Industry Outlook

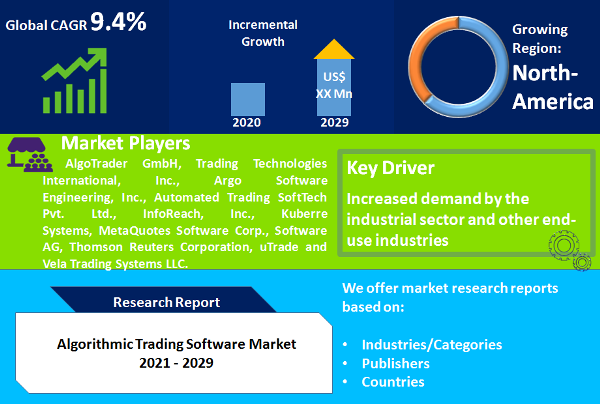

Algorithmic Trading can be termed as an application powered by artificial intelligence and sophisticated algorithm to carry out trading decisions without any human intervention. Dynamics of trading sector are changing at brisk pace and new technologies such as algorithmic trading are giving a head start to trading institutes and financial organizations. This is one of the many several factors acting as a catalyst for the growth of algorithmic trading software. Global algorithmic trading software registered a market value of US$ 14.95 Bn in 2021 indicating the growing faith of investors in such software. Considering the growing popularity, the market projected to register market value of US$ 26.08 Bn marks growing with a notable CAGR of 9.4% throughout the forecast period from 2022 to 2027.

"Cloud Software Snitching Opportunities from On-premises Software Segment"

In 2021, on-premises software for algorithmic trading runs the show by acquiring majority of market share and higher market value. Initially, on-premise software were the only sources an organization could procure such applications. However, introduction and acceptance of cloud concept opened new doors of opportunities not only algorithmic trading but across all the end-use application sector. These software requires minimum infrastructure and provides faster processing compared to its tradition on-premise counterpart. Besides all the aforementioned merits, cost-effectiveness is the biggest driver of cloud algorithmic trading as it allows the company to extract more profits with better flexibility and scalability. All these merits give an upper hand to cloud algorithmic trading and contemplated to overcome on-premise algorithmic trading in coming years.

"Boom in Cryptocurrency Brought New Energy in Cryptocurrency Algorithmic Trading"

Algorithmic trading for stock market by far leads the overall segment in terms of market value and expected to continue its good run in coming year. Rising financial literacy attracted more people to invest in stock market. This opened new window of opportunity for software firms to concentrate and develop algorithmic trading tools for stock market considering its nuances and dynamics. Besides stock market commodities including metals, oil & gas, and consumer products also claims a considerable share in overall market. Forex and bonds anticipated growing with a moderate growth rate. However, sudden exponential growth in cryptocurrency trading attracted several software companies to develop application catering to cryptocurrency trading. Consequently, cryptocurrency expected to emerge as the fastest growing segment in terms of market value throughout the forecast period from 2022 to 2027.

"Algorithmic Trading Spreading its Wing From Developed Region to Developing Regions"

North America region is known for its initiative in accepting new technology and algorithmic trading is no exception to it. At present, North America considered as the torchbearer in global algorithmic trading software market with largest market share. The region estimated to dominate the market in coming year owing to a majority of trade going through such software and applications. North America is followed by Europe in close quarters. Open Economy in European countries allows a facilitated trade and created more opportunities for algorithmic trading to flourish. Asia Pacific estimated to be the fasted growing market as major stock exchange in this region are accepting new form trading. Organizations in India such as SEBI and national stock exchange welcomed such trading alternative and encouraging such mediums. Growing trades and developing economies projected to contribute to the development of overall Algorithmic trading software market in Asia Pacific.

"Algorithmic Trading Software Companies in Race to Comply with Dynamic Nature of Trading Sector"

Software companies face intense competition from each other in this highly fragmented market. These companies have been on their toes and dedicate themselves to develop software for different trading sectors and on different compatible platforms. The biggest challenge for these companies is to incorporate all the constraints and elements of trading into their software for maximum profitability and mitigating the potential losses. The companies are in a race to capture attention of their potential customers and engage themselves with consumers for long terms partnerships. Some of the most prominent algorithmic trading software developers and service providers profiled in this research study include AlgoTrader GmbH, Trading Technologies International, Inc., Argo Software Engineering, Inc., Automated Trading SoftTech Pvt. Ltd., InfoReach, Inc., Kuberre Systems, MetaQuotes Software Corp., Software AG, Thomson Reuters Corporation, uTrade and Vela Trading Systems LLC among others.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Algorithmic Trading Software market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Software

|

|

Services

|

|

Trading

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report