials market is propelled by rapid technological advancements and the widespread adoption of digital solutions. The integration of wearable devices, mobile health applications, and electronic health records has revolutionized data collection, enabling real-time monitoring of patient health. This shift towards digitalization enhances patient engagement, reduces the burden on participants, and ensures more accurate and timely data. The industry has seen a surge in virtual trial platforms that streamline processes, from patient recruitment to data analysis, fostering efficiency and accelerating trial timelines.

Patient-centric Approaches and Inclusivity

Patient-centricity is a driving force in the virtual clinical trials arena, with a growing focus on inclusivity and diversity in trial populations. Virtual trials break down geographical barriers, allowing a more diverse range of participants to engage in studies. This inclusivity not only aligns with ethical considerations but also enhances the generalizability of study findings. Moreover, patient-centric approaches, such as decentralized trial designs and remote monitoring, contribute to higher patient retention rates, positively impacting the overall success of clinical trials.

Cost-Efficiency and Time Savings

Cost efficiency and time savings are compelling factors propelling the adoption of virtual clinical trials. The traditional clinical trial model often involves significant expenses related to site infrastructure, travel, and logistics. Virtual trials eliminate many of these costs by leveraging digital platforms for data collection, reducing the need for physical site visits. This streamlined approach not only reduces expenses but also accelerates trial timelines, bringing new therapies to market faster. The cost-effectiveness of virtual trials is further augmented by the potential for a more extensive participant pool, resulting in economies of scale.

Restraints Impacting the Virtual Clinical Trials Market

Regulatory and Compliance Challenges

Despite the promising trajectory of virtual clinical trials, regulatory and compliance challenges pose a significant restraint. The complex regulatory landscape requires thorough adaptation to accommodate the virtual trial model. Ensuring data integrity, patient privacy, and adherence to regulatory standards present ongoing challenges. Achieving a harmonized approach across different regions and regulatory bodies is essential for the widespread acceptance of virtual trials. Navigating these regulatory hurdles demands a concerted effort from industry stakeholders and regulatory authorities to establish clear guidelines and frameworks that align with the evolving nature of virtual clinical trials.

Market Segmentation Analysis

Market by Study Design

In the realm of study design, virtual clinical trials encompass three primary categories: interventional, observational, and expanded access. In 2023, interventional trials dominated both in terms of revenue and compound annual growth rate (CAGR). The robust revenue was driven by the demand for virtual interventional studies, providing sponsors with valuable insights into the efficacy of investigational treatments. The highest CAGR during the forecast period of 2024 to 2032, however, is anticipated in the expanded access category, reflecting a growing recognition of the importance of providing early access to promising therapies.

Market by Indication

The virtual clinical trials market exhibits diverse indications, each with its unique revenue potential and CAGR outlook. In 2023, oncology emerged as the market leader in both revenue and CAGR. The increasing prevalence of cancer and the urgency to expedite clinical trials for novel oncology treatments contributed to this dominance. However, during the forecast period from 2024 to 2032, infectious disease trials are expected to register the highest CAGR, driven by the pressing need for rapid vaccine and antiviral development. This dynamic shift underscores the adaptability of virtual trials across varied therapeutic areas.

Market by Phase

The segmentation by phase in virtual clinical trials presents a nuanced landscape. In 2023, Phase III trials led both in revenue and CAGR. This can be attributed to the pivotal role of Phase III trials in determining the efficacy and safety of investigational treatments, making them a focal point for virtualization. However, during the forecast period from 2024 to 2032, Phase II trials are anticipated to exhibit the highest CAGR. This shift emphasizes the growing importance of early-phase virtual trials in expediting the drug development process.

North America Remains the Global Leader

The global landscape of virtual clinical trials manifests diverse geographic trends. North America, 2023, emerged as the region with the highest revenue percent in 2023, attributable to a robust healthcare infrastructure, technological advancements, and a favorable regulatory environment. However, the region with the highest CAGR during the forecast period is projected to be the Asia-Pacific region. This shift can be attributed to a rising awareness of virtual trial benefits, increasing clinical trial activity, and a growing patient pool. The Asia-Pacific region is poised to become a key player in the virtual clinical trials space, offering significant growth opportunities.

Market Competition to Intensify during the Forecast Period

In 2023, notable industry leaders included Pfizer, Johnson & Johnson, Novartis, Icon, plc, Parexel International Corporation, Iqvia, Covance, PRA Health Sciences, LEO Innovation Lab, Medidata, Oracle, CRF Health, Clinical Ink, Medable, Inc., Signant Health, Halo Health Systems, and Croprime. Pfizer focused on strategic partnerships with technology providers to enhance its virtual trial platform. Johnson & Johnson emphasized a patient-centric approach, incorporating virtual engagement tools for improved participant experiences. Novartis invested significantly in research and development, aiming to enhance the technological capabilities of its virtual trial solutions. These pharmaceutical giants collectively contributed to the market's growth in 2023, with their strategies positioning them as frontrunners for the forecast period from 2024 to 2032.

Historical & Forecast Period

This study report represents analysis of each segment from 2022 to 2032 considering 2023 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2024 to 2032.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Virtual Clinical Trials market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2022-2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Year | 2022 |

| Unit | USD Million |

| Segmentation | |

Study

| |

Indication

| |

Phase

| |

|

Region Segment (2022-2032; US$ Million)

|

Key questions answered in this report