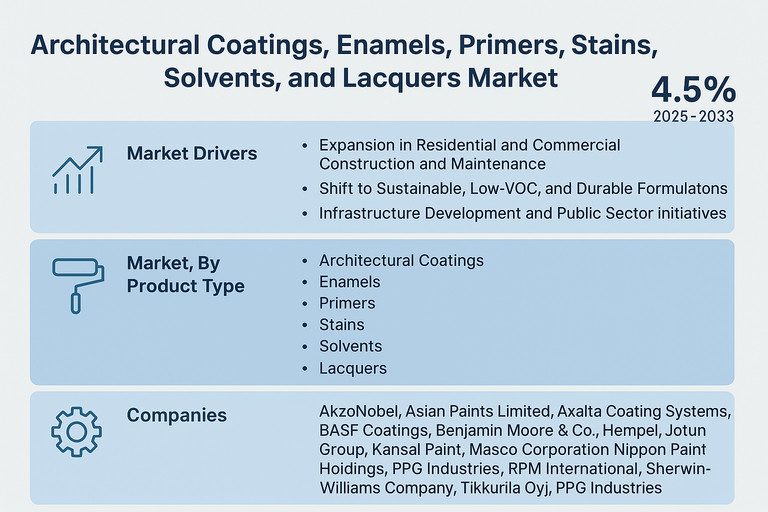

The architectural coatings, enamels, primers, stains, solvents, and lacquers market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% from 2025 to 2033, driven by rising construction and renovation activities, rapid urbanization, and the increasing focus on aesthetic appeal and surface protection across residential, commercial, and industrial sectors. Architectural coatings and related products such as primers, enamels, and stains offer essential benefits like surface durability, corrosion resistance, color retention, and water repellence. The adoption of low-VOC formulations and water-based technologies continues to gain momentum, aligning with evolving environmental regulations and sustainability goals. Ongoing innovations in product formulations, along with the advent of advanced resins and specialty additives, are improving finish performance and application ease, further supporting market growth.

Market Drivers

Expansion in Residential and Commercial Construction and Maintenance

The global growth in housing, commercial real estate, and renovation projects continues to drive demand for architectural coatings, enamels, primers, stains, and lacquers. These products play a critical role in surface aesthetics, durability, and protective performance across both interior and exterior surfaces. Emerging economies with rising disposable incomes and ongoing investments in real estate infrastructure are key contributors to increased consumption, especially in Asia Pacific and Latin America.

Shift to Sustainable, Low-VOC, and Durable Formulations

Tightening regulations on volatile organic compounds (VOCs), solvent emissions, and toxic additives are pushing the shift toward water-based and eco-friendly solutions. Consumers and commercial property owners alike prefer sustainable paints and coatings with easy application and long-term durability. Continued product innovation such as anti-microbial, stain-resistant, and weather-resistant finishes is driving this transition and increasing the market's overall value proposition.

Infrastructure Development and Public Sector Initiatives

Large-scale infrastructure and institutional development projects funded by public and private entities further encourage uptake of primers, lacquers, and stains, especially for bridges, public buildings, schools, airports, and transportation terminals. Incentives for energy-efficient and low-carbon footprint products, alongside long-term asset preservation initiatives in developed markets like Europe and North America, also bolster adoption.

Market Restraint

Raw Material Price Volatility and Environmental Compliance Costs

While demand remains strong, fluctuating costs of raw materials like pigments, resins, and solvents present a recurring challenge. Compliance with environmental and safety standards requires continuous investment in product reformulation, advanced testing, and safety protocols. Small and medium-sized paint and coatings companies may face margin pressures owing to these compliance and cost structures, creating a barrier to aggressive price competition.

Market Segmentation by Product Type

In 2024, architectural coatings led by revenue, driven by broad usage in interior and exterior surfaces. Strong demand stems from residential and commercial property maintenance as well as newbuilds. Enamels continue to grow steadily due to their glossy finish and robust surface protection, supporting furniture, doors, windows, and metal components across commercial and household settings. Primers remain vital for surface adhesion, uniform finish, and substrate protection against rust, peeling, and moisture. Growing awareness of surface preparation techniques fuels stable consumption rates. Stains show increasing demand due to their ability to enhance natural wood grains, supporting their use in furniture, flooring, and outdoor decking. Solvents cater to traditional oil-based paints and lacquers. However, usage is declining as waterborne products gain momentum under stricter VOC rules. Lacquers maintain a niche but significant share for high-gloss furniture and automotive refinishing, owing to quick-drying and hard-finish characteristics.

Market Segmentation by Technology

In 2024, water-based products dominated global revenues. Rising emphasis on eco-friendliness, low-VOC requirements, and ease of application drive their popularity across all sectors, especially in Europe and North America. Solvent-based formulations retain relevance where high durability and rapid drying are required, especially for industrial and protective coatings, though their market share is declining due to environmental regulation.

Geographic Trends

Asia Pacific led the Architectural Coatings, Enamels, Primers, Stains, Solvents, and Lacquers Market in 2024 and is expected to register the highest CAGR from 2025 to 2033. Rapid urbanization, middle-class expansion, and booming construction industries in China, India, and Southeast Asia drive substantial demand. North America maintained a substantial market position owing to large-scale remodeling, restoration projects, and robust housing demand. Europe’s focus on sustainable, energy-efficient paints and coatings supports steady growth, with stricter green building standards fueling demand for waterborne and low-VOC products. Latin America and Middle East & Africa present incremental opportunities tied to rising commercial investments, large-scale infrastructure projects, and evolving consumer awareness of aesthetics and surface protection across Brazil, Mexico, the GCC, and South Africa.

Competitive Trends

The competitive landscape features a broad mix of international giants and regional specialists with advanced R&D capabilities. In 2024, companies like AkzoNobel, PPG Industries, Sherwin-Williams Company, Nippon Paint Holdings, Axalta Coating Systems, and BASF Coatings maintained leadership in diverse coatings portfolios. Players such as Jotun Group, Hempel, Kansai Paint, and RPM International expanded their water-based and sustainable offerings to comply with VOC regulations. Meanwhile, Benjamin Moore & Co. and Masco Corporation strengthened direct customer engagement through dedicated retail channels and exclusive color palettes. Other notable companies like Asian Paints Limited and Tikkurila Oyj invested in capacity expansions and co-development programs with applicators and architects. Going forward, the market is projected to witness further alliances around green chemistry, automated color-matching solutions, surface performance data, and smart coating diagnostics. Global partnerships with raw material suppliers and the digitalization of application techniques will remain competitive differentiators up to 2033.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Architectural Coatings, Enamels, Primers, Stains, Solvents, and Lacquers market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Product Type

| |

Technology

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report