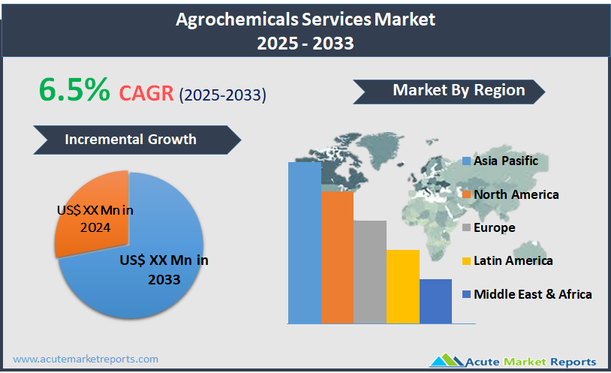

The agrochemicals services market encompasses a broad range of activities aimed at enhancing the effectiveness and efficiency of agrochemical products such as fertilizers, pesticides, herbicides, and fungicides. This market covers services ranging from consultation and training for farmers on proper chemical application techniques to the development and implementation of integrated pest management (IPM) strategies. These services are crucial in optimizing the use of agrochemical products, ensuring regulatory compliance, and promoting sustainable agricultural practices. The agrochemicals services market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.5%. This growth is attributed to several factors, including the increasing adoption of technologically advanced farming solutions, heightened awareness among farmers about the benefits of professional agrochemical services, and stringent environmental regulations promoting the safe use of agrochemicals.

Increasing Demand for High Agricultural Yield

The primary driver of the agrochemicals services market is the escalating demand for high agricultural yield to meet the food requirements of a growing global population. The world population, expected to reach nearly 10 billion by 2050, necessitates significant enhancements in agricultural productivity. To achieve this, farmers increasingly rely on agrochemicals to boost crop production and protect against pests and diseases. The effectiveness of these chemicals, however, depends on proper application, timing, and management, which are facilitated by specialized agrochemical services. These services help in optimizing the use of resources, thus ensuring higher crop yields while minimizing environmental impact. As a result, there is a heightened demand for professional advice and support in chemical handling, application techniques, and compliance with safety and environmental regulations, driving the market forward.

Expansion into Emerging Markets

A notable opportunity within the agrochemicals services market lies in its expansion into emerging markets, where agriculture plays a crucial economic role but remains under-optimized. Countries in regions such as Southeast Asia, Africa, and Latin America are experiencing rapid agricultural development and are increasingly open to adopting modern farming technologies and practices. Agrochemical service providers have the potential to tap into these markets by offering tailored solutions that address local farming challenges and training programs that educate farmers on the benefits and safe use of agrochemicals. This not only aids in improving the local agricultural output but also opens up new revenue streams for service providers.

Stringent Environmental Regulations

One significant restraint in the agrochemicals services market is the increasingly stringent environmental regulations concerning the use and disposal of agrochemicals. Governments worldwide are imposing strict rules to curb the environmental damage caused by excessive and improper use of agrochemicals, such as contamination of water sources, soil degradation, and loss of biodiversity. These regulations require farmers and agrochemical service providers to adhere to precise application norms and use environmentally friendly products. While these regulations aim to promote sustainable farming practices, they also pose operational challenges and increase costs for service providers, limiting the market's growth potential.

Adaptation to Climate Change

A major challenge facing the agrochemicals services market is the need to adapt to the varying patterns of climate change, which significantly affect farming practices worldwide. Changes in temperature, unexpected weather events, and shifting pest dynamics require constant adjustments in agrochemical applications and farming techniques. Service providers must continually develop and adjust their offerings to cope with these changes effectively. This necessitates ongoing research and development efforts, which can be costly and resource-intensive. The challenge lies in keeping pace with these changes while maintaining the effectiveness and efficiency of agrochemical applications, ensuring that services remain relevant and valuable to farmers.

Market Segmentation by Services

The agrochemicals services market is segmented into several categories, including Formulation Support, Testing & Inspection, Regulatory Guidance, Off-Patent Active Solutions, and Others. Of these, Regulatory Guidance is expected to exhibit the highest Compound Annual Growth Rate (CAGR) due to the increasing complexity of regulatory environments across different regions. This segment involves providing essential services to ensure compliance with local and international regulations, which is critical as these regulations continue to evolve and become more stringent. Regulatory guidance services are crucial for agrochemical manufacturers and farmers to navigate these complexities, ensuring that their products and practices meet all legal standards. On the other hand, the Testing & Inspection services segment accounts for the highest revenue within the market. This dominance is attributed to the essential need for ensuring the safety, efficacy, and quality of agrochemical products. Testing and inspection services are integral in certifying products for market release and routine checks to adhere to ongoing safety standards, driving substantial revenue to this segment as agrochemical users continue to prioritize product reliability and compliance.

Market Segmentation by Crop Type

In terms of crop type, the agrochemicals services market is categorized into Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, and Others. The segment catering to Cereals & Grains is poised for the highest revenue generation, as these are staple crops globally and command extensive agricultural acreage requiring substantial agrochemical applications. The consistent demand for cereals and grains, coupled with the need to protect these crops from pests and diseases efficiently, drives significant investment in agrochemical services tailored for this segment. Meanwhile, the Fruits & Vegetables segment is anticipated to register the highest CAGR. This growth can be attributed to the increasing consumer demand for high-quality, pesticide-free, and organic produce, which requires more specialized agrochemical services. Services for fruits and vegetables often involve more frequent and precise chemical applications, advanced pest management techniques, and a growing emphasis on sustainable practices, responding to consumer preferences and regulatory pressures for safer, residue-free produce. This trend highlights the segment’s rapid expansion as providers innovate and adapt services to meet these specific agricultural demands.

Geographic Segment

The agrochemicals services market exhibits varied geographic trends, with Asia Pacific leading in terms of both highest Compound Annual Growth Rate (CAGR) and revenue percentage. The region's dominance in the highest CAGR can be attributed to its extensive agricultural activities, rapid adoption of modern farming techniques, and growing awareness of sustainable practices. Asia Pacific also hosts a large number of emerging economies where the agricultural sector plays a critical role in economic development. This contributes significantly to its high revenue share in the agrochemicals services market. Countries like China and India, with their vast agricultural lands and increasing need for productivity enhancements, drive considerable demand for agrochemical services. North America and Europe also show robust market activities, with advanced agricultural technologies and stringent regulatory environments fostering a steady demand for services like testing, inspection, and regulatory guidance.

Competitive Trends and Top Players

In 2024, the competitive landscape of the agrochemicals services market was defined by the strategic endeavors of key players such as Clariant, Creative Proteomics, ALLIANCE PHARMA, Frontage Labs, Intertek Group plc, PerkinElmer Inc, Bioneeds India Pvt. Ltd., Labcorp Drug Development, Baroda Agro Chemicals Ltd, JRF Global, and PI Industries. These companies collectively pursued strategies including mergers and acquisitions, geographic expansions, and the launch of new services tailored to meet the evolving needs of the agricultural sector. Clariant, known for its innovation in chemical services, focused on expanding its sustainable product line, while Creative Proteomics emphasized advancing its analytical testing capabilities. ALLIANCE PHARMA and Frontage Labs extended their geographic reach to tap into emerging markets, enhancing their global presence. Intertek Group plc and PerkinElmer Inc. continued to excel in providing superior testing and regulatory services, which were crucial for maintaining compliance with global agrochemical standards. Bioneeds India Pvt. Ltd. and Labcorp Drug Development leveraged their expertise in bio-analytical testing to support agrochemical safety and efficacy assessments. Baroda Agro Chemicals Ltd, JRF Global, and PI Industries focused on innovation in off-patent active solutions, catering to cost-effective needs in the market. For the forecast period of 2025 to 2033, these companies are expected to further enhance their service offerings, focusing on integrating digital technologies like AI and IoT to improve the precision and efficiency of agrochemical applications, responding to the increasing demand for high-yield and sustainable agricultural practices. This strategic focus is anticipated to drive their growth and competitiveness in the global market.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Agrochemicals Services market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Services

| |

Crop Type

| |

Application

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report