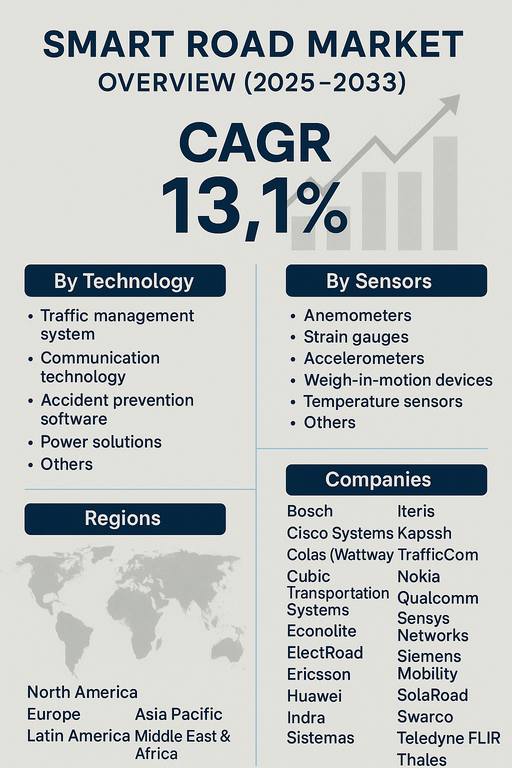

The global smart road market is projected to expand at a CAGR of 13.1% from 2025 to 2033. Growth is driven by the increasing adoption of connected infrastructure, integration of intelligent transport systems (ITS), and rising investments in smart city projects. Smart road technologies enable improved traffic flow, enhanced safety, and sustainable mobility solutions through advanced monitoring, communication, and power systems.

Integration of Technology and Sustainability Driving Growth

Governments and private stakeholders are investing heavily in smart road technologies to manage congestion, reduce accidents, and support the transition to autonomous and electric vehicles. Advanced communication systems, real-time data exchange, and renewable power solutions are being integrated into road infrastructure. Projects like solar-powered roads and inductive charging lanes highlight the role of smart roads in sustainable mobility ecosystems.

Challenges: High Infrastructure Costs and Integration Issues

Despite strong drivers, the market faces challenges such as high upfront investment for large-scale deployments, integration with legacy road infrastructure, and interoperability across different technology providers. Cybersecurity risks also pose a challenge with growing reliance on connected systems. However, supportive government policies, pilot smart road projects in Europe and Asia, and growing demand for real-time data-driven mobility solutions are expected to mitigate these challenges.

Market Segmentation by Technology

By technology, the market includes traffic management systems, communication technology, accident prevention software, power solutions, and others. In 2024, traffic management systems dominated due to widespread deployment in urban areas to manage congestion. Communication technologies are expanding rapidly with the rollout of 5G and vehicle-to-infrastructure (V2I) systems. Accident prevention software is increasingly adopted to enhance road safety. Power solutions, including solar-powered and wireless charging systems, are gaining traction to support electric vehicles.

Market Segmentation by Sensors

By sensors, the market is segmented into anemometers, strain gauges, accelerometers, weigh-in-motion devices, temperature sensors, and others. Weigh-in-motion devices and accelerometers held the largest share in 2024, widely deployed for vehicle monitoring and traffic management. Strain gauges and anemometers are increasingly used in structural health monitoring of bridges and highways. Temperature sensors support road safety applications, particularly in cold-weather regions, while other sensor categories enable niche monitoring functions.

Regional Insights

In 2024, Europe led the smart road market with large-scale smart city projects, including smart highways in the Netherlands, France, and Germany. North America followed, supported by strong adoption of ITS in the United States and Canada. Asia Pacific is the fastest-growing region, driven by urbanization, traffic congestion, and government-backed investments in smart transportation infrastructure in China, Japan, and South Korea. Latin America and Middle East & Africa (MEA) are emerging regions, where pilot projects and public-private partnerships are gradually building momentum.

Competitive Landscape

The 2024 market was characterized by diverse global players spanning traffic management, telecommunications, and smart infrastructure solutions. Bosch, Siemens Mobility, Kapsch TrafficCom, and Swarco led with strong ITS portfolios. Cisco Systems, Ericsson, Nokia, and Huawei expanded communication technology integration for V2I applications. Iteris, Cubic Transportation Systems, and Econolite focused on traffic management and accident prevention software. Colas (Wattway), ElectRoad, and SolaRoad pioneered renewable energy road solutions, including solar-powered highways and inductive charging. Qualcomm, Sensys Networks, Teledyne FLIR, Thales, and TransCore strengthened the ecosystem with advanced sensors, communication protocols, and monitoring platforms. Competitive strategies revolve around partnerships with governments, pilot deployments, and integration of renewable and digital technologies.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Smart Road market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Technology

| |

Sensors

| |

Deployment

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report