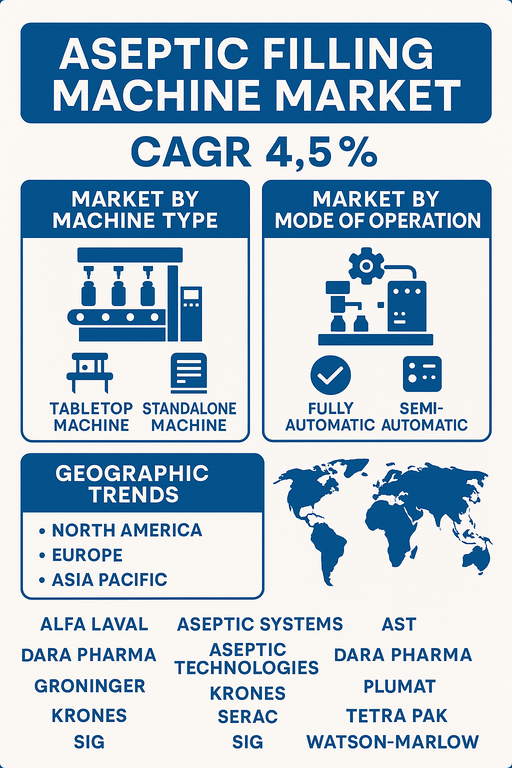

The aseptic filling machine market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.5% from 2025 to 2033, driven by increasing demand for sterile packaging solutions in pharmaceuticals, food & beverages, and biotechnology sectors. Aseptic filling machines ensure the safe and sterile packaging of liquid products without contamination, thereby extending product shelf life and meeting stringent regulatory compliance. The rising need for high-throughput, contamination-free filling processes in vaccine manufacturing, dairy processing, and parenteral drug production is further catalyzing market expansion.

Market Drivers

Rising Demand in Pharmaceutical and Biotech Applications

The pharmaceutical sector remains a key driver due to the increasing production of biologics, vaccines, IV fluids, and injectable drugs that require sterile packaging. With the global rise in chronic diseases and mass immunization campaigns, manufacturers are investing in aseptic filling lines to ensure sterility, reduce human contact, and maintain consistent product quality.

Growth in Demand for Preservative-Free Beverages and Dairy Products

Consumers are shifting toward clean-label and preservative-free liquid foods and beverages. Aseptic filling machines enable extended shelf life without the use of preservatives, making them ideal for milk, juices, plant-based beverages, and soups. This is boosting demand, particularly in emerging markets with limited cold chain infrastructure.

Technological Advancements in Aseptic Filling Lines

Innovations such as robotic filling arms, advanced clean-in-place (CIP) and sterilize-in-place (SIP) systems, and integration with Industry 4.0 technologies (e.g., remote monitoring, predictive maintenance) are enhancing operational efficiency, accuracy, and regulatory compliance. Compact, modular, and scalable systems are increasingly favored across small and mid-sized production facilities.

Market Restraint

High Capital Investment and Regulatory Complexity

Initial setup of aseptic filling systems involves high investment in specialized machinery, sterile environments, validation protocols, and skilled personnel. Moreover, stringent regulatory standards from authorities such as the FDA, EMA, and WHO require extensive compliance and documentation, posing entry barriers for small manufacturers.

Market Segmentation by Machine Type

In 2024, Standalone Machines held the dominant market share due to their application in high-volume manufacturing environments such as pharmaceutical production units, beverage bottling plants, and large-scale dairy operations. Their integration with upstream and downstream automation lines provides continuous and efficient sterile filling. Tabletop Machines, while limited in throughput, are increasingly adopted by laboratories, R&D facilities, and small-scale production units for their compact footprint, lower cost, and flexibility in handling small batches of specialized products.

Market Segmentation by Mode of Operation

Fully Automatic Machines led the market in 2024 and are expected to maintain dominance due to demand for high-speed, low-contamination operations in pharmaceuticals, biotechnology, and high-volume beverage facilities. These systems minimize human intervention, enabling higher precision, sterility, and compliance. Semi-Automatic Machines are preferred by small and medium enterprises (SMEs) and pilot-scale facilities where operational flexibility, lower costs, and easier maintenance are key requirements.

Geographic Trends

Europe dominated the aseptic filling machine market in 2024, driven by the region’s advanced pharmaceutical manufacturing infrastructure and stringent regulatory landscape. Germany, Switzerland, and Italy are major contributors. North America followed, supported by continued investments in biologics, vaccine manufacturing, and sterile packaging by U.S. and Canadian manufacturers. Asia Pacific is expected to register the fastest CAGR through 2033, owing to rising demand for aseptic dairy and beverage packaging, expanding pharmaceutical manufacturing in India and China, and government support for localized production. Latin America and Middle East & Africa are witnessing steady growth due to increased consumption of long-shelf-life beverages and expanding local production facilities.

Competitive Trends

The aseptic filling machine market is moderately consolidated, with a mix of multinational corporations and specialized machine manufacturers. In 2024, Tetra Pak, SIG, and Krones led the food and beverage segment through integrated packaging solutions and aseptic filling systems tailored for high-volume operations. Groninger, Romaco, and Dara Pharma excelled in pharmaceutical filling lines with modular aseptic machines capable of handling vials, syringes, and ampoules. AST, Aseptic Technologies, and Aseptic Systems specialized in sterile environments and compact robotic systems tailored for biotech and personalized medicine. Alfa Laval, Serac, Watson-Marlow, and Weiler Engineering offered robust machine portfolios with global service support and emphasis on CIP/SIP capabilities. Strategic collaborations, technology licensing, and regional manufacturing hubs are anticipated to shape the competitive landscape through 2033.

Historical & Forecast Period

This study report represents analysis of each segment from 2023 to 2033 considering 2024 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2025 to 2033.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Aseptic Filling Machine market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2023-2033 |

| Base Year | 2024 |

| Forecast Period | 2025-2033 |

| Historical Year | 2023 |

| Unit | USD Million |

| Segmentation | |

Machine Type

| |

Mode of Operation

| |

Output Capacity

| |

Packaging Type

| |

Material Compatibility

| |

End Use Industry

| |

Distribution Channel

| |

|

Region Segment (2023-2033; US$ Million)

|

Key questions answered in this report