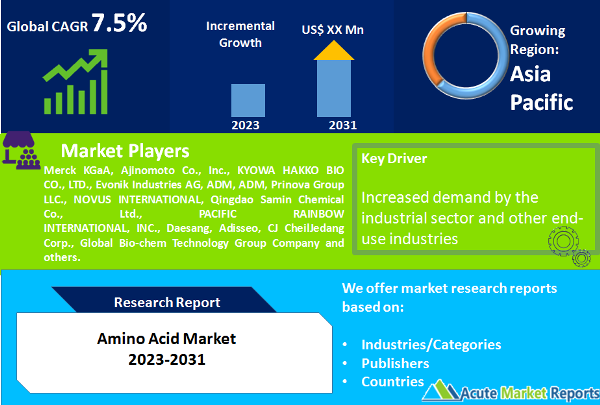

The global market for amino acids is projected to expand at a CAGR of 7.5% during the forecast period of 2026 and 2034. This is a result of increased consumer spending capacity and growing awareness of healthy lifestyles and preventive care among individuals. In dietary supplements, amino acids are used to reduce muscle pain and fatigue, as well as the risk of cardiovascular disease. Additionally, their use in nutritional sports supplements is gaining popularity. For muscle growth, many athletes prefer to consume amino acid-based supplements in the form of tablets, powders, and drinks. The segments of nutraceutical products include functional beverages, functional foods, and dietary supplements. In the animal feed industry, amino acids are utilized as bioactive supplements because they provide animals with numerous health benefits. In addition, they are used as essential ingredients in pet food and veterinary supplements to improve food digestibility and bolster the immune system. Feed-grade amino acids are in high demand because their consumption enhances the health and activity of animals and improves their joint mobility. It is anticipated that the animal feed industry will experience a high demand for feed-grade amino acids due to the aging pet population, specific dietary requirements, and specialized diets. Growing household pet ownership in several countries is anticipated to increase the demand for pet food, which will in turn increase the demand for amino acids in the pet food industry.

In the past few years, the prices of soybean oilseeds, wheat, and corn, which are used in the production of amino acids, have fluctuated. This trend is expected to continue over the forecast period due to the rising demand for raw materials in the production of other foods, resulting in a limited supply of amino acids. A shortage of raw materials for the production of amino acids is exacerbated by several short-term factors, including rising energy costs. In developing economies, manufacturers are frequently compelled to produce amino acids from alternative ingredients of inferior quality, such as cassava or sorghum. These substitute ingredients are less digestible than corn and soybeans. The COVID-19 pandemic has increased demand for amino acids in the year 2021, as amino acids are regarded as essential commodities in the pharmaceutical and food industries. People's awareness of the need to fortify their immune systems contributed to the rise of dietary supplements.

Reliable Supply Chain

Since the availability of high-quality raw materials is essential for the production of amino acids. To ensure a continuous supply of raw materials, prominent market participants are employing forward and backward integration strategies aimed at ensuring a high-quality and dependable supply of raw materials. These vertical integration processes provide greater raw material supply reliability and opportunities for the creation of innovative products from existing raw materials. Therefore, a robust supply chain for the feasible production of amino acids is established.

In addition, the manufacturers' efficient direct and indirect distribution channels ensure the timely delivery of products, leading to an increase in demand for amino acids. As a result, the robust supply chain is increasing the demand for amino acids on the market because it ensures their timely availability.

Market Accessibility to Various Types of Amino Acids

There are three groups of amino acids: non-essential amino acids, essential amino acids, and conditional amino acids. These groups contain various types of amino acids based on their specific needs. As each essential amino acid serves a distinct purpose in the body, the symptoms of deficiency vary accordingly. Consequently, the availability of various types of amino acids and their varying needs have led to the production of products containing various amino acids. Therefore, the demand for various types of amino acids has resulted in the production of various products with varying compositions and benefits, ultimately leading to the expansion of the market for amino acids.

Strong Rivalry Among Market Participants to Challenge Market Growth

For new market entrants, the high level of competition among the existing market players presents a formidable obstacle. Numerous market participants offer high-quality amino acid products to a variety of end-users, including food & beverage manufacturers, the pharmaceutical industry, and manufacturers of dietary supplements, among others. In addition, there are several local players and small-scale manufacturers that offer low-quality or counterfeit products at lower prices, thereby impacting the global amino acids market. In addition, an increase in the number of manufacturers offering a diverse selection of amino acids for various applications will intensify competition among market participants. On the global amino acids market, an increase in the number of players offering high-quality amino acids for various applications poses a significant challenge.

A Rise in The Number of Initiatives Undertaken by Amino Acid Producers to Open New Market Avenues

An increase in the number of initiatives taken by manufacturers of amino acids, such as product launches, expansion, and investments, will create a significant opportunity for the global amino acids market to expand. Due to its various health benefits, such as boosting the immune system, building muscle, assisting in the repair of body tissue, and maintaining healthy skin, nails, and hair, and other benefits, the demand for amino acids is growing in numerous industries, including food and beverage, cosmetics, dietary supplements, pharmaceuticals, and others. With increasing consumer awareness of the health benefits provided by amino acids, the demand for amino acids will increase, allowing manufacturers to introduce new products to the market, expand their manufacturing facilities, and increase their investment in the production of amino acid products for a variety of end users.

L-glutamate Dominating the Market with over 50% of Market Revenue

In 2025, L-glutamate dominated the market with a revenue share of 50%. This is due to its extensive use as a flavor enhancer, dietary supplement, and feed additive. This is a raw material used to manufacture organic chemicals. In the food and beverage industry, sodium salt of l-glutamate, also known as seasoning salt, is widely used to improve food flavor. In the coming years, the rising demand for processed food products and the rising use of l-glutamate in animal feed is expected to fuel the growth of the l-glutamate market segment.

Lysine's Dominating Market Remains the Second Largest Product Segment

Lysine is the second largest product segment in 2025, accounting for 23% of total revenue. The demand for lysine is primarily driven by the expansion of the global market for dietary supplements. In addition to being consumed by humans, this is also a popular additive for animal feed. It is widely utilized for protein deposition in the body. The daily consumption of lysine influences the growth of animals. Changing the concentration of dietary lysine in animal feed improves both animal growth and feed quality. Animal feed manufacturers' increasing demand for lysine, coupled with the rising consumption of dietary supplements, is anticipated to increase the global demand for lysine over the forecast period.

Poultry Dominated the Market by Livestock in Animal Feed

In 2025, poultry dominated the livestock segment of animal feed with the highest revenue share of 41%. The expansion of the poultry industry can be attributed to the global increase in demand for meat and poultry products. This segment includes, among others, chicken, duck, turkey, and broiler. Increasing demand for chicken and broiler meat in countries such as Russia, the United States, and Mexico is expected to drive the poultry feed market. Manufacturers are compelled to produce high-quality, disease-free meat products for human consumption by the rising demand for pork. This has increased the demand for feed additives. As a feed additive, amino acids improve production efficiency and performance while also facilitating protein synthesis. Products such as lysine and methionine are deficient in pork diets; consequently, they are frequently added to pork feed as feed additives to compensate for the deficiency.

Plant-Based Raw Materials Dominated the Market

In 2025, plant-based raw materials dominated the segment with an 88% revenue share. Growing consumer awareness of natural and organic products is anticipated to drive the global production and consumption of amino acids derived from plants. In addition, the increased social awareness regarding animal slaughter is anticipated to have a positive effect on the demand for amino acids derived from plants. However, the production of plant-based products is restricted due to a lack of production technology and the need for substantial capital expenditures.

Animals are the primary source of amino acid extraction. Meat from animals, including pork, beef, and chicken, as well as fish muscle, skin, intestine, blood, and placenta. From slaughterhouses, meat processors, and aquaculture farms, animal by-products can be obtained. JBS S.A., Tyson Foods, Inc., and Smithfield Foods are key players in the meat processing industry. The global increase in meat consumption has fueled its production. This is likely to stimulate market expansion in the coming years.

F&B Remains the Dominant Application Segment

In 2025, the food & dietary supplements application held a revenue share of more than 60% of the market. Utilizing amino acids increases the nutritional value of food products. In bread and soy products, respectively, ingredients such as lysine and methionine are used. During the forecast period, the segment is expected to be driven by the growing demand for functional and nutritional food products. In the nutraceutical industry, amino acids are utilized as a dietary supplement for the treatment of muscle fatigue and muscle soreness, as well as the maintenance of cardiovascular health.

APAC Remains a Global Leader

In 2025, Asia-Pacific dominated the market with a revenue share of over 48%. Increasing pork consumption in China is anticipated to stimulate market expansion in the country. Increasing health concerns and individual medical expenditures are anticipated to fuel the demand for dietary supplements in China, which is anticipated to increase the demand for amino acids. The shift toward ready-to-drink (RTD) beverages is anticipated to have a positive impact on the demand for aspartame, which will increase the consumption of amino acids in the form of aspartic acids in the region over the forecast period.

Europe is the second-largest producer of compound feed in the world, with Germany and France being the principal producing nations. About one-third of the total market for compound feed in the region is comprised of poultry feed. Principal market participants have diversified businesses and broader animal feed product portfolios. Increasing production and consumption of animal feed are anticipated to propel the growth of the regional market during the forecast period.

The recent COVID-19 outbreak in the United States has resulted in the shutdown of numerous manufacturing industries, which has prompted numerous farmers to purchase animal feed in a panic due to the possibility of a shortage caused by reduced deliveries and logistics disruptions. This has increased the demand for animal feed additives, such as amino acids, and is expected to drive the growth of the North American market in the coming years.

Market Competition to Intensify During the Forecast Period

The market for amino acids on a global scale is fragmented due to a large number of market participants. The largest market share is captured by leaders and other emerging players in the country, such as traders, small manufacturers, and players operating at the local market level. Merck KGaA, Ajinomoto Co., Inc., KYOWA HAKKO BIO CO., LTD., Evonik Industries AG, ADM, ADM, Prinova Group LLC., NOVUS INTERNATIONAL, Qingdao Samin Chemical Co., Ltd., PACIFIC RAINBOW INTERNATIONAL, INC., Daesang, Adisseo, CJ CheilJedang Corp., Global Bio-chem Technology Group Company and others.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Amino Acid market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product

|

|

Application

|

|

Livestock In Animal Feed

|

|

Raw Material

|

|

Purity level

|

|

Form

|

|

Fat content

|

|

Product Category

|

|

Function

|

|

Distribution Channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report