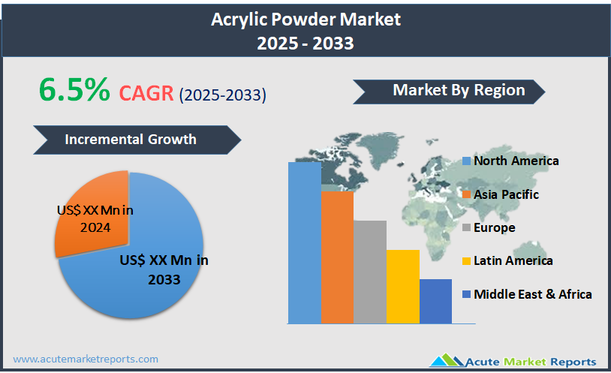

The acrylic powder market refers to the segment of the chemical industry that involves the production and sale of acrylic polymers in powdered form. Acrylic powder is widely used in various applications due to its excellent clarity, resistance to breakage, and UV stability. It is primarily utilized in the manufacturing of products in the cosmetics industry, such as nail enhancements, as well as in industrial applications like coatings, adhesives, and sealants, where its binding properties and durability are highly valued. The global acrylic powder market is projected to grow at a compound annual growth rate (CAGR) of 6.5% from 2025 to 2033. This growth is driven by the extensive use of acrylic powder in the beauty and personal care industry, particularly for artificial nails, where there is a continuing trend towards personalized and long-lasting cosmetic enhancements.

Expanding Beauty and Cosmetic Industry

A major driver of the acrylic powder market is the expanding beauty and cosmetic industry, particularly the surge in demand for nail care products. Acrylic powders are extensively used in nail salons for artificial nail applications due to their durability and versatility in design. The increasing consumer interest in aesthetic enhancements, coupled with rising disposable incomes globally, has led to more frequent visits to nail salons and higher consumption of nail care products. Social media and fashion trends further amplify this demand, as influencers and celebrities showcase elaborate nail art, driving the popularity of acrylic-enhanced manicures. These factors collectively contribute to the robust growth of the acrylic powder market, as manufacturers ramp up production to meet the soaring consumer demand for innovative and high-quality nail products.

Technological Advancements in Product Formulation

An opportunity in the acrylic powder market arises from technological advancements in product formulation. Innovations aimed at improving the quality and application properties of acrylic powders—such as faster setting times, improved color retention, and enhanced durability—are crucial for market expansion. These advancements not only attract new customers but also improve user satisfaction and product loyalty. Additionally, there is growing interest in developing eco-friendly acrylic powders that minimize environmental impact, responding to the increasing consumer demand for sustainable products. Such innovations expand the potential applications of acrylic powders beyond traditional sectors, tapping into markets that value both performance and sustainability.

Volatility in Raw Material Prices

A significant restraint facing the acrylic powder market is the volatility in raw material prices. Acrylic powders are derived from acrylic acid, the price of which is susceptible to fluctuations in the global chemical market. These price variations can be attributed to changes in crude oil prices, regulatory policies, and supply chain disruptions, which are often unpredictable. This volatility affects the cost structure of acrylic powder manufacturing, leading to challenges in pricing, profitability, and budget forecasting for producers. Companies must manage these cost pressures without compromising product quality to maintain competitiveness, which can strain operational efficiencies and market growth.

Regulatory and Environmental Challenges

A persistent challenge in the acrylic powder market is navigating the complex regulatory and environmental landscape. As governments worldwide tighten regulations on chemical production and waste management, manufacturers must invest in compliance measures and adopt cleaner production technologies. The use of acrylic powders, like many chemicals, involves scrutiny regarding environmental impact and occupational safety. Producers are tasked with reducing emissions and waste, improving workplace safety, and ensuring that products meet stringent standards without affecting performance. These requirements demand significant financial and research commitments and pose operational hurdles, especially for smaller players in the market.

Market Segmentation by Application

In the acrylic powder market, segmentation by application includes Fingernail, Plastisol Production, Textile Printing Inks, Specialty Coatings, Dry Film Photo, and Others. The Fingernail segment leads the market in terms of revenue due to the widespread use of acrylic powders in the cosmetic industry, particularly for artificial nails. This segment benefits from the global popularity of nail fashion and the continuous innovation in nail art, which consistently drives consumer demand. Textile Printing Inks are anticipated to experience the highest CAGR, fueled by the growing textile industry and the shift towards high-quality, durable inks for fabric decoration and branding. The advancements in printing technology and the increasing demand for customized and branded apparel contribute significantly to the growth of this segment.

Market Segmentation by End-use

The acrylic powder market is also segmented by end-use into Cosmetics, Automotive, Inks, Plastics, Paints and Coatings, and Others. The Cosmetics sector dominates the market in revenue generation, primarily driven by the extensive use of acrylic powders in nail care products. This sector's growth is supported by the ongoing trends in personal grooming and beauty enhancements, along with increasing consumer spending on cosmetic products globally. However, the Paints and Coatings sector is expected to register the highest CAGR. This growth is attributed to the increasing use of acrylic powders to produce high-performance coatings that offer superior durability and finish, particularly in automotive and industrial applications. The need for more environmentally friendly coating solutions also drives innovations in this segment, supporting its rapid expansion.

Geographic Trends

In the acrylic powder market, North America led in revenue generation in 2024, driven by robust demand in the cosmetics and automotive sectors. This region benefits from a mature market with high consumer spending power and a strong presence of leading industry players. However, Asia Pacific is expected to exhibit the highest CAGR from 2025 to 2033, due to rapid industrialization, expanding manufacturing bases, and increasing disposable incomes. Countries like China and India are significant contributors to this growth, driven by rising consumer demand for cosmetic products and an expanding automotive industry, which necessitates high-quality paints and coatings.

Competitive Trends

In 2024, the competitive landscape of the acrylic powder market was shaped by key players such as Mitsubishi Chemical Holdings Corporation, DIC Corporation, BASF SE, Arkema, AkzoNobel, PPG, The Sherwin-Williams Company, Esschem Europe, Axalta, Cosmaire Co., Limited, and Hebei Yibang Building Material Co., Ltd. These companies held significant market shares due to their comprehensive product portfolios, global distribution networks, and robust R&D capabilities. From 2025 to 2033, these companies are expected to intensify their efforts in innovation and strategic expansion. Key strategies will likely include the development of new, more sustainable acrylic products, enhancements in manufacturing efficiency, and expansion into emerging markets to tap into new customer segments. Additionally, collaborations and mergers and acquisitions are anticipated to be prevalent as companies aim to broaden their technological capabilities and reinforce their market positions. These strategies are crucial for addressing the dynamic demands of the market and capitalizing on the growing sectors such as eco-friendly paints and advanced cosmetic products.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Acrylic Powder market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Application

| |

End-use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report