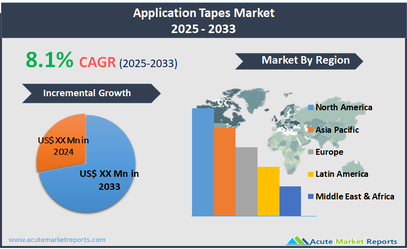

Application tapes, also known as transfer tapes, are pressure-sensitive adhesive tapes used to transfer vinyl graphics and printed materials from their original backing to another surface. These tapes are crucial in the sign-making and graphic arts industries, where they facilitate the accurate and efficient placement of vinyl letters and shapes onto various substrates. Application tapes come in different types based on their tack levels—low, medium, and high—catering to different types of materials and application requirements. The application tapes market is projected to grow at a Compound Annual Growth Rate (CAGR) of 8.1%. This growth is driven by the expanding advertising and marketing sectors, which extensively utilize vinyl graphics for promotional activities. As businesses increasingly seek cost-effective and impactful advertising methods, the demand for vinyl graphics, and consequently application tapes, is rising. The use of application tapes in automotive wraps, public transport advertising, and large-format retail ads also contributes to market expansion. Additionally, advancements in adhesive technology have improved the ease of use and efficiency of application tapes, further fueling their adoption across various industries. As digital printing technology continues to evolve, the precision and durability required from application tapes are expected to spur innovations in adhesive formulations, supporting sustained growth in this market.

Expansion of the Digital Printing Industry

The growth of the digital printing industry acts as a major driver for the application tapes market. Digital printing has revolutionized graphic design by enabling cost-effective, high-quality, and customized prints for a wide range of applications from commercial advertising to personal décor. This expansion directly increases the demand for application tapes, as they are essential for transferring these prints onto various substrates. For instance, in the vehicle wrapping sector, application tapes are used to apply customized graphic designs onto cars and trucks for advertising or aesthetic purposes. The same trend is observed in the signage industry, where the ability to produce vibrant, complex graphics quickly and economically has led to increased use of vinyl graphics and application tapes. The continual innovations in printing technology, which enhance the quality and decrease the cost of vinyl graphics, are expected to sustain the growth in the application tapes market.

Increasing Demand for Eco-Friendly Adhesives

An emerging opportunity within the application tapes market is the rising demand for eco-friendly adhesives. Environmental concerns and stringent regulations regarding VOC emissions are pushing manufacturers to develop sustainable adhesive solutions. These eco-friendly adhesives are designed to minimize environmental impact while maintaining the performance standards required for effective graphic application. This shift not only appeals to environmentally conscious consumers but also opens new markets where regulations restrict the use of traditional adhesives. As the global emphasis on sustainability grows, the demand for these greener alternatives is expected to rise, presenting a significant opportunity for innovation and growth in the application tapes industry.

Volatility in Raw Material Prices

A significant restraint in the application tapes market is the volatility of raw material prices, particularly for petroleum-based products which are a primary component of adhesives. Fluctuations in the global oil market can lead to unpredictable costs for adhesive manufacturing, complicating budgeting and financial planning for producers of application tapes. These cost variations can impact the pricing of final products, potentially affecting competitiveness and profitability. Manufacturers must manage these challenges while trying to maintain product quality and price stability, which can be particularly difficult during periods of economic instability or when oil prices are highly volatile.

Adapting to Rapid Technological Change

A major challenge facing the application tapes market is keeping pace with rapid technological changes in both the digital printing and adhesive industries. As digital printing technologies advance, the specifications for application tapes, such as adhesion strength and removability, also evolve. Manufacturers must continually adapt their products to meet the requirements of newer printing technologies and materials. This necessitates ongoing R&D investment and agile manufacturing processes to quickly respond to market changes. Moreover, the shift towards more sustainable products and practices requires innovations in adhesive formulations, which can be costly and time-consuming, adding another layer of complexity to the development process.

Market Segmentation by Product Type

Within the application tapes market, product types are segmented into low tack, medium tack, and high tack. High tack tapes currently generate the highest revenue due to their broad utility in various industries requiring robust adhesion to rough and textured surfaces, such as in construction and heavy-duty signage. These tapes ensure that materials firmly adhere during the application process, particularly in environments subject to high wear and tear. Conversely, low tack tapes are anticipated to register the highest Compound Annual Growth Rate (CAGR). This growth is driven by increasing demand in industries like electronics and automotive detailing, where precision is critical, and the tape must be removed cleanly without damaging the underlying surface. This segment benefits from the rising trend of customization and temporary graphics in advertising and consumer products.

Market Segmentation by Material Type

The application tapes market by material type includes plastic and paper segments. Plastic-based tapes dominate in terms of revenue due to their durability, flexibility, and resistance to environmental factors like moisture and heat, making them suitable for a wide range of applications from outdoor signage to automotive graphics. Paper tapes are expected to witness the highest CAGR, spurred by the growing demand for sustainable products. Paper tapes are increasingly preferred for their environmental benefits, being recyclable and often made from renewable resources. This segment's growth is supported by rising regulatory pressures and shifting consumer preferences towards green products, particularly in European and North American markets.

Market Segmentation by Adhesive Type

Segmentation by adhesive type in the application tapes market includes rubber-based (both natural and synthetic rubber) and acrylic-based adhesives, along with hot melt adhesives. Acrylic-based adhesives lead in revenue generation due to their excellent aging and weather resistance, making them ideal for outdoor applications where long-term adhesion and reliability are required. These adhesives are prevalent in automotive and architectural applications where exposure to extreme conditions is common. On the other hand, rubber-based adhesives, particularly synthetic rubber, are projected to exhibit the highest CAGR. The growth of synthetic rubber adhesives is propelled by their enhanced performance characteristics such as quick tack and strong bond, which are essential for fast-paced industrial environments and temporary applications where ease of removal is a priority.

Geographic and Competitive Trends

In 2024, the North American region dominated the application tapes market in terms of revenue, bolstered by the robust presence of major industries such as automotive, electronics, and construction, which extensively utilize application tapes for various purposes including labeling, masking, and graphic installations. The region’s advanced manufacturing infrastructure and the rapid adoption of innovative advertising techniques have also contributed to its leading position. However, the Asia Pacific region is expected to exhibit the highest Compound Annual Growth Rate (CAGR) from 2025 to 2033. This growth projection is driven by expanding manufacturing sectors in countries like China and India, coupled with increasing urbanization and industrialization which boost the demand for signage and automotive graphics.

Top players in the application tapes market include 3M Company, Nekoosa Coated Products, LLC, Presto Tape, Avery Dennison Corporation, Intertape Polymer Group, Shurtape Technologies, LLC, H.B. Fuller Company, SICAD S.p.A, Nitto Denko Corporation, and Lohmann GmbH. In 2024, these companies primarily focused on expanding their product portfolios and improving adhesive technologies to cater to a diverse range of industries. Strategies such as mergers and acquisitions, along with global expansions, were widely employed to consolidate market presence and enhance competitive advantages. From 2025 to 2033, these companies are expected to intensify efforts towards innovation, particularly in developing eco-friendly and high-performance adhesives to meet the stringent environmental regulations and evolving customer demands. Emphasis will also be placed on enhancing global supply chains and entering emerging markets where there is significant growth potential, particularly in environmentally sensitive products and applications. The future strategic direction will likely include increased investment in R&D activities aimed at creating differentiated products that offer unique value propositions, such as improved environmental profiles or application-specific performance enhancements.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Application Tapes market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Product Type

|

|

Material Type

|

|

Adhesive Type

|

|

Application

|

|

End Use

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report