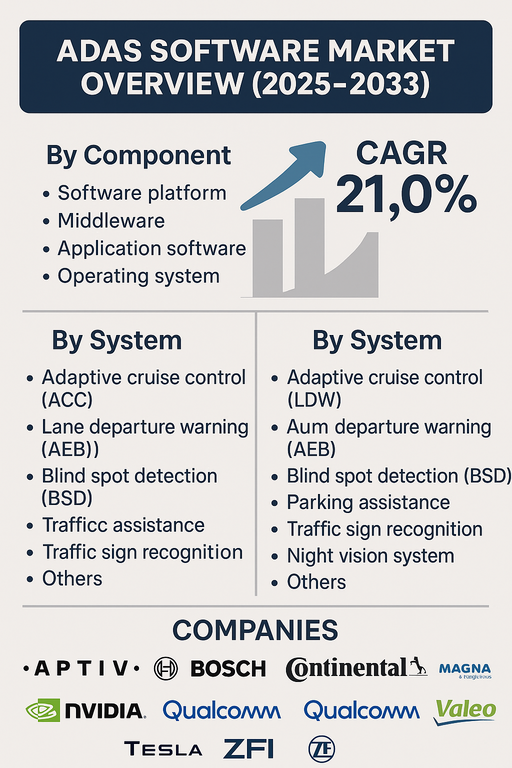

The global Advanced Driver Assistance Systems (ADAS) software market is projected to grow at a robust CAGR of 21.0% from 2025 to 2033, fueled by the rapid evolution of autonomous driving technologies, increasing demand for vehicle safety, and stringent regulatory mandates for advanced driver support systems. ADAS software plays a critical role in interpreting sensor data, enabling decision-making algorithms, and facilitating real-time vehicle response. As the automotive industry transitions toward higher levels of autonomy, software will serve as the intelligence backbone for adaptive and context-aware vehicle behavior.

Accelerating Demand for Software-Defined Vehicle Intelligence

As automotive manufacturers shift toward software-defined vehicles (SDVs), the importance of modular, upgradable, and scalable ADAS software platforms has significantly increased. Modern ADAS applications rely on multi-sensor fusion (radar, LiDAR, cameras, ultrasonic) and AI-driven algorithms to interpret complex driving environments. These platforms provide critical functionalities such as real-time object detection, path planning, obstacle avoidance, and adaptive control. Automakers are investing in proprietary and third-party software stacks to differentiate their safety offerings and future-proof their vehicle architectures for Level 2+ and Level 3 automation.

Technological Advancements in AI, Edge Computing, and OTA Updates

Breakthroughs in artificial intelligence (AI), machine learning (ML), and edge computing are enabling the real-time processing of vast sensor data streams directly within the vehicle. Middleware and operating system components support communication between control units, sensors, and application software, allowing predictive and proactive responses in dynamic environments. Over-the-air (OTA) update capabilities are transforming how OEMs deliver feature enhancements, bug fixes, and compliance updates post-sale. This dynamic software lifecycle management is becoming central to customer satisfaction and regulatory alignment in future mobility ecosystems.

Data Security, Interoperability, and Validation Challenges

The complexity of ADAS software brings challenges related to cybersecurity, interoperability, and real-world validation. As vehicles become increasingly connected, they are more susceptible to software vulnerabilities and cyber threats. Ensuring functional safety (ISO 26262), compliance with regional standards, and real-world scenario testing across diverse geographies requires extensive investment and time. Furthermore, OEMs and Tier 1 suppliers must ensure seamless integration of ADAS software with legacy ECUs, infotainment systems, and cloud-based mobility platforms—posing technical and commercial barriers for rapid deployment.

Market Segmentation by Component

By component, the market is segmented into software platforms, middleware, application software, and operating systems. In 2024, application software held the dominant share due to its central role in executing ADAS functionalities such as object recognition, lane detection, and adaptive control. Middleware is growing rapidly as it enables communication across hardware abstraction layers and supports cross-functional ADAS integration. Software platforms that offer modularity and pre-certified compliance with safety standards are seeing strong demand from OEMs aiming to streamline development. The operating system layer, including real-time operating systems (RTOS), is critical for ensuring deterministic behavior in safety-critical ADAS functions.

Market Segmentation by System

By system, ADAS software is deployed across multiple functionalities. Adaptive Cruise Control (ACC) and Lane Departure Warning (LDW) were among the most adopted systems in 2024, particularly in mid-range and premium vehicles. Automatic Emergency Braking (AEB) and Blind Spot Detection (BSD) are mandated or incentivized in several regions and are seeing widespread integration. Parking Assistance and Traffic Sign Recognition (TSR) are becoming standard features in urban-centric vehicle models. Night Vision Systems and other advanced capabilities are still niche but are gaining attention for premium and commercial vehicle applications. The increasing bundling of these systems into unified software suites is reshaping how OEMs approach system architecture and feature delivery.

Regional Market Insights

North America led the ADAS software market in 2024, with strong regulatory support, early adoption of autonomous vehicle programs, and the presence of major automotive tech providers like Tesla, Nvidia, and Qualcomm. Europe followed closely, driven by the Euro NCAP safety rating system and safety mandates such as GSR II regulations. Germany and France remain innovation hubs for ADAS software development. Asia Pacific is expected to exhibit the fastest CAGR through 2033, led by increasing ADAS integration in vehicles from Japanese, South Korean, and Chinese OEMs. Government support for advanced mobility, combined with domestic software innovation, is accelerating market expansion in countries like China and India. Latin America and the Middle East & Africa are emerging regions, where ADAS integration is beginning to expand beyond luxury models into mid-segment vehicles.

Competitive Landscape

The 2024 competitive landscape of the ADAS software market was defined by leading automotive Tier 1 suppliers, semiconductor companies, and autonomous tech firms. Bosch, Continental, and ZF Friedrichshafen offered integrated ADAS software-hardware solutions to global OEMs. Aptiv and Magna International developed modular ADAS platforms supporting scalable deployment. Mobileye (Intel) led in vision-based driver assistance and autonomous navigation algorithms, while Nvidia and Qualcomm provided powerful SoCs (system-on-chips) and AI frameworks enabling real-time data processing. Tesla, through its in-house Autopilot and Full Self-Driving (FSD) stack, played a pivotal role in software-first vehicle architecture innovation. Valeo contributed software for sensor fusion and adaptive control, targeting mass-market electric vehicles. Competitive strategies focus on real-time decision-making capabilities, AI-powered edge intelligence, compliance with functional safety standards, and seamless OTA software management to reduce lifecycle costs and accelerate feature delivery.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of ADAS Software market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Component

| |

System

| |

Vehicle

| |

End Use

| |

Level of Autonomy

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report