The market for adhesive tapes is expected to grow at a CAGR of 6.2% throughout the forecast period of 2026 to 2034 with the global market revenue that is expected to crossover US$ 80 billion by 2034. The demand for adhesive tapes is being driven by factors such as the expanding use of sticky tapes across a variety of industries, the increasing urbanization of populations, and the improvement of healthcare systems. These tapes make it easier to package since they can hold the layers of packaging products together, which in turn simplifies the process of transporting packaged products. When used in place of mechanical operations, the utilization of adhesive tapes enables low-temperature working, which simplifies a variety of industrial procedures. Tapes are also helpful in protecting surfaces, not only from damage caused by fasteners or screws but also from paints and coatings. This is because tapes provide a temporary interface between the two layers of protection, allowing paints and coatings to be applied without damaging the surface. Depending on the requirements of the final consumer, adhesive tapes can either be single-sided or double-sided, meaning that the resin can be found on either of the two sides.

Covid-19 had an Adverse Impact on the Adhesive & Tapes Market

COVID-19 has had a substantial impact on the economies of a number of different industrial and financial sectors, including the travel and tourism industry, manufacturing, and aviation, among others. The biggest economic downturn occurred in the years 2021 and 2022. The decline in economic activities is having a negative influence on economies around the world as a direct result of an increasing number of nations adopting and prolonging lockdowns. The International Monetary Fund (IMF) estimates that the global economy contracted by 4.4% in 2021, marking the most significant slowdown since the Great Depression of the 1930s.

E-Commerce Industry Raising the Need for Packaging

The rise of e-commerce, particularly in less developed nations, has resulted in a tremendous increase in the need for materials used in packing products to protect them from damage caused by manufacturing, packaging, and transportation. As a result of the necessity for packaging materials to be attached and sealed so that the product contained therein is protected, there has been a significant increase in the need for adhesive tapes. Additionally, adhesive tapes make it easier to glue two broken parts together, which lowers the amount of stress placed on the raw materials used in the production of a variety of goods.

Increasing Price of Raw Materials Adversely Impacting the Market

When it comes to determining the cost structure of their products, adhesive tape producers need to give primary consideration to the prices of raw materials as well as the availability of such commodities. Raw materials that go into the production of adhesive tapes include things such as rubber, acrylic, and silicone, as well as things like paper, polypropylene (PP), polyvinyl chloride (PVC), adhesives, and release liners. The vast majority of these basic materials are derivatives of petroleum, which are susceptible to swings in the cost of their underlying commodities. The ever-increasing demand from around the world and the instability in the Middle East have both contributed to the historically erratic behavior of oil prices. The growth of the market is impacted by the unpredictability of the industry as well as volatility in the cost and availability of feedstock.

Drawbacks of Conventional Fastening Systems Creates Opportunity for Adhesive Tapes

Conventionally speaking, the ways of joining that make use of mechanical fastenings such as nuts and bolts, screws and rivets, and other forms of mechanical interlocking are regarded as being the most trustworthy and the most robust. However, attaching surfaces that are not identical is difficult because there is a risk of the material cracking under high pressure as a result of tensile stress; as a result, there is a lack of reliability and long-term attachment. New applications of adhesive tapes for fixing and fastening are created as a result of the widespread substitution of old fastening systems with adhesive tapes. These tapes eliminate the problems that are caused by conventional methods of fastening and contribute to an increase in the product's overall lifespan. Tapes are also helpful in preventing rust and corrosion, cutting down on noise and vibration, speeding up manufacturing and assembly, and improving product design. It has been demonstrated that these can improve efficiency and performance while also reducing the costs of production and materials.

Regulations to Challenge the Market Growth

Challenges are posed by regulatory authorities such as the Control of Substances Hazardous to Health (COSHH), the European Union (EU), the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), the Globally Harmonized System (GHS), and the Environmental Protection Agency to the chemical industry in Europe and North America (EPA). In order to cut down on the release of volatile organic compounds (VOCs), it is mandatory for manufacturers in these areas to comply with laws governing both the production of adhesive tapes and their use in a variety of applications. These regulations require manufacturers to modify their technologies from solvent-based to water-based, which presents a significant challenge for manufacturers because solvent-based adhesive tapes offer durability and can withstand a high range of temperatures, making them suitable for a wide range of applications. Water-based adhesive tapes, on the other hand, are only suitable for a limited number of applications due to their inability to withstand such a wide range of temperatures.

Paper-Based Adhesive Tapes to Dominate the Market

Paper-based adhesive tapes accounted for the highest revenue contribution in 2022. As a result of the pores present in the backing material, adhesive tapes with a paper backing can also be referred to as micropore tapes. These tapes can be purchased with an adhesive layer that is covered with kraft, crape, or any other sort of recyclable paper. Paper tapes that have a rubber adhesive coating and are created from crape paper can be used for a variety of different things. These tapes are safe for the environment and come in a plethora of different hues to choose from. Paper tapes are known for their strong gripping force as well as their ability to insulate against heat and withstand high temperatures. In comparison to PET sticky tapes, these tapes offer a far higher level of comfort. Because they are relatively thin, flexible, and also smooth, they are well-suited for use in the production of automobiles and aircraft; the production of home appliances; heating, ventilation, and air conditioning (HVAC); and applications involving paper and printing. The different types of raw materials that are utilized in the production of paper might result in vast variations in the quality of the paper backing tapes that are produced.

Water-Based Technology to Lead the Market Growth During the Forecast Period

Water-based technology is anticipated to register the highest CAGR during the forecast period of 2026 to 2034. The need for water-based adhesive tapes in the building and construction industry in the Asia Pacific region is steadily increasing as a result of new infrastructure projects in India, Taiwan, and other rising countries. This demand is driving the growth of the water-based adhesive tapes market. The water-based technology possesses exceptional adhesion to a number of surfaces and is put to use in a wide range of packaging applications due to its versatility. As a result of the water-based technology's low impact on the surrounding ecosystem and the absence of any VOC emissions during the formulation process, there is a growing demand for these tapes.

Single-Coated Adhesive Tapes Dominate the Current Revenues, Double-Coated Adhesives to Lead the Growth

Single-coated adhesive tapes were the most popular type sold on the global market for adhesive tapes in 2025. Tapes with a single coating consist of adhesive that has been applied on just one side of the backing. The adhesive might be made of natural rubber, silicone, or acrylic, while the backing material could be a polymeric film, paper, foil, nonwoven, or high thread count is woven cloth. Natural rubber, silicone, or acrylic could make up the adhesive. These tapes, which include masking tapes and medical tapes as well as electrical tapes, carton sealing tapes, and BOPP adhesives, make it easier to connect a substance to a surface and link two materials that are adjacent to or overlap one another.

Due to the rise in consumption of double-coated tapes because of their longevity, superior surface adherence, and high shear strength, it is projected those traditional methods of sealing and adhering will be replaced by double-coated tapes in the near future. It is anticipated that a robust production base, the rapid expansion of the automotive industry, and the substitution of adhesive tapes for conventional fasteners, such as screws, bolts, and rivets, will boost the market for adhesive tapes around the world.

Electronic Industry Contributed the Largest to Revenues, While Automobile Promises Significant Opportunities

The electronic industry contributed the largest in terms of global revenues in 2025. However, the automobile segment is expected to grow fastest registering the highest CAGR during the forecast period of 2026 to 2034. For the purpose of installing components directly into devices, the electronic industry makes use of pressure-sensitive tapes and adhesives. The global market for sticky tapes is being driven in large part by the ongoing trend toward the shrinking of electronic devices, particularly mobile phones, small personal computers, and tablet computers. In the automobile industry, adhesive tapes are utilized extensively in a variety of applications, including but not limited to: wire harnessing, electric insulation, vehicle body repairs, masking, and surface protection. The adhesive tapes market is expected to be propelled throughout the forecast period by an increase in the utilization of adhesive tapes in vehicle interior parts to provide improved resistance and exceptional adhesion ability. This is likely to occur during the course of the forecast period.

APAC is the Most Promising Investment Destination During the Forecast Period

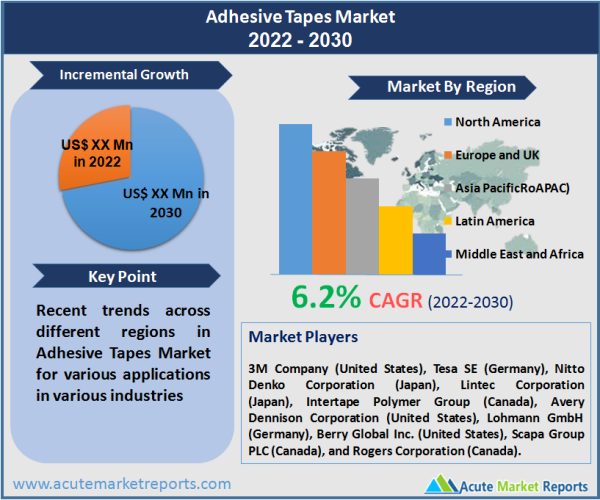

The high economic growth rate in APAC is the primary contributor to the region's expansion, which is then followed by significant investments in a variety of industries, including the building and construction industry, the healthcare industry, the electrical and electronics industry, and the automotive industry. Several different corporations, including Nitto Denko (Japan) and Ajit Industries (India), are expanding their existing adhesive tape production units in the region or constructing new adhesive tape production plants in the region. The production costs will be lower in Asia and the Pacific, and you will be able to better serve the local emerging markets. These are two of the primary advantages of moving production there.

Additionally, with respect to both consumption and manufacturing, the Asia-Pacific region held the maximum share accounting for about 45% of the market revenues in 2022. It is projected that countries in the Asia Pacific region, including China and India, will drive an increase in demand for adhesive tape in the global market. It is also anticipated that the market will be able to attain significant momentum because of the expansion of several industries across the area, including e-commerce, automotive, and healthcare.

It is anticipated that North America would account for a significant portion of the overall market for adhesive tapes. The United States is home to a number of important manufacturing industries, including those specializing in consumer goods and healthcare, both of which make increasing use of sticky tapes. Owing to the large demand for adhesive tapes from the electronics and automotive industries in Europe, Europe holds a significant proportion of the global market for adhesive tapes. It is anticipated that the expansion of the food packaging sector in the Middle East and Africa will drive the market for adhesive tapes in those regions, whilst the paper and packaging industry would be the driving force behind growth in Latin America.

Costing to Remain as an Entry Barrier for Potential Entrants

There is a large number of global and regional players operating in the adhesive tape market, due to which the market is largely fragmented. The most important suppliers in the market for adhesive tapes are focusing their efforts on developing new merger and acquisition strategies in order to expand the market internationally. The high cost of raw materials makes it difficult for new players to enter the market, but manufacturers who are already established see this as an opportunity and consider it a boon in order to boost their product in the market and attract more revenue share in the market. The high cost of raw materials is serving as a significant entry barrier for the entry of new players. The companies are also focusing on the production of more cutting-edge products in order to increase their revenue, meet the growing demand for adhesive tapes on the market and increase their production capacity through competitive technologies.

Companies such as 3M Company (United States), Tesa SE (Germany), Nitto Denko Corporation (Japan), Lintec Corporation (Japan), Intertape Polymer Group (Canada), Avery Dennison Corporation (United States), Lohmann GmbH (Germany), Berry Global Inc. (United States), Scapa Group PLC (Canada), and Rogers Corporation (Canada) are among the major competitors in the market for adhesive tapes (US). The 3M Company in the United States is among the leading companies in this market. This company has a significant presence in several countries throughout the world.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Adhesive Tapes market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Resin type

|

|

Backing material

|

|

Technology

|

|

Category

|

|

End User

|

|

Product

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report