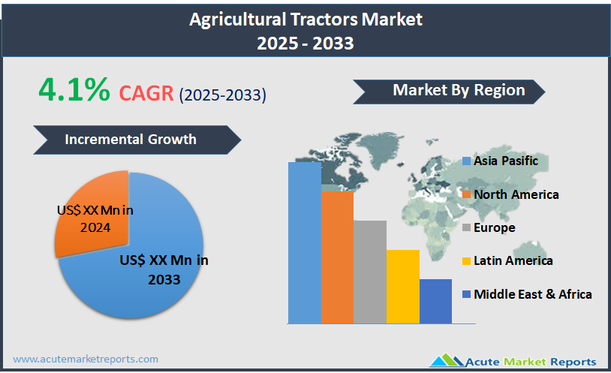

The agricultural tractors market encompasses the sale and manufacturing of mobile power units used primarily in the agricultural sector for mechanizing various farm tasks such as plowing, tilling, planting, harrowing, and harvesting. These tractors are equipped with powerful engines and designed to operate over rough terrain, with the capability to mount various agricultural implements depending on the specific farming requirement. The agricultural tractors market is driven by the increasing need for mechanization in farming to boost productivity and reduce labor intensity. The market is influenced by factors such as the rising demand for food globally, technological advancements in farming equipment, and government subsidies for agricultural machinery. The global market for agricultural tractors is witnessing a Compound Annual Growth Rate (CAGR) of 4.1%, reflecting steady growth influenced by the adoption of modern agricultural practices in both developed and developing regions. This growth trajectory is expected to be supported by continuous innovations in tractor technology, such as automation and precision agriculture, enhancing efficiency and environmental sustainability in farming operations.

Driver: Technological Advancements in Tractors

The agricultural tractors market is significantly driven by the continuous technological advancements in tractor design and functionality. Modern tractors are increasingly equipped with GPS technology, automation features, and advanced sensors that enhance precision in farming operations. These technologies allow for precise planting, fertilizing, and harvesting, which improves crop yields and efficiency. For example, GPS-enabled tractors can reduce overlap during seeding or fertilizing, thus saving fuel and time and reducing input costs. Furthermore, the integration of telematics systems in tractors enables remote monitoring of tractor functions, optimizing the maintenance schedule and minimizing downtime, which is crucial during critical farming periods.

Opportunity: Rising Demand for Food Security

The global increase in population and the subsequent rise in demand for food security present significant opportunities for the agricultural tractors market. As countries strive to enhance their agricultural output to feed their growing populations, the reliance on mechanized farming becomes more critical. This is particularly evident in regions like Asia and Africa, where traditional farming methods are rapidly being replaced with mechanized techniques to increase productivity and ensure food availability. The adoption of tractors plays a pivotal role in this transformation, offering opportunities for market expansion as governments and international bodies invest in agricultural mechanization as a strategy for achieving food security.

Restraint: High Cost of Advanced Tractors

One major restraint in the agricultural tractors market is the high cost associated with advanced models, which feature new technology and enhanced functionalities. These costs can be prohibitively high, particularly for small-scale farmers in developing countries, where capital is often limited. The initial purchase price, coupled with the cost of maintenance and repair of sophisticated equipment, poses a significant barrier to market penetration. This situation is exacerbated by the lack of financing options or credit facilities available to these farmers, limiting their ability to upgrade their agricultural machinery and, by extension, their farming practices.

Challenge: Adoption in Developing Regions

A major challenge facing the agricultural tractors market is the adoption rate in developing regions, where traditional farming practices are deeply entrenched. Many smallholder farmers in these areas rely on manual labor and animal power, and the transition to mechanized solutions like tractors is often hindered by factors such as cost, lack of infrastructure (such as roads and fuel stations), and limited technical know-how. Moreover, the availability of service centers and spare parts can be scarce, discouraging farmers from investing in machinery that they cannot maintain or repair locally. Addressing these issues requires concerted efforts in education, infrastructure development, and financial support services to enhance the adoption of agricultural tractors.

Market Segmentation by Engine Power

The agricultural tractors market is segmented by engine power into four categories: below 30 HP, 30 HP to 100 HP, 100 HP to 200 HP, and above 200 HP. The segment of 30 HP to 100 HP tractors holds the highest revenue share due to its versatility and suitability for a broad range of agricultural tasks, making it a preferred choice for both small and medium-sized farms. These tractors offer the optimal balance of power and efficiency for most farming needs, which includes crop cultivation and harvesting tasks. On the other hand, tractors with above 200 HP are witnessing the highest Compound Annual Growth Rate (CAGR). This growth is fueled by large-scale farming operations and commercial agricultural enterprises that require powerful machinery to efficiently manage large areas of land. These high-power tractors are capable of performing intensive farming tasks more efficiently, supporting the trend towards larger, more industrialized farm operations that prioritize productivity and time management.

Market Segmentation by Propulsion

In the propulsion category, the agricultural tractors market is divided into internal combustion engine (ICE) tractors, electric tractors, and others. The ICE segment dominates the market in terms of revenue due to its longstanding reliability and the extensive infrastructure that supports these engines. Diesel-powered tractors, in particular, are favored for their durability and high torque output, which are essential for heavy-duty fieldwork. Despite the dominance of ICE tractors, the electric segment is projected to grow at the highest CAGR. This growth is driven by the increasing emphasis on sustainability and the reduction of greenhouse gas emissions in agriculture. Electric tractors offer the benefits of lower operational costs, reduced maintenance, and zero emissions, which aligns with the global shift towards environmentally friendly farming practices. The development of better battery technologies and the expansion of charging infrastructure further bolster the adoption of electric tractors, positioning them as a key growth segment in the future of agricultural machinery.

Geographic Segment

In the agricultural tractors market, geographic trends indicate a robust expansion across several key regions, with Asia Pacific leading in terms of highest revenue due to the large agricultural base and the increasing mechanization in countries such as India and China. The region benefits from governmental support in the form of subsidies for farm machinery, a growing population, and an increasing need for agricultural productivity. However, North America is expected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2025 to 2033, driven by the adoption of advanced farming technologies, the presence of large farm holdings, and the shift towards sustainable farming practices that require modern, efficient machinery.

Competitive Trends

The competitive landscape of the agricultural tractors market is dominated by key players such as Deere & Company, Mahindra Group, and Kubota Corporation, which collectively accounted for significant market share in 2024. These companies are continuously innovating their product offerings, for instance, by integrating GPS and IoT technologies into their tractors to enhance functionality and efficiency. Other significant players include Yanmar, Massey Ferguson, and CNH Industrial N.V., each contributing to the market dynamics with their specialized product lines tailored to different farming needs and regions. In 2024, Deere & Company led the market in revenue, driven by its strong global network and reputation for high-quality machinery. From 2025 to 2033, these companies are expected to focus on expanding their geographical presence and product portfolio through strategies such as mergers, acquisitions, and partnerships. For example, Kubota Corporation and CNH Industrial N.V. are expected to invest in expanding their electric tractor lines to cater to the growing demand for sustainable agricultural practices. Additionally, companies like Mahindra & Mahindra Limited and TAFE Limited are focusing on affordability and efficiency to penetrate emerging markets where small to medium-scale farming predominates. This strategic focus is aimed at leveraging the growth opportunities in these regions, where the demand for cost-effective and versatile farming solutions is on the rise.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Agricultural Tractors market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Engine Power

| |

Propulsion

| |

Drive Type

| |

Level of Autonomy

| |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report