The global arterial filter market is expected to grow at a CAGR of 7.0% from 2025 to 2033, driven by the increasing volume of cardiac surgeries, advancements in extracorporeal circulation technologies, and rising demand for improved patient safety during cardiopulmonary bypass (CPB) procedures. Arterial filters play a critical role in capturing emboli, air bubbles, and particulate matter before blood re-enters the patient’s body, minimizing post-operative complications. The rising geriatric population, growing incidence of cardiovascular diseases, and increasing access to surgical interventions in emerging markets are accelerating market demand. Innovations in filter materials, priming volume optimization, and integration with heart-lung machines are further enhancing product adoption.

Market Drivers

Increasing Prevalence of Cardiovascular Disorders and Cardiac Surgeries

With the global burden of cardiovascular diseases rising sharply especially among aging populations - demand for safe and efficient extracorporeal circulation systems is growing. Arterial filters are integral to bypass circuits, ensuring embolic protection during coronary artery bypass grafting (CABG), valve replacement, and congenital defect repairs. As procedural volumes rise, particularly in high-income and rapidly developing countries, hospitals and surgical centers are adopting advanced arterial filters to reduce systemic inflammatory responses and improve clinical outcomes.

Technological Innovations in Filter Materials and Design

Manufacturers are focusing on the development of arterial filters made from biocompatible, non-thrombogenic materials such as polypropylene, polyethylene, and PVC. These materials offer optimal blood compatibility, reduced pressure drop, and enhanced microemboli removal. Innovations such as low-priming-volume designs, integrated heat exchange features, and radial flow configurations are improving usability, reducing hemodilution, and enhancing procedural safety. Additionally, the shift toward pre-assembled and disposable CPB circuits is driving demand for compact and efficient filter systems.

Market Restraint

Cost Sensitivity and Limited Adoption in Low-Resource Settings

Despite clinical benefits, the arterial filter market faces challenges in low-income and cost-sensitive regions due to the relatively high cost of advanced surgical disposables. Public hospitals and underfunded healthcare systems may prioritize cost over innovation, leading to slower replacement cycles or reliance on reusable components. Regulatory hurdles and fragmented reimbursement policies also limit swift adoption of next-generation arterial filters. Furthermore, variability in clinical preferences and standardization gaps across regions can affect product penetration.

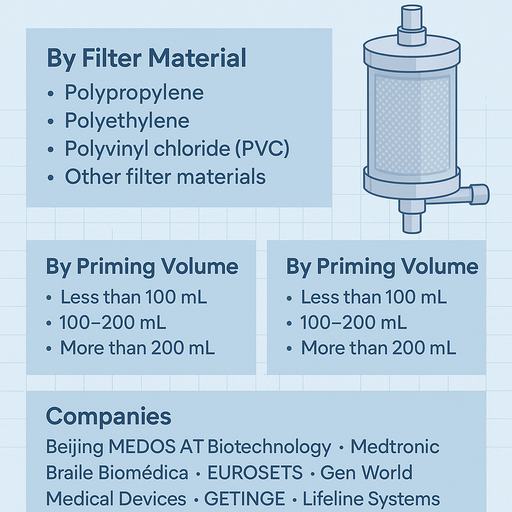

Market Segmentation by Filter Material

The market is segmented into Polypropylene, Polyethylene, Polyvinyl chloride (PVC), and Other filter materials. In 2024, Polypropylene dominated the market due to its widespread use in biocompatible filtration devices, offering high flow rates and minimal hemolysis risk. Polyethylene is also gaining popularity due to its lower cost and structural flexibility. PVC continues to be used in budget-sensitive applications. The “Others” segment includes advanced polymer blends and coated materials under development for next-gen applications aiming to reduce protein adhesion and improve hemodynamic performance.

Market Segmentation by Priming Volume

By priming volume, the market is classified into Less than 100 mL, 100–200 mL, and More than 200 mL. The 100–200 mL segment held the largest revenue share in 2024 due to its balance between hemodilution risk and air removal efficiency. Filters in this range are commonly used in adult cardiac surgeries. The Less than 100 mL segment is expected to grow rapidly due to increasing adoption in pediatric surgeries and minimally invasive cardiac procedures, where minimizing circuit volume is essential. The More than 200 mL segment caters to specific high-flow and complex cases, particularly in multi-organ support systems or large patients.

Geographic Trends

In 2024, North America held the largest share of the arterial filter market, owing to high volumes of open-heart surgeries, strong hospital infrastructure, and early adoption of innovative medical technologies. Europe followed, with strong penetration in countries like Germany, France, and the UK, where advanced cardiac care systems are widely established. The Asia Pacific region is projected to witness the highest CAGR from 2025 to 2033, supported by rising healthcare investments, increasing cardiovascular disease prevalence, and improving access to surgical interventions in China, India, and Southeast Asia. Latin America and the Middle East & Africa are emerging markets, where rising cardiac awareness and public health initiatives are boosting demand.

Competitive Trends

The arterial filter market is moderately consolidated, with established players focusing on R&D, product integration, and clinical safety. TERUMO, Medtronic, and LivaNova lead the global market with robust portfolios, strong distribution networks, and innovation in filter material and flow dynamics. NIPRO and GETINGE provide integrated extracorporeal circulation systems bundled with arterial filters. Companies like Pall Corporation and SENKO Medical Instrument focus on precision microfiltration and biocompatibility. EUROSETS, Braile Biomédica, and Beijing MEDOS AT Biotechnology are expanding regionally with affordable, regulatory-compliant offerings. Competitive priorities include low priming volume, modular integration with CPB systems, and reduced inflammatory response through better design and coating technologies.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Arterial Filter market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Filter Material

| |

Priming Volume

| |

Age Group

| |

Application

| |

End Use

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report