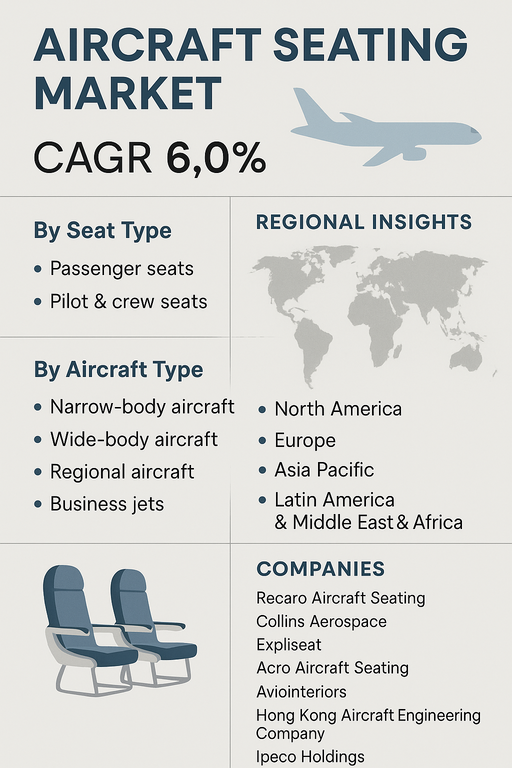

The global aircraft seating market is projected to grow at a CAGR of 6.0% from 2026 to 2034. Growth is driven by rising passenger traffic, expanding airline fleets, and increasing demand for enhanced comfort, safety, and fuel-efficient seating solutions. Airlines are investing in lightweight and ergonomically designed seats to optimize cabin space, reduce operating costs, and meet evolving passenger expectations. Advancements in materials, modular designs, and in-flight entertainment integration are further transforming the aircraft seating industry.

Rising Demand for Comfort, Safety, and Fuel Efficiency

Airlines are modernizing their fleets with seating solutions that balance passenger comfort and operational efficiency. Lightweight seating systems contribute to fuel savings and reduced carbon emissions, aligning with sustainability goals. Increasing demand for premium travel experiences is pushing innovation in seat design, including reclining mechanisms, in-seat power, and connectivity. Meanwhile, regulatory requirements for crashworthiness and safety standards ensure continuous investment in advanced pilot, crew, and passenger seating technologies.

Challenges: High Costs and Certification Requirements

Despite growth opportunities, the aircraft seating market faces challenges such as high R&D and manufacturing costs, making innovation expensive for suppliers. Stringent certification requirements from aviation authorities increase product development timelines. Airlines, particularly low-cost carriers, often prioritize cost efficiency over luxury, limiting the adoption of premium seating in certain categories. Additionally, supply chain disruptions and raw material price volatility can hinder timely delivery and increase costs for manufacturers. Nevertheless, increasing airline investments in fleet expansion and passenger-centric upgrades are expected to sustain long-term market growth.

Market Segmentation by Seat Type

By seat type, the market is segmented into passenger seats and pilot & crew seats. In 2025, passenger seats accounted for the largest share, driven by rising air passenger volumes and airline fleet expansion. Pilot and crew seats remain critical for safety and ergonomic design, particularly in long-haul operations. Continuous upgrades in cushioning, adjustability, and lightweight structures are improving comfort and reducing pilot fatigue.

Market Segmentation by Aircraft Type

By aircraft type, the market is segmented into narrow-body aircraft, wide-body aircraft, regional aircraft, and business jets. Narrow-body aircraft dominated in 2025, supported by strong demand from low-cost carriers and short- to medium-haul routes. Wide-body aircraft seats are evolving with premium economy and business class innovations. Regional aircraft demand is steady, while business jets represent a high-value niche market, focusing on luxury, personalization, and comfort.

Regional Insights

In 2025, North America led the aircraft seating market, supported by major airlines, strong fleet expansion, and continuous investments in passenger experience upgrades. Europe followed, with manufacturers such as Recaro, Geven, and Aviointeriors driving innovations in seating technology. Asia Pacific is the fastest-growing region, with rising air travel demand in China, India, and Southeast Asia, alongside large-scale fleet procurement by regional carriers. Latin America and the Middle East & Africa (MEA) are emerging markets where airline expansion and modernization programs are opening new growth opportunities.

Competitive Landscape

The 2025 market was marked by strong competition among established global aircraft seat manufacturers and emerging players. Recaro Aircraft Seating, Collins Aerospace, and Jamco Corporation are global leaders, offering a wide range of seating solutions for passenger and crew applications. Geven, Aviointeriors, and Acro Aircraft Seating maintain strong positions in Europe with lightweight and modular seat offerings. Zim Aircraft Seating, Elevate Aircraft Seating, and Expliseat are expanding with innovative lightweight and cost-efficient products. Ipeco Holdings and Martin-Baker Aircraft specialize in advanced crew and pilot seating systems, focusing on safety and ergonomics. LifePort remains a leader in specialized seating solutions for medevac and military aircraft. Regional players like Hong Kong Aircraft Engineering Company and Mirus Aircraft Seating are strengthening their positions in Asia Pacific through customized solutions. Competitive strategies are increasingly focused on sustainability, comfort, cost efficiency, and advanced materials to meet evolving airline and passenger needs.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Aircraft Seating market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Seat Type

|

|

|

Seat Type |

|

Aircraft Type

|

|

Standard

|

|

Fit

|

|

End Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report