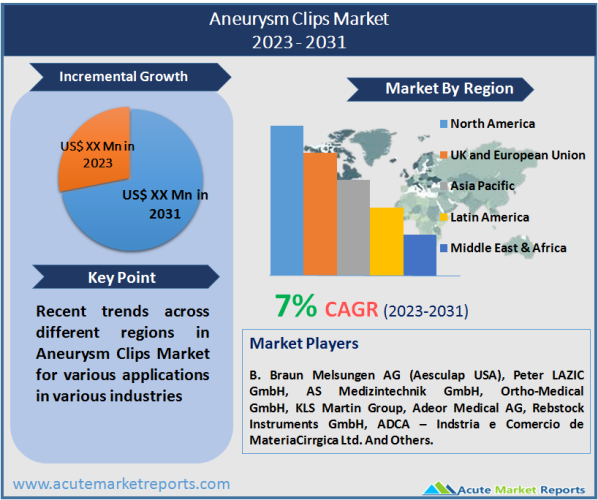

The global market for aneurysm clips is anticipated to expand at a CAGR of over 7% during the forecast period of 2025 to 2033. Rapid development in information dissemination via the Internet has significantly contributed to the adoption of aneurysm clips and disease treatments. Clinical management information, availability of aneurysm clips, pricing, defects in aneurysm clips material biocompatibility, physician feedback, R&D, etc., are all available to the general public via open-source websites. This increases patient interest and promotes active physician-patient relationship management, leading to improved patient outcomes. Last but not least, the active contribution to aneurysm clips market information by some of the leading manufacturers simplifies the information dissemination process and positively contributes to the aneurysm clips market's steady revenue growth.

Increasing Prevalence of Unhealthy Lifestyle Demanding Technological Advancement

The increasing need for laparoscopic surgical procedures and the use of highly appropriate materials, such as stainless steel alloys, such as pure titanium, titanium alloy, Elgiloy, and Phynox, in aneurysm clips, are expected to have an impact on the market's growth. In addition, the market is anticipated to be driven by the increasing prevalence of unhealthy lifestyles, the growing geriatric population, the rising incidence of intracranial aneurysm ruptures, and the availability of biocompatible aneurysm clips in a range of sizes and shapes. The global market for aneurysm clips is undergoing rapid technological advances in terms of portability and miniaturization, such as clip appliers and tipsters that can be used endoscopically or laparoscopically without making significant incisions on a patient's body surface area. For instance, in May 2019, Stryker received FDA PMA for the Neuroform Atlas Stent System for treating intracranial aneurysms, a second aneurysm adjunctive stent used in conjunction with embolic detachable coils to treat wide-neck brain aneurysms.

The adoption of aneurysm clips is primarily driven by the global expansion of healthcare facilities. Previously, aneurysm clips were manufactured with silver and other traditionally biologically inert materials. Metals such as cobalt and titanium have entered the market for aneurysm clips over time. Clips for aneurysms are versatile, safe, and widely accessible in a variety of sizes and shapes. Yasargil and Sugita, two widely used aneurysm clips, have a closing pressure of between 0.88-1.08N (90-110g) and 0.69N (70g), respectively. These are temporary aneurysm clips. Despite the availability of alternative treatment options, the market for aneurysm clips is anticipated to experience a rise in revenue as a result of the technological evolution of products.

The Rise in Prevalence of Neurology Related Disorders

A rise in the prevalence of neurology-related disorders such as cerebral or brain aneurysms, epilepsy, and strokes, among others, is anticipated to fuel the aneurysm clip market growth in several countries. According to a January 2021 NHS England article, approximately 1 in 15,000 people in England suffer from a ruptured brain aneurysm each year. Additionally, approximately 3% of adults in the UK have a cerebral aneurysm. Brain aneurysms are caused by the increasing prevalence of hypertension, alcohol consumption, and smoking. Consequently, the market for aneurysm clips among healthcare providers will increase.

Cleveland Clinic published in April 2020 that approximately 6% of U.S. citizens have unruptured brain aneurysms and approximately 30,000 U.S. citizens suffer from brain rupture aneurysms annually. According to an article published by NEWS Medical Lifescience in May 2020, brain aneurysms are more prevalent in women, accounting for approximately 60% of the female population. Moreover, it is especially prevalent among postmenopausal women, making it riskier. This factor is anticipated to contribute to the market expansion of aneurysm clips.

In addition, high cholesterol, diabetes, cigarette smoking, and high blood pressure increase the risk of brain aneurysm rupture due to atherosclerosis. According to the IDF Diabetes Atlas Tenth Edition 2021, approximately 537 million people between the ages of 20 and 79 will have diabetes in September 2021. In addition, it is expected to increase by 643 million by 2033 and 738 million by 2045. Consequently, the increase in unhealthy lifestyles among youths around the world is anticipated to fuel the aneurysm clips market in the coming years.

Competitive Product Pricing Drives Revenue Expansion

In all markets, aneurysm clips are priced competitively. The wide availability of product variety by material type and technology type contributes to the competitive pricing of products. The average price of aneurysm clips is low across the countries analyzed, which encourages their use. The market is fragmented at the bottom and consolidated at the top, resulting in a monopolistic competitive environment and competitive product pricing. Due to the availability of both branded and locally manufactured products, pricing in emerging markets with low costs is quite low. However, pricing is high in developed markets, particularly for B. Braun products in the United States.

Comprehensive Regulatory Compliance Dampens Product Market Entry Scope

The growth of the global aneurysm clips market has been hampered by stringent regulatory compliances. Part 807 of the FDA's 21 CFR requires manufacturers and distributors to register their establishments. To launch their products in the United States – the largest revenue-generating market – companies must adhere to stringent regulatory compliances and undergo rigorous clinical trials. Aneurysm clips with unknown biocompatibility and metallurgical patterns are frequently used in low-cost markets.

On the market for aneurysm clips, smaller manufacturers lack adequate quality control procedures, particularly for testing clip closing pressures. This resulted in fatal instances of uncontrollable bleeding. Thus, the American Society for Testing and Materials Committee has implemented stringent guidelines for brain clip biocompatibility and force measurement. To prevent unfavorable occurrences and increase patient safety, there are also stringent bio-magnetic compatibility standards in place. This factor is primarily responsible for impeding the expansion of the global market for aneurysm clips.

Titanium aneurysm Dominated the Market by Material

Titanium aneurysm clips dominated the market in 2024 with a market share of 82 % and are projected to grow at the highest CAGR of 7.5 % over the forecast period. Titanium aneurysm clips have characteristics including inertness, durability, high tensile strength, nonreactivity, and lightness. Its compatibility with imaging modalities such as MRI, CT, and X-rays, as well as its ability to effectively secure the closure of delicate vessels during procedures, makes it a preferred option as surgical equipment, thereby driving the growth of the segment. In addition, titanium aneurysm clips have minimal interference with MRI and CT scans when compared to other materials.

According to the Brain Aneurysm Foundation, titanium clips are commonly used because they are MRI-compatible and therefore do not trigger metal detector alarms. Titanium and its alloys are widely used in medical equipment due to their high biocompatibility. According to an article published in November 2025 by Medical Device News Magazine, more than 70 percent of surgical implant equipment and 95 percent of orthopedic implants are made of metal due to their strength and durability. Titanium and its alloys are utilized in spinal implants, hip and joint implants, and a variety of other implants due to their advantageous distinguishing properties.

The Stroke Segment Dominated the Market through Indications

In 2024, the stroke segment dominated the market with a share of 55%, due to factors such as the increasing prevalence of stroke, hypertension, and other neurological disorders. According to the CDC, one in six people worldwide will have a stroke at some point in their lives, and more than 795,000 people in the United States experience stroke. Strokes are the second leading cause of death worldwide and account for approximately 140,000 deaths annually in the United States. The increase in the global prevalence of stroke due to an unhealthy lifestyle, hypertension, and aging would contribute to the growth of the aneurysm clip market.

The segment for cerebral aneurysms is expected to grow at the highest CAGR during the forecast period, primarily due to the increasing incidence of intracranial aneurysms. According to an article published by Frontiers Media S.A. in March 2025, aneurysmal subarachnoid hemorrhage will affect approximately 6 out of every 100,000 people worldwide. In February 2020, Cerus Endovascular Ltd. received European CE Mark approval for its flagship product, the Contour Neurovascular System, for the treatment of intracranial aneurysms. This is a result of the increasing demand for minimally invasive surgeries and the adoption of advanced technological equipment.

Hospitals Remain the Dominant End-Use Segment

The hospital segment dominated the aneurysm clip market in 2024, accounting for 65% of total revenue. This is due to an increase in surgical procedures, such as abdominal and neurosurgery laparoscopy, and the frequency of trauma. In developed nations, insurance companies cover medical costs, including ligature costs. The increase in surgical procedures performed in hospitals with clipping equipment had a positive impact on the segment's growth.

During the forecast period, ambulatory surgical centers (ASCs) are anticipated to have the highest CAGR. This can be owned due to lower out-of-pocket costs, lower facility costs, and improved patient access. The majority of Middle Eastern and Asian nations still lack the resources and infrastructure to establish ambulatory centers; however, they are working to do so to reduce the burden of surgical procedures in hospitals.

North America Remains as the Global Leader

North America dominated the market in 2024 with a revenue share of 26.5 percent. This region's aneurysm clip market is being driven by the increasing prevalence of neurological disorders and demand for minimally invasive surgical procedures. According to the CDC, each year in the United States, more than 795,000 people suffer a stroke, of which 87% are ischemic.

In addition, the increasing number of initiatives undertaken by various organizations is anticipated to fuel the growth of the aneurysm clip market in the United States. Through innovative research, the Bee Foundation (TBF), a non-profit organization, aims to raise awareness and reduce the number of deaths caused by cerebral aneurysms.

The medical market in Asia-Pacific is anticipated to experience the highest growth rate over the forecast period due to factors such as the increasing incidence of target diseases, the growing geriatric population, the increasing prevalence of unhealthy lifestyles among adolescents, and the rising incidence of acute ischemic stroke. According to a ResearchGate article published in April 2020, the prevalence of obesity in individuals 18 years and older in ASEAN countries is as follows: Cambodia 50.20 percent, Indonesia 28 percent, Laos 20.9 percent, Malaysia 15.4 percent, Singapore 44.1 percent, Myanmar 8.4 percent, Vietnam 2.53 percent, Thailand 12.5 percent, and Brunei Darussalam 29.5 percent. In addition, in all ASEAN nations, females have a higher prevalence of obesity.

Moreover, emerging economies such as China, South Korea, and India are anticipated to experience substantial growth over the forecast period. Moreover, the establishment of organizations such as the Asia-Pacific Centre for Neuromodulation (APCN), which was founded to conduct research and raise awareness about the associated benefits of deep brain stimulation surgeries, is anticipated to boost the growth of the aneurysm clip market.

Market Competition to Intensify During the Forecast Period

Companies are concentrating on the innovations of medical devices, expansions, and technological advances. In addition, mergers and acquisitions for the development of new products and the expansion of supply chain networks are among the strategic initiatives implemented by major players. As evidenced by numerous sources B. Braun is the global market leader in the manufacture of aneurysm clips. Yasirgil aneurysm clips are the most widely used worldwide. The company's Aesculap division is reportedly the largest global provider of aneurysm clips, with a product portfolio that includes over 340 distinct aneurysm clip designs and 38 appliers (Phynox, titanium, mini, standard, permanent, temporary, and fenestrated). It has been noted that 70% of the aneurysm clip production process was performed manually. This greatly contributes to error reduction, and the availability of such data ensures direction for future product development, thereby driving the global aneurysm clips market's revenue growth.

The competition section of the report on the aneurysm clips market includes profiles of the leading market participants based on their market shares, product offerings, distinctive strategies, company dashboards, and marketing strategies. Among the key players profiled in this report are B. Braun Melsungen AG (Aesculap USA), Peter LAZIC GmbH, AS Medizintechnik GmbH, Ortho-Medical GmbH, KLS Martin Group, Adeor Medical AG, Rebstock Instruments GmbH, and ADCA – Indstria e Comércio de MatériaCirrgica Ltd. The companies provide an extensive selection of aneurysm clips. Emerging players in the aneurysm clips market are concentrating heavily on new marketing strategies to expand their product footprint in the global aneurysm clips market.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Aneurysm Clips market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Material

| |

Indication

| |

End-use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report