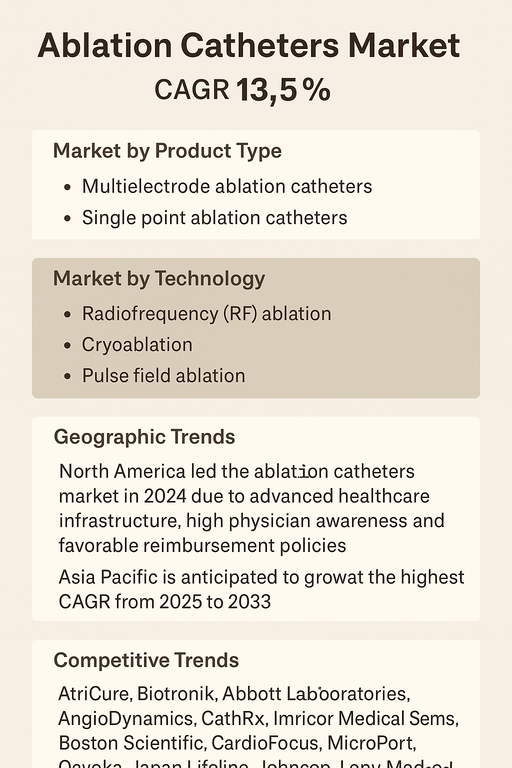

The global ablation catheters market is projected to grow at a CAGR of 13.5% between 2025 and 2033. Market expansion is driven by the rising prevalence of cardiac arrhythmias, increasing adoption of minimally invasive surgical techniques, and ongoing technological advancements that improve precision, safety, and clinical outcomes. Ablation catheters serve as primary tools in the electrophysiological management of conditions such as atrial fibrillation, atrial flutter, and ventricular tachycardia. The market is supported by robust healthcare infrastructure in developed countries, strong research investments, and expanding healthcare access across emerging regions. Growing awareness among physicians and patients about the long-term efficacy of catheter ablation over pharmacotherapy further enhances demand for these devices.

Market Drivers

Prevalence of Cardiac Arrhythmias and Aging Population

One of the most significant drivers is the rising prevalence of arrhythmias worldwide. Aging populations and increasing rates of cardiovascular diseases have led to higher rates of arrhythmias that require interventional procedures. Ablation therapy offers a proven, often definitive, solution, making catheters indispensable tools for electrophysiologists.

Advances in Catheter Technologies and Procedural Success Rates

Technological innovations including contact force sensing, advanced imaging guidance, and miniaturization continue to enhance catheter safety and procedural efficiency. These innovations allow for greater precision and shorter procedure times, encouraging hospitals and clinics to adopt newer catheter designs. Improved success rates and reduced complications boost clinician confidence and overall market uptake.

Growing Adoption of Minimally Invasive Therapies

Compared to open-heart surgery and long-term medication use, catheter ablation provides a minimally invasive, highly effective alternative. Rising preference for less invasive options due to shorter hospital stays, quicker recovery, and better patient experiences is anticipated to sustain long-term demand, especially as hospital systems aim to reduce procedural costs and improve throughput.

Market Restraint

High Procedural and Equipment Costs

Despite strong drivers, the high capital expenditure for advanced electrophysiology labs, as well as device-specific costs for catheters, remain significant restraints. Training requirements and the complexity of procedures also add to per-patient expenses, limiting accessibility especially in price-sensitive and developing markets. Pricing pressures and reimbursement constraints can impact the rate of adoption across different geographies.

Market Segmentation by Product Type

The Ablation Catheters Market is segmented into multielectrode ablation catheters and single-point ablation catheters. Multielectrode ablation catheters accounted for the largest share of revenue in 2024, supported by their widespread adoption for treating complex arrhythmias like atrial fibrillation. These catheters enable simultaneous mapping and ablation at multiple sites, improving procedural efficiency and accuracy. Single-point ablation catheters continue to maintain steady demand due to their cost-effectiveness and familiarity among electrophysiologists, especially for treating simpler arrhythmic conditions like AVNRT and WPW. Going forward, multielectrode devices are expected to grow at a faster rate owing to continuous innovation and clinician preference for improved clinical efficacy and time savings.

Market Segmentation by Technology

By technology, radiofrequency (RF) ablation accounted for the largest revenue share in 2024 owing to its well-established track record, effectiveness, and broad availability across healthcare settings. RF energy catheters have long been a standard in arrhythmia treatment, making them a popular choice for most electrophysiologists. Cryoablation is also witnessing significant uptake due to its safety profile and reduced risk of collateral damage to surrounding tissues. Pulse field ablation, while relatively new, is projected to register the highest CAGR during the forecast period. Its non-thermal mechanism offers increased precision and tissue selectivity, making it highly promising for treating atrial fibrillation and other arrhythmias with minimal collateral injury to adjacent structures.

Geographic Trends

North America led the Ablation Catheters Market in 2024 owing to advanced healthcare infrastructure, high physician awareness, strong reimbursement policies, and significant investment in electrophysiology labs across the U.S. and Canada. Europe also accounted for a substantial share, driven by increasing adoption of advanced catheter designs and strong healthcare spending in countries like Germany, the U.K., and France. Asia Pacific is projected to register the highest CAGR from 2025 to 2033 due to rapid growth in healthcare spending, expanding electrophysiology capacity in hospitals, and increasing access to advanced cardiac care across China, Japan, South Korea, and India. Latin America and the Middle East & Africa will show incremental growth as infrastructure improves, and awareness of catheter-based arrhythmia treatments increases.

Competitive Trends

The competitive landscape features a range of global companies continuously investing in innovation, research, and strategic collaborations. Leading companies like AtriCure, Biotronik, Abbott Laboratories, AngioDynamics, CathRx, Imricor Medical Systems, Boston Scientific, CardioFocus, MicroPort, Osypka, Japan Lifeline, Johnson & Johnson, Lepu Medical, Medtronic, and Stryker maintain strong market positions. These players focus on device innovation including multielectrode configurations and novel energy delivery methods to enhance ablation precision, reduce procedure times, and improve patient safety. Strategic partnerships with hospitals and specialized clinics, increased clinical training programs for electrophysiologists, and sustained R&D into next-generation catheter technologies will support long-term competitiveness. Many companies also leverage geographic expansions and tailored device designs to meet region-specific clinical and regulatory requirements, allowing them to better serve diverse healthcare systems across the globe.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Ablation Catheters market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product Type

| |

Technology

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report