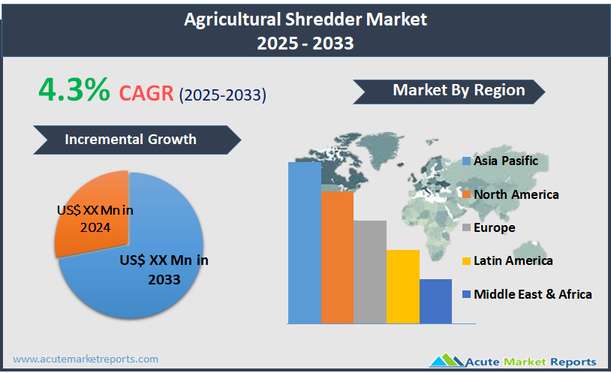

The agricultural shredder market covers equipment designed to cut, shred, and process agricultural waste, crop residues, weeds, branches, and organic matter into smaller, manageable pieces suitable for mulching, composting, or bioenergy production. Agricultural shredders are used by farmers, agro-industrial operators, and municipal agencies to improve soil fertility, manage farm waste sustainably, and support land clearing activities. These machines vary in capacity, size, and operating mode (manual, semi-automatic, or automatic) and are often tailored for specific tasks such as shredding sugarcane waste, coconut fronds, cotton stalks, and horticultural residues. The agricultural shredder market is expanding steadily, supported by the global focus on sustainable farming practices, organic waste management, and soil enrichment through mulching. With a projected Compound Annual Growth Rate (CAGR) of 4.3%, market growth is driven by rising awareness among farmers regarding the benefits of residue management and the increased demand for equipment that supports eco-friendly agricultural practices.

Increasing Focus on Sustainable Agriculture and Organic Waste Management

A major driver for the agricultural shredder market is the increasing global focus on sustainable agriculture and effective organic waste management. Farmers and agricultural enterprises are becoming more aware of the environmental and economic benefits associated with recycling crop residues, green waste, and organic byproducts rather than burning or discarding them. Agricultural shredders play a crucial role in this process by converting waste materials into mulch, compost, or biomass fuel, thereby improving soil fertility, enhancing moisture retention, and reducing dependence on chemical fertilizers. Moreover, governments across various regions are implementing stricter regulations against stubble burning due to its contribution to air pollution and greenhouse gas emissions, pushing farmers toward adopting shredders as a sustainable alternative. Financial incentives, subsidies, and awareness programs promoting residue management and organic farming practices further stimulate demand for agricultural shredders. As the global agricultural sector moves towards eco-friendly and regenerative practices, shredders are becoming essential tools for small, medium, and large-scale farmers seeking to optimize productivity while minimizing environmental impact.

Expansion of Bioenergy and Biomass Projects

An important opportunity within the agricultural shredder market lies in the expanding bioenergy and biomass production sectors. Agricultural residues such as crop stalks, sugarcane trash, and horticultural waste are increasingly being utilized as raw materials for biomass-based power generation, biogas plants, and composting facilities. Shredders are critical for preparing this biomass by reducing material size, increasing surface area, and enhancing the efficiency of subsequent energy conversion processes. As many countries set renewable energy targets and incentivize the production of clean energy from agricultural sources, demand for agricultural shredders is expected to rise significantly. Farmers and rural entrepreneurs are increasingly recognizing the economic benefits of selling shredded biomass to bioenergy plants or using it for onsite energy generation. Furthermore, advancements in decentralized bioenergy systems, such as compact biogas units and on-farm biomass gasifiers, are creating new markets for shredding equipment tailored to specific feedstock preparation requirements. This shift toward utilizing agricultural waste for sustainable energy production presents manufacturers with opportunities to design versatile, durable shredders capable of handling diverse biomass materials efficiently.

High Initial Investment and Maintenance Costs

A significant restraint in the agricultural shredder market is the high initial investment and ongoing maintenance costs associated with purchasing and operating shredders. For smallholder farmers, especially in developing countries, the upfront cost of acquiring shredding equipment can be prohibitive, limiting widespread adoption. In addition to the purchase price, operational costs such as fuel or electricity consumption, regular maintenance, and parts replacement add to the financial burden. Complex mechanical systems in modern shredders require skilled maintenance, and delays in servicing can lead to operational downtime and lost productivity during critical farming periods. While subsidies and financing options help mitigate this issue to some extent, the economic feasibility of shredder ownership remains a concern for many small and medium-scale farmers. This situation often forces farmers to rely on traditional waste disposal methods or shared machinery access models, which can limit the market potential for individual shredder sales. Manufacturers must focus on designing cost-effective, durable, and low-maintenance shredders to overcome these affordability barriers and expand market reach.

Variability in Crop Residues and Field Conditions

One of the major challenges in the agricultural shredder market is the variability in crop residues and field conditions that affect machine performance and user satisfaction. Agricultural shredders must handle a wide range of biomass types—ranging from soft green waste to tough fibrous materials like coconut fronds, maize stalks, and cotton residues—which can vary significantly in moisture content, fiber strength, and bulk density. Designing a shredder that performs optimally across these different materials without clogging, excessive wear, or reduced throughput is technically demanding. Furthermore, field conditions such as uneven terrain, the presence of stones or debris, and climatic factors like heavy rainfall or drought can impact machine operability and durability. Farmers often seek shredders that offer versatility, minimal downtime, and ease of operation across different crop cycles, but meeting these diverse requirements while maintaining cost efficiency is a constant challenge for manufacturers. Addressing this challenge requires continuous investment in research and development to improve blade designs, powertrains, material handling mechanisms, and machine adaptability while ensuring that the equipment remains affordable and user-friendly for a broad spectrum of agricultural users.

Market Segmentation by Type

In the agricultural shredder market, the Portable segment accounted for the highest revenue in 2024 and is projected to witness the highest CAGR from 2025 to 2033. Portable agricultural shredders are highly favored due to their flexibility, ease of transportation, and ability to operate directly in fields without requiring extensive setup, making them ideal for small and medium-sized farms where mobility and versatility are essential. Farmers appreciate portable models because they can be easily moved between plots, allowing them to shred different types of agricultural waste across various locations, optimizing farm operations and minimizing the need to transport heavy biomass manually. Furthermore, portable shredders are increasingly available in a range of sizes and power options, from small tractor-mounted units to compact motorized models, catering to a wide variety of farm sizes and operational scales. On the other hand, the Fixed shredder segment, while still significant, primarily serves large-scale agricultural or agro-industrial operations where waste processing is centralized, such as in commercial farms, sugarcane processing units, or agro-waste recycling plants. Fixed shredders are known for their higher throughput capacity and durability for processing large volumes of biomass continuously; however, their lack of mobility limits their application to specific locations. As trends in sustainable farming and decentralized waste management practices continue to grow, demand for portable shredders is expected to accelerate, reinforcing their dominance both in terms of revenue and growth rate during the forecast period.

Market Segmentation by Operation

In terms of operation, the Automatic segment held the highest revenue in 2024 and is expected to record the highest CAGR from 2025 to 2033 within the agricultural shredder market. Automatic shredders are increasingly preferred by farmers and agro-industrial users because they offer higher productivity, reduced manual intervention, consistent shredding quality, and enhanced safety features, which together help optimize labor costs and operational efficiency. Technological advancements such as programmable settings, automatic feed mechanisms, overload protection systems, and real-time performance monitoring have significantly improved the reliability and ease of use of automatic shredders. These machines are particularly popular in regions where labor shortages or high labor costs drive the need for greater mechanization in agricultural waste management. Meanwhile, the Semi-automatic segment continues to serve a sizable portion of the market, especially among small-scale and cost-conscious farmers who prioritize affordability and simplicity over full automation. Semi-automatic shredders typically require manual feeding or partial manual control of shredding operations, making them suitable for farms where labor availability is not a major constraint and where budgets for mechanization investments are limited. However, as farming practices modernize and the economic benefits of automation become clearer, the preference is expected to continue shifting toward automatic models, particularly in developing economies experiencing rapid agricultural mechanization, thereby reinforcing the dominant position of the automatic shredder segment through the forecast period.

Geographic Segment

In the agricultural shredder market, Asia Pacific accounted for the highest revenue in 2024, led by countries such as India, China, and Japan, where agricultural activities remain a cornerstone of the economy and there is a strong push toward rural mechanization and sustainable waste management practices. Rapid population growth, rising food demand, and government initiatives promoting modern farming techniques significantly boosted shredder adoption across small and large farming operations in the region. Meanwhile, Asia Pacific is also projected to register the highest CAGR from 2025 to 2033, driven by expanding agricultural sectors, increased awareness of the benefits of organic waste recycling, and ongoing investment in rural infrastructure and farming equipment subsidies. North America held a substantial share of the market in 2024, with strong adoption supported by large-scale farming operations, high mechanization rates, and the widespread practice of crop residue management to meet sustainable farming regulations, especially in the United States and Canada. Europe also contributed significantly to global revenues in 2024, fueled by strict environmental regulations encouraging sustainable farming, particularly in countries like Germany, France, and Italy, and growing demand for biomass production from agricultural waste. Latin America and the Middle East & Africa recorded smaller revenue shares but are expected to show steady growth from 2025 to 2033, driven by agricultural modernization efforts, increased emphasis on organic farming practices, and the need to manage expanding crop areas and associated biomass waste more efficiently.

Competitive Trends and Key Strategies

In 2024, the competitive landscape of the agricultural shredder market was shaped by key players such as AGCO Corporation, Bamford Excavators Limited, Alamo Group, Beri Udyog Private Limited, Bertolini, Bobcat Company, Changzhou Dongfeng Agricultural Machinery Group Co. Ltd., Daedong Industry Co. Ltd., Deere & Company, Iseki & Co., Ltd., Kubota Corporation, Landoll Company LLC, and Mahindra & Mahindra Limited. AGCO Corporation focused on expanding its product range and enhancing shredder performance by integrating smart farming solutions and IoT technologies to offer precision residue management equipment. Bamford Excavators Limited and Alamo Group strengthened their market presence by introducing durable, high-capacity shredders suitable for both large commercial farms and municipal applications, emphasizing operational efficiency and rugged design. Beri Udyog Private Limited capitalized on rising demand in emerging markets by offering cost-effective, locally manufactured shredders that meet diverse agricultural needs with robust after-sales support. Bertolini and Bobcat Company targeted niche segments by offering compact, easily maneuverable shredders designed for horticulture and specialty crop applications. Changzhou Dongfeng Agricultural Machinery Group Co. Ltd. and Daedong Industry Co. Ltd. expanded their geographic reach in Southeast Asia and Africa through strategic partnerships and dealership networks, promoting affordable and versatile shredder models. Deere & Company maintained its leadership through technological innovation, focusing on integrated shredder solutions that enhance overall farm productivity by combining shredding with data-driven crop management. Iseki & Co., Ltd. and Kubota Corporation emphasized compact, lightweight shredder designs for smallholder farms, addressing the mechanization gap in densely farmed regions. Landoll Company LLC diversified its portfolio to include heavy-duty shredders aimed at agro-industrial applications such as biomass preparation for bioenergy projects. Mahindra & Mahindra Limited leveraged its extensive rural distribution network and strong brand presence in India and Africa to boost sales of multi-purpose shredders tailored for small and medium-sized farms.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Agricultural Shredder market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Type

| |

Operation

| |

Power Range (HP)

| |

Shredding Capacity (Kg/Hrs.)

| |

Power Type

| |

Equipment

| |

Distribution Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report