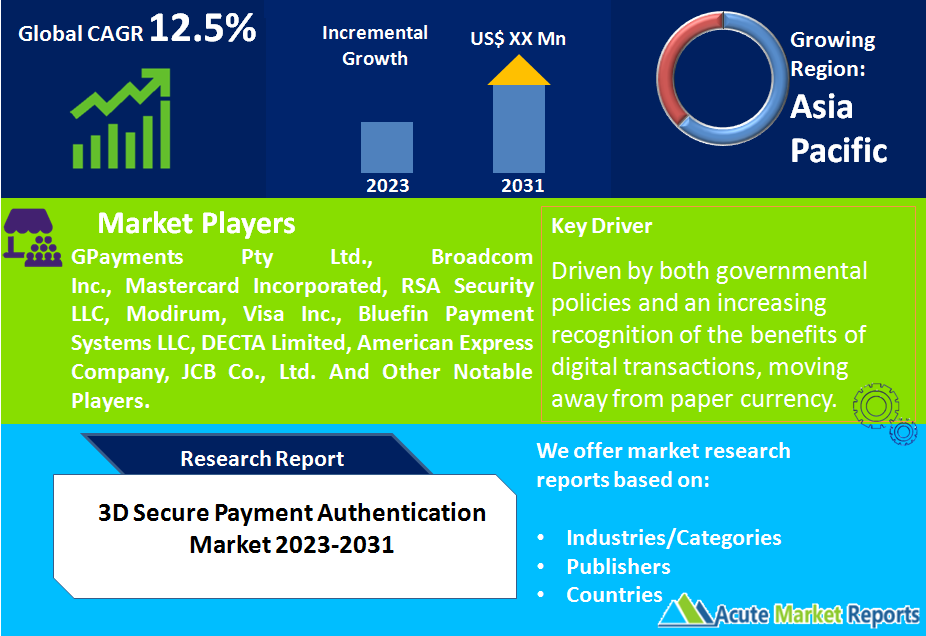

The 3D secure payment authentication market pertains to a protocol designed to enhance online payment security. By integrating an additional security layer for online credit and debit card transactions, it verifies the cardholder's identity, reducing potential fraud. In 2025, the market saw substantial growth, driven by the rapid increase in online transactions worldwide. As online purchasing continues to flourish, the forecast from 2026 to 2034 suggests an optimistic trajectory for the 3D secure payment authentication market. 3D secure payment authentication marketis estimated to grow at a CAGR of 12.5% from 2026 to 2034.

Unprecedented Growth of Online Transactions

The year 2026 was characterized by the explosive growth of e-commerce platforms on a global scale, leading to a corresponding surge in online transactions. The comfort of shopping from home, coupled with the diverse array of products available at the fingertips, transformed consumer behavior. However, with the increase in digital transactions came the escalating menace of online payment frauds, compelling businesses to prioritize secure payment methods. This landscape proved fertile for the growth and adoption of 3D Secure Payment Authentication systems.

Global Transition Towards Cashless Economies

The global economic fabric has been witnessing a paradigm shift towards cashless transactions. In 2025, this trend accelerated, with numerous nations, driven by both governmental policies and an increasing recognition of the benefits of digital transactions, moving away from paper currency. Countries such as Sweden, China, and India played a pivotal role in this digital financial revolution. With this shift, the demand for foolproof payment security measures like 3D Secure grew exponentially.

Technological Advancements: AI and ML Integration

The power of Artificial Intelligence (AI) and Machine Learning (ML) began to be harnessed more effectively in the realm of 3D Secure Payment Authentication as of 2026. The integration of these advanced technologies facilitated smarter authentication processes. By analyzing transaction patterns and user behavior, AI and ML reduced instances of false transaction declines, significantly improving the overall user experience. This enhancement undoubtedly contributed to the increased allure of 3D Secure systems among vendors and payment platforms.

Potential for Over-complicated User Experience

While the year 2026 saw a proliferation of 3D Secure Payment Authentication adoption, it also highlighted a pressing concern: at times, users found the extra authentication step to be overly complicated. This added layer, while designed for enhanced security, occasionally translated into longer transaction times. Consequently, users, driven by impatience or confusion, abandoned their online shopping carts, a phenomenon businesses could ill-afford. Such potential disruptions in the customer journey made certain vendors hesitant in adopting this security measure.

Market Segmentation by Component

Delving into the components of the 3D secure payment authentication market, we find segments such as the Access Control Server, Merchant Plug-in, and Others. The Access Control Server, by virtue of its pivotal role in seamlessly orchestrating the authentication process and linking all involved entities, commanded the most significant revenue slice in 2025. However, as the online marketplace expands, the Merchant Plug-in segment's importance cannot be overlooked. It is anticipated to showcase the most impressive CAGR from 2026 to 2034, as more merchants grasp the indispensable nature of transaction security in fostering trust among consumers.

Market Segmentation by Application

From an application standpoint, the market can be delineated into Banks, Merchants, and Payment Gateways. Given their foundational role in digital transactions, banks unsurprisingly accounted for the most substantial revenue chunk in 2025. However, as the e-commerce ecosystem expands and diversifies, merchants are quickly catching up. The period from 2026 to 2034 is projected to see the Merchants segment register the steepest CAGR, reflecting the increasing emphasis businesses place on transaction security to engender consumer confidence.

Asia Pacific Remains as a Leader

Regionally, the Asia-Pacific region, with its vast consumer base, burgeoning e-commerce industry, and increasing levels of digital literacy, stood out as the premier revenue generator in 2025. Yet, Europe, with its stringent regulatory frameworks advocating online transaction security and a population already accustomed to digital payments, is poised to manifest the highest CAGR between 2026 and 2034.

Competitive Landscape

The competitive vista of the 3D secure payment authentication market is peppered with industry titans such as GPayments Pty Ltd., Broadcom Inc., Mastercard Incorporated, RSA Security LLC, Modirum, Visa Inc., Bluefin Payment Systems LLC, DECTA Limited, American Express Company, JCB Co., Ltd. These major players, in their quest to solidify their market standing in 2025, were seen adopting multifaceted strategies. These included forming strategic alliances, pushing the envelope in technological advancements, and geographical expansions. As we traverse from 2026 to 2034, market stakeholders are expected to focus on innovations that strike a balance between enhanced security and user experience. Mergers and collaborations to expand user bases and harness technological synergies will also play a defining role in sculpting the market's competitive dynamics.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of 3D Secure Payment Authentication market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Component

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report