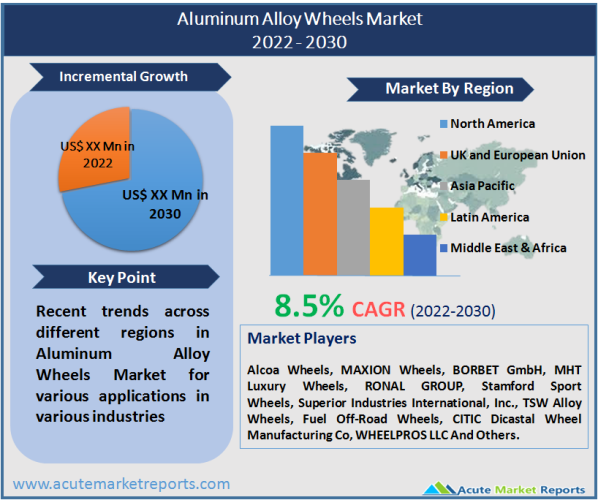

The global Aluminum Alloy Wheels Market is expected to grow at a CAGR of 8.5% during the forecast period of 2026 to 2034. Alloy wheels are automotive wheels manufactured from an aluminum or magnesium alloy. Mixing metals and other elements, alloy wheels are produced. Compared to pure metals, which are often softer and more ductile, they typically provide more strength. Due to their greater heat conductivity, anti-corrosion properties, and lighter weight than steel wheels, aluminum alloy wheels are a popular option for passenger cars. Several producers brand their merchandise by imprinting their logos into the rim. Demand for automotive alloy wheels is anticipated to expand during the forecast period, owing to a rise in customer purchasing power and an increase in global demand for lightweight automobiles. Due to their great durability and small weight, alloy wheels are utilized extensively. Moreover, aluminum alloy wheels enhance the vehicle's aesthetic appeal. Because the amount of carbon dioxide emitted is proportional to the amount of fuel consumption and the size of the vehicle, automakers are compelled to produce lighter, more environmentally friendly, and safer vehicles. Altering consumer lifestyles and a growing preference for light vehicles are anticipated to create new growth prospects for the market. Rapid urbanization, an increase in vehicle demand and production, and laws about fuel efficiency are anticipated to continue to drive the growth of the Aluminum Alloy Wheels Market over the forecast period.

The High Demand for Lightweight Vehicles Will Stimulate Market Expansion

In response to consumer demand, automakers have shifted their focus to safe, luxury, and lightweight solutions. Among the greatest prospects in the car business, lightweight materials and high-quality interiors are crucial variables. This necessitates that supplier offer solutions that assist OEMs comply with ever-tightening standards and fulfilling a growing variety of consumer preferences. The U.S. Department of Energy reports that a 10% reduction in vehicle weight can result in a 6%-8% gain in fuel efficiency. By replacing cast iron and steel components with lightweight alloys such as magnesium alloys, aluminum alloys, high-strength steel, and carbon fiber, the body weight of a vehicle can be reduced by 50 percent. This reduces the vehicle's fuel usage directly. According to the U.S. Department of Energy, a quarter of the U.S. fleet employing lightweight components and high-efficiency engines may save more than 5 billion gallons of fuel annually by 2034. Consequently, the rising demand for lightweight vehicles and the accelerating rate of vehicle manufacturing is anticipated to create a positive trend for this market over the forecast period.

Increasing Need for Durable, Aesthetically Pleasing, And Economically Viable Wheels

Increasing demand for lightweight materials from the automobile sector and a growing emphasis on fuel efficiency have dramatically raised the global demand for fuel-efficient vehicles. Aluminum alloys are distinguished from their steel equivalents by their resistance to corrosion and rust. In addition to being lightweight, it also has a longer lifespan, which is financially advantageous to the customers. In addition, as their purchasing power and urbanization expand, clients' car-buying preferences are evolving towards luxury. This is anticipated to stimulate the expansion of this market over the forecast period.

Accelerating Vehicle Production Will Fuel Market Expansion

Automakers have been compelled to adopt new technology due to the escalating competitiveness in the manufacturing sector during the past decade. As car sales climbed, so did the need for these kinds of wheels. A rise in the sales and manufacturing of all sorts of cars in developing and developed nations as a result of rising mobility and investment in the transportation sector is anticipated to contribute to the expansion of the global market's revenue.

The High Price of Aluminium Alloy Wheels Will Restrain Market Expansion

Steel and aluminum prices fluctuate based on worldwide supply and demand, the availability of iron and bauxite ore, and fuel prices; nonetheless, steel is often less expensive than aluminum. The most abundant metal in the Earth's crust is aluminum. Primarily due to the amount of electricity required in the extraction process, it is expensive. In addition, the production procedure for these wheels is more complicated than that of conventional steel wheels. Thus, alloy wheels are typically more expensive than steel wheels. Moreover, steel wheels are far less expensive to fix than alloy wheels. Consequently, the cost element may inhibit market expansion.

Due To Its Low Price, The Polished Alloy Wheel Segment Dominates the Market

The polished alloy wheel segment represents a significant portion of the global market. The wheels of polished metal are polished and not plated. The polishing procedure entails sanding the alloy wheel's surface until it is entirely smooth. The surface is then polished using a polishing chemical to achieve a beautiful sheen. Since polishing does not add weight to the wheel, polished lightweight racing wheels are more prevalent than chromed or toned lightweight wheels. When the finish of polished wheels becomes dull and tarnished, they may be repolished, which is another advantage. The automobile and trucking industries have increased demand for polished wheels because they are inexpensive, automatically polished, and buffed to a mirror sheen. In March of 2022, for instance, Dymag, the pioneer of alloy wheel production, delivered the SSC Tuatara with its polished 20-inch wheels. The aluminum alloy and carbon fiber hybrid produced by Dymag weighs 40% less than standard alloys.

The segment of two-tone alloy wheels is expected to demonstrate a higher CAGR over the forecast period. There are two methods for manufacturing two-toned alloy wheels. The first method for painting alloy wheels involves a machine process in which the rims receive a two-tone surface protected by a clear coat layer. The second technique involves a diamond-cut alloy wheel with a machine-turned face and a painted backdrop. This method gives the rims a precise color transition without the need for masking or painting. In addition, this makes the rim incredibly durable and resistant. The painting makes it easier for the user to clean the rims. Any type of dirt or dust adheres less firmly to the surface and can be removed more readily. Two-toned alloy wheels provide visual attractiveness to a vehicle's exterior. Consequently, sales of luxury automobile brands increased, and when this occurred with luxury cars, all automakers took notice. Consequently, this causes the segment of two-tone alloy wheels to expand.

The Segment for Passenger Cars Will Hold the Largest Market Share

The passenger car category is likely to maintain its dominant position in the aluminum alloy wheels market throughout the forecast period. Passenger cars include SUVs, hatchbacks, sedans, and electric vehicles (battery electric vehicles (BEV), multi-utility vehicles (MUV), and hybrid electric vehicles (HEV)). The passenger car sector enjoys a high market share and is expected to maintain its dominance during the projection period.

The segment of commercial vehicles is anticipated to have the highest CAGR over the projection period. Durability is now one of the downsides of alloy wheels. When struck by the road, these wheels tend to bend and even shatter more readily than more durable steel wheels. Due to the increased exposure of commercial vehicles to such weights, steel wheels are preferable over alloy wheels. However, technological advances in the production of alloy wheels and a mix of other materials to make alloy wheels more resilient and long-lasting are expected to boost market expansion.

APAC Remains as the Global Leader

In 2022, the Asia-Pacific dominated the global automotive alloy wheels market. Currently, it has the greatest market share in the industry. The huge population of nations such as China and India, which account for more than 38% of the world's population, is a crucial element driving the development of this region. This expansion is a result of increasing urbanization and rising disposable income, which has led to a shift in individual tastes. The automotive industries in South Korea, India, and China are expanding mostly due to rising car production. In 2019, India produced 4.51 million autos, of which 3.62 million were cars, according to the OICA. According to the International Organization of Motor Vehicle Manufacturers, China was the largest vehicle-producing nation in 2019; it produced 25.72 million vehicles, of which 21.36 million were automobiles. The expansion of the market is primarily driven by the presence of a thriving automotive industry and an increasing number of passenger vehicle manufacturers.

Due to the highest population proportion in the world and the presence of two densely populated nations, China and India, the demand for automobiles in the region will be the highest in the world throughout the projected period, with nearly 60% of the world's vehicles located there. Likewise, the income level of the residents in this region is increasing at a quick rate. The region has a substantial proportion of middle-income residents and is concerned with automobile fuel economy. With a decrease in the vehicle's total mass, the fuel economy is anticipated to improve. During the forecast period, the wheels market is anticipated to increase with the demand for automobiles.

China, the world's largest automotive market, is also anticipated to play a significant role in driving the industry ahead, primarily due to its workforce, production capabilities, and manufacturing-friendly policies. The automobile wheel market in India is continuously expanding, and this expansion is anticipated to quicken in the future years. The growth rate of alloy wheels in India exceeds the average growth rate of the automobile wheel market. Passenger cars have been expanding at a rate of roughly 9% every year. The growth rate of alloy wheels has exceeded 15%, and future growth is anticipated to reach 20%. India produces alloy wheels ranging in diameter from 12 to 18 inches. Nevertheless, 14 to 16-inch alloy wheels account for nearly 68% of the market, since the components industry is robust enough to capitalize on India's cost-effectiveness, profitability, and internationally renowned engineering expertise.

Europe is anticipated to be the second-largest shareholder and to have the greatest CAGR on the global market over the projection period. It can be ascribed to the fact that consumers prefer aluminum alloy wheels to standard steel wheels. According to a market assessment issued by BVRLA, the size of the car fleet in the United Kingdom increased by 1.5% in the first quarter of 2022, following two consecutive quarters of decline. In addition, Germany is home to forty alloy wheel manufacturers, a considerable proportion of the European market.

North America maintains the third-largest market position. The United States ranks first in the region due to its concentration of big manufacturers. Currently, the U.S. fleet market operates in an environment characterized by low inflation and low-interest rates and conforms to the country's economic requirements, necessitating major OEM investment. Standard steel wheels are more prevalent in the country. Although they are less expensive, steel wheels are on the verge of being replaced by aluminum alloy wheels. Increasing globalization contributes to the region's market expansion.

Market Remains Fragmented

The Automotive Wheels market is fragmented, with several competitors holding substantial market shares. Thyssenkrupp, Superior Industries, Enkei Wheels, and HRE Wheels are market leaders. Companies are making substantial investments in research and development for the creation of innovative new products and technology. Manufacturers can produce wheels with the most modern characteristics due to developments in materials and production methods. To reinvent wheels, the automotive wheel market is using new design tools and materials such as high-strength steel. Numerous wheel manufacturers use structural analysis techniques and simulation software to create high-performance vehicle wheels.

To boost the market value of vehicle alloy wheels, major corporations have begun embracing new technology. Mergers, acquisitions, and the growth of product portfolios are important strategies implemented by market leaders. The automotive alloy wheels market outlook research focuses on key industry drivers, market potential, leading regions, etc. Alcoa Wheels, MAXION Wheels, BORBET GmbH, MHT Luxury Wheels, RONAL GROUP, Stamford Sport Wheels, Superior Industries International, Inc., TSW Alloy Wheels, Fuel Off-Road Wheels, CITIC Dicastal Wheel Manufacturing Co, WHEELPROS LLC, And Others are among the market's prominent players.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Aluminum Alloy Wheels market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Vehicle

|

|

Finishing

|

|

Rim Size

|

|

Material

|

|

Sales Channel

|

|

Finishing

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report