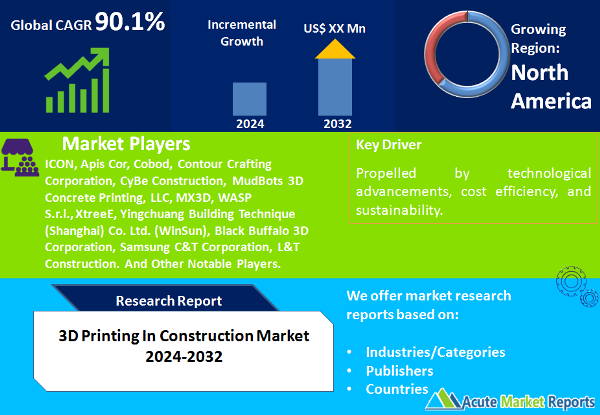

The 3D printing in construction market is expected to grow at a CAGR of 90.1% during the forecast period of 2026 to 2034, propelled by technological advancements, cost efficiency, and sustainability. While regulatory challenges present a restraint, the market's segmentation by construction method and material type reveals the dominance of extrusion and concrete. Geographically, North America leads in 2025, with Asia-Pacific expected to witness the highest CAGR. The competitive landscape showcases ICON, Apis Cor, COBOD, and Winsun as key players adopting strategic approaches. As the industry progresses from 2026 to 2034, 3D printing in construction is poised for continued growth, shaping the future of the global construction landscape.

Technological Advancements and Innovation

Technological advancements play a pivotal role in driving 3D printing in construction market. Companies at the forefront of innovation, such as ICON and Apis Cor, have been consistently investing in research and development to enhance 3D printing technology for construction purposes. For example, ICON's use of robotics and advanced materials has led to the development of scalable 3D printing solutions for housing. These innovations not only improve construction efficiency but also contribute to sustainability goals by reducing material waste.

Cost Efficiency and Time Savings

Cost efficiency and time savings are paramount in the construction industry, and 3D printing addresses these challenges effectively. Companies like COBOD and Winsun have demonstrated the ability of 3D printing to significantly reduce construction costs and timelines. By eliminating the need for traditional formwork and enabling rapid construction, 3D printing emerges as a cost-effective alternative, attracting the interest of construction companies globally. This has led to widespread adoption, especially in residential and commercial construction projects.

Sustainable Construction Practices

The increasing emphasis on sustainable construction practices has positioned 3D printing as a key driver in the construction industry. Construction companies are under growing pressure to adopt eco-friendly methods, and 3D printing addresses this demand by minimizing material waste and reducing the carbon footprint. Companies like COBOD have leveraged 3D printing to create intricate and resource-efficient structures, aligning with the global push towards sustainable and environmentally conscious construction practices.

Challenges in Regulatory Approval and Standardization

While 3D printing in construction offers numerous benefits, challenges related to regulatory approval and standardization have restrained its widespread adoption. The lack of standardized building codes and regulatory frameworks poses hurdles for companies like ICON and Winsun seeking to implement 3D printing technology on a larger scale. Ensuring compliance with existing construction regulations and obtaining approval for 3D-printed structures remain significant challenges, slowing down the market's expansion.

Market Segmentation by Construction Method: Extrusion and Powder Bonding Dominate the Market

The market segmentation by construction method includes extrusion, powder bonding, and other innovative techniques. In 2025, extrusion and powder bonding emerged as the predominant methods, generating the highest revenue. Extrusion, utilizing materials layer by layer, gained traction for its versatility, while powder bonding, involving the bonding of powdered materials, showcased its efficacy in constructing complex structures. During the forecast period from 2026 to 2034, extrusion is expected to maintain the highest CAGR, driven by its adaptability to diverse construction projects.

Market Segmentation by Material Type: Concrete Segment Dominates the Market

The market segmentation by material type encompasses concrete, metal, composite, and other materials. In 2025, concrete dominated the market, contributing significantly to revenue. The forecast for 2026 to 2034 indicates a continued preference for concrete in terms of both the highest revenue and CAGR. While metal and composite materials offer specific advantages, such as increased structural strength, concrete's widespread availability and cost-effectiveness contribute to its sustained dominance in the 3D printing construction market.

North America Remains the Global Leader

The 3D printing in construction market exhibits diverse geographic trends. In 2025, North America led in terms of both highest revenue and CAGR, driven by a strong emphasis on technological innovation and sustainable construction practices. However, Asia-Pacific is expected to surpass North America in terms of CAGR during the forecast period, highlighting the region's rapid adoption of 3D printing in construction. Europe is anticipated to maintain a substantial market share, with the Middle East and Africa showcasing a growing interest in the technology.

Market Competition to Intensify during the Forecast Period

The competitive landscape of 3D printing in construction market is characterized by key players such as ICON, Apis Cor, Cobod, Contour Crafting Corporation, CyBe Construction, MudBots 3D Concrete Printing, LLC, MX3D, WASP S.r.l., XtreeE, Yingchuang Building Technique (Shanghai) Co. Ltd. (WinSun), Black Buffalo 3D Corporation, Samsung C&T Corporation, L&T Construction. These companies have strategically positioned themselves by focusing on technological innovation, cost efficiency, and sustainable practices. In 2025, ICON reported significant revenue, leveraging its advanced robotic construction techniques. Apis Cor excelled in its use of 3D printing for residential construction. COBOD and Winsun demonstrated leadership in providing cost-effective and time-efficient 3D printing solutions. The key strategies of these players involve strategic partnerships, continuous research and development, and expanding their global footprint.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of 3D Printing In Construction market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Construction Method

|

|

Material Type

|

|

End-User

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report