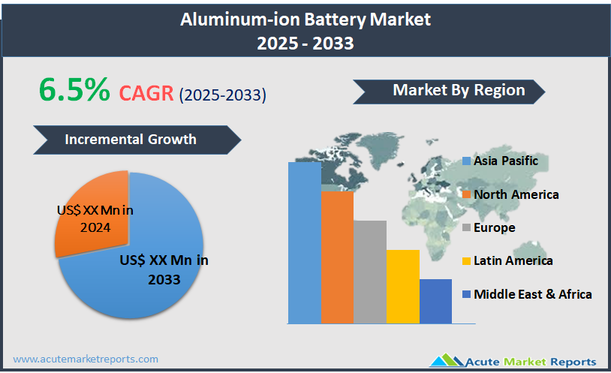

The aluminum-ion battery market encompasses the development, production, and sale of batteries that use aluminum ions as the charge carriers. Unlike traditional lithium-ion batteries, aluminum-ion batteries utilize aluminum anodes and are recognized for their higher charge capacity, potential for faster charging, and greater safety due to their lower risk of catching fire. This type of battery is particularly noted for its ability to sustain more charge-discharge cycles, offering a longer lifespan compared to many other battery types. Aluminum-ion batteries find applications in various sectors including consumer electronics, electric vehicles, and grid storage, offering an alternative to other rechargeable battery systems with potential environmental and performance benefits. The aluminum-ion battery market is experiencing growth driven by the escalating demand for sustainable and high-performance battery technologies across various industries. With a Compound Annual Growth Rate (CAGR) of 6.5%.

Increasing Adoption of Electric Vehicles

The rapid growth in the electric vehicle (EV) market serves as a primary driver for the development of aluminum-ion batteries. With global initiatives to reduce carbon emissions and dependency on fossil fuels, governments and automotive manufacturers are heavily promoting and adopting EVs. Aluminum-ion batteries, known for their high energy density and safety due to a lower risk of thermal runaway compared to lithium-ion counterparts, are increasingly viewed as viable options for powering EVs. This shift is supported by the expanding infrastructure for EVs, including charging stations and renewable energy integration. As more consumers and corporations embrace electric transport, the demand for advanced battery technologies that offer quicker charging times and longer lifespans grows, further stimulating the aluminum-ion battery market. These batteries’ potential for recycling and sustainability aligns well with the green policies of numerous nations, adding to their attractiveness as the automotive sector becomes more eco-conscious.

Expansion into Renewable Energy Storage

In the realm of opportunities, the expansion of renewable energy installations presents significant potential for aluminum-ion batteries. These energy systems require reliable and efficient storage solutions to manage the intermittency of power sources such as solar and wind. Aluminum-ion batteries are well-suited for this role due to their rapid charging capabilities, durability, and cycle stability, which are essential for storing and dispatching energy on demand. The integration of aluminum-ion technology into energy storage helps stabilize grid operations and enables the more effective use of renewable resources. This utility is crucial as countries push towards greener energy matrices and strive to meet international climate targets. The ability of aluminum-ion batteries to support large-scale storage systems without the risks associated with traditional batteries, such as fire hazards, positions them as a key technology in the transition to sustainable energy practices.

High Initial Development Costs

A significant restraint facing the aluminum-ion battery market is the high initial costs associated with their development. Developing new battery technologies involves substantial investment in research, materials, and testing to ensure performance, safety, and compliance with regulatory standards. The production of aluminum-ion batteries currently requires advanced materials and techniques that are expensive and less mature than those used in established battery technologies such as lithium-ion. This cost factor is compounded by the need for new manufacturing facilities equipped to handle novel production processes specific to aluminum-ion cells. These economic barriers can delay market entry and limit initial adoption, particularly in cost-sensitive sectors where the capital outlay for switching to new technologies is scrutinized.

Technical Limitations and Market Penetration

One of the major challenges for the aluminum-ion battery market is overcoming technical limitations related to energy density and power output, which are crucial for wider market penetration. While aluminum-ion batteries offer notable advantages in safety and charging speed, their current energy density levels are lower than those of advanced lithium-ion batteries. This limitation impacts their suitability for certain high-energy applications such as long-range electric vehicles and large-scale energy storage systems. Additionally, the market for aluminum-ion batteries is still in its developmental phase, with few commercial products available. Gaining acceptance in a market dominated by well-established lithium-ion technologies requires not only improvements in technical specifications but also in demonstrating clear advantages in cost, performance, and environmental impact. Addressing these challenges is essential for aluminum-ion batteries to transition from niche applications to mainstream acceptance in competitive energy storage and automotive markets.

Market Segmentation by Capacity

In the aluminum-ion battery market, the segment of 1000 mAh and above holds the highest revenue share and is also projected to experience the highest CAGR during the forecast period. This segment's prominence is primarily driven by its applicability in high-demand scenarios such as electric vehicles (EVs) and grid storage systems, where high capacity batteries are essential to ensure long durations of operation and efficient energy management. The increasing penetration of EVs and the expansion of renewable energy installations demand batteries that not only provide greater energy storage but also sustain longer operational lifespans, thus favoring higher capacity aluminum-ion batteries. Additionally, advancements in technology that increase the energy density and reduce the cost of production for these larger capacity batteries contribute to their rapid growth in the market. The segments of 600-1000 mAh and 200-600 mAh are also significant but tend to be used in smaller-scale applications such as portable devices and some medical equipment, offering moderate growth potential. Meanwhile, batteries with capacities of 0-200 mAh typically find usage in very small or niche applications, resulting in a relatively smaller share and slower growth rate in the overall market landscape.

Market Segmentation by Application

Within the aluminum-ion battery market, the electric vehicle (EV) segment is both the largest in terms of revenue generation and the fastest-growing in terms of CAGR. The drive towards electrification of the transport sector, supported by global environmental policies and consumer demand for sustainable alternatives to fossil fuel vehicles, significantly fuels this segment's expansion. Aluminum-ion batteries are increasingly considered for EVs due to their safety benefits, high charge capacities, and potential for faster charging compared to conventional lithium-ion batteries. These attributes make them particularly appealing for automotive applications, where long battery life and quick recharge capabilities are critical. The grid storage application also shows substantial growth prospects, driven by the need for efficient energy storage solutions that can handle the variable outputs of renewable energy sources like wind and solar. Aluminum-ion batteries are valued in this sector for their quick charging times and durability, which are essential for stabilizing grid energy supply and improving the reliability of renewable energy systems. Portable devices and medical equipment represent significant segments as well, with steady growth anticipated. These applications benefit from the lightweight and potentially smaller size of aluminum-ion batteries, making them ideal for devices that require reliable power in a compact form. However, these sectors face intense competition from more established battery technologies that currently offer higher energy densities and are more deeply integrated into supply chains and manufacturing processes. The others category, which includes emerging and miscellaneous applications, presents a smaller portion of the market but is an area to watch for future growth as new uses for aluminum-ion technology are developed.

Geographic Segment

The aluminum-ion battery market showcased diverse growth dynamics across global regions, with Asia Pacific leading in terms of both revenue generation in 2023 and projected CAGR from 2024 to 2033. This dominance is driven by the region's robust expansion in electric vehicle production, significant investments in renewable energy projects, and substantial advancements in battery technology. Countries like China, Japan, and South Korea are at the forefront, leveraging their extensive manufacturing capabilities, government support for clean energy technologies, and growing consumer demand for advanced energy storage solutions. Furthermore, Asia Pacific's lead in electronics manufacturing, where aluminum-ion batteries are increasingly incorporated, contributes to its top position. In contrast, North America and Europe also reported significant market shares in 2023, supported by strong regulatory frameworks for environmental sustainability and technological innovation in energy storage and automotive sectors. These regions are expected to maintain steady growth rates due to ongoing investments in EV infrastructure and grid modernization. However, their growth pace is slightly overshadowed by the rapid advancements and larger scale of implementation seen in Asia Pacific.

Competitive Trends and Key Strategies

In 2024, the competitive landscape of the aluminum-ion battery market was characterized by the strategic initiatives of leading and emerging players such as Graphene Manufacturing Group Ltd., Saturnose, Ionix Technology, Inc., Phinergy Ltd., BOSCH, Albufera Energy Storage, and TasmanIon. These companies focused on scaling up their technological capabilities and expanding their market reach through various strategies including partnerships, research and development, and geographic expansion. Graphene Manufacturing Group Ltd. and BOSCH were noted for their advancements in enhancing the energy density and efficiency of aluminum-ion batteries, aiming to match and surpass the performance metrics of traditional lithium-ion batteries. Saturnose and Ionix Technology, Inc. invested heavily in proprietary technologies to lower production costs and improve the recyclability of their battery products, responding to the growing consumer and regulatory demand for sustainable manufacturing practices. Phinergy Ltd. concentrated on developing aluminum-air batteries, which offer extended range possibilities particularly suited for electric vehicles and grid storage applications. Albufera Energy Storage and TasmanIon engaged in collaborations with academic and industrial partners to foster innovation and speed up commercialization of their solutions.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Aluminum-ion Battery market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Capacity

| |

Application

| |

End-use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report