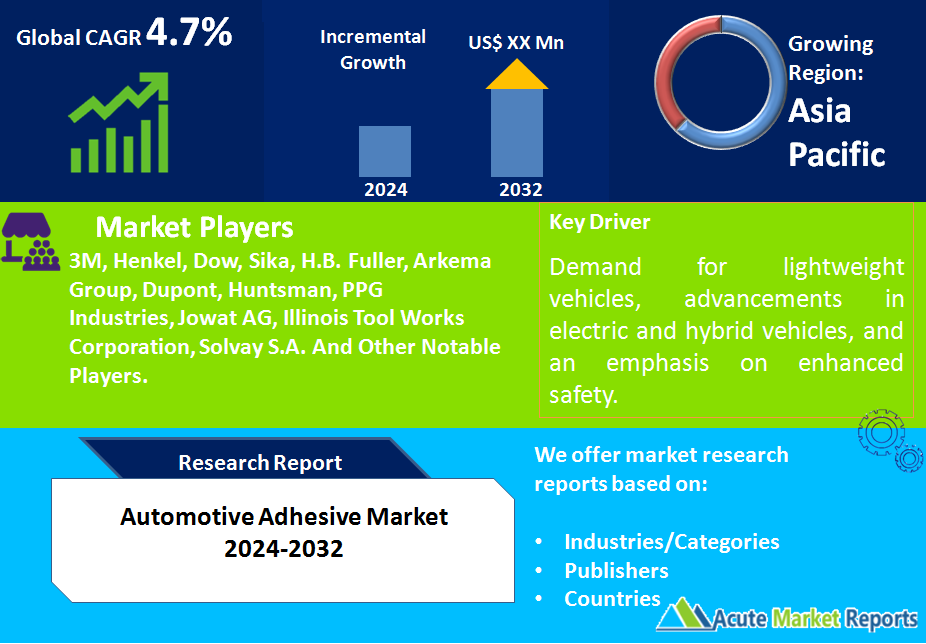

The automotive adhesives market plays a pivotal role in modern vehicle manufacturing, providing essential solutions for bonding, noise, vibration, and harshness (NVH) reduction, and sealing/protection. The automotive adhesives market is expected to grow at a CAGR 4.7% during the forecast period of 2026 to 2034, propelled by the demand for lightweight vehicles, advancements in electric and hybrid vehicles, and an emphasis on enhanced safety. However, challenges associated with solvent-based adhesives present a notable restraint. Market segmentation reflects the dynamic applications of adhesives, with water-based adhesives leading in revenue in 2025, while reactive adhesives exhibit the highest anticipated CAGR. Geographically, Asia-Pacific contributes significantly to revenue, while Europe presents high growth potential.Competitive trends highlight the strategies adopted by major players, including 3M, Henkel, and Dow. These companies leverage innovation and strategic collaborations to maintain a competitive edge. As the automotive adhesives market progresses from 2026 to the forecast period of 2034, strategic positioning, ongoing research, and addressing environmental concerns will be critical for sustained success in this essential sector of modern vehicle manufacturing.

Demand for Lightweight Vehicles and Fuel Efficiency

The automotive industry's pursuit of lightweighting for enhanced fuel efficiency and reduced emissions is a significant driver for the adoption of advanced adhesives. Automakers such as BMW and Tesla have embraced structural adhesives in their manufacturing processes to reduce vehicle weight without compromising structural integrity. The evidence lies in the use of adhesives in bonding lightweight materials like aluminum and composites in vehicle construction. This driver aligns with global initiatives for sustainable transportation and stricter emission standards, propelling the automotive adhesives market forward.

Advancements in Electric and Hybrid Vehicles

The rise of electric and hybrid vehicles is driving the demand for specialized adhesives to address unique challenges. Companies like 3M and Henkel are at the forefront, developing adhesives that offer thermal conductivity for battery applications and contribute to the overall lightweighting of electric vehicles. The evidence lies in the development of electrically conductive adhesives and thermal interface materials tailored for the specific needs of electric powertrains. As electric vehicle adoption continues to surge globally, the demand for such specialized adhesives is expected to be a key growth driver.

Emphasis on Enhanced Safety and Crashworthiness

The automotive industry's continuous focus on improving safety and crashworthiness is driving the adoption of structural adhesives for enhanced bonding and structural integrity. Companies like Dow and Sika have played a pivotal role in developing adhesives that contribute to the overall safety of vehicles by providing additional strength to joints and improving overall crash performance. The evidence lies in the incorporation of structural adhesives in the assembly of critical components, including side impact beams and roof structures. This driver aligns with the growing consumer demand for safer vehicles, making adhesives a crucial component in the pursuit of enhanced automotive safety standards.

Challenges in Solvent-based Adhesive Usage

Despite the overall market growth, challenges associated with solvent-based adhesives pose a notable restraint. Companies such as 3M and Henkel, while offering a wide range of adhesive technologies, face increasing scrutiny due to environmental and health concerns related to solvent-based adhesives. The evidence lies in the industry's shift towards water-based and hot melt adhesives, driven by regulatory pressures and a growing emphasis on eco-friendly alternatives. Overcoming these challenges requires continuous research and development efforts to improve the performance of alternative adhesive technologies while ensuring compliance with stringent environmental regulations.

Technology Segmentation: automotive adhesives market Dominates the Market

In 2025, the highest revenue in the automotive adhesives market was generated by water-based adhesives, offering environmentally friendly solutions and meeting stringent emission standards. However, the highest CAGR during the forecast period (2026-2034) is expected from reactive adhesives and others. This dynamic growth is driven by the demand for adhesives that offer fast curing times and high bond strength, addressing the evolving needs of modern vehicle assembly processes.

Function Segmentation: Bonding Applications Dominates the Market

Bonding applications led the market in revenue in 2025, with adhesives serving a critical role in joining various vehicle components. However, the highest CAGR during the forecast period is anticipated from the NVH segment. Adhesives designed for NVH reduction, as offered by companies like Dow and Sika, play a crucial role in enhancing vehicle comfort and meeting consumer expectations for quieter and smoother driving experiences. This dual segmentation approach reflects the diverse applications of adhesives in addressing both structural and comfort-related aspects in automotive manufacturing.

APAC Remains the Global Leader

Geographically, Asia-Pacific contributed the highest revenue percentage in 2025, driven by the significant automotive production in countries like China and India. However, Europe is poised to exhibit the highest CAGR during the forecast period. The evidence lies in the region's commitment to stringent emission standards and the increasing adoption of electric and hybrid vehicles, driving the demand for advanced adhesives. These geographic trends underscore the importance of tailoring strategies to diverse regional dynamics for market players.

Market Competition to Intensify during the Forecast Period

In 2025, major players in the automotive adhesives market included 3M, Henkel, Dow, Sika, H.B. Fuller, Arkema Group, Dupont, Huntsman, PPG Industries, Jowat AG, Illinois Tool Works Corporation, Solvay S.A., and others. These companies adopted diverse strategies, including research and development, strategic collaborations, and product innovations, to strengthen their market positions. The evidence lies in Henkel's focus on developing adhesives for electric vehicles and Dow's collaboration with automakers for structural adhesive applications. As of 2026, the competitive landscape indicates a dynamic market with companies strategically positioning themselves to capitalize on emerging trends. Revenues for 2026 and the expected landscape for the forecast period (2026-2034) reveal a competitive environment where innovation, market awareness, and global strategies play crucial roles in determining success.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Adhesive market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Technology

|

|

Function

|

|

Vehicle

|

|

Application

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report