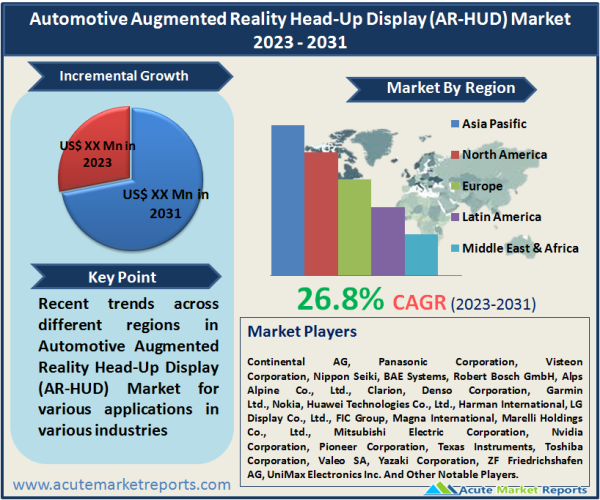

The automotive augmented reality head-up display (AR-HUD) market is expected to experience a CAGR of 26.8% during the forecast period of 2026 to 2034, driven by technology advancements transforming the way drivers interact with vehicle information. In conclusion, the AR-HUD market is driven by enhanced safety and convenience, rising consumer expectations, and regulatory standards, while the high cost remains a restraint. The segmentation reveals a focus on safety and enhanced driving experiences. Geographically, North America and Europe lead the market, while the Asia-Pacific region is expected to grow rapidly. The competitive landscape is characterized by innovation and partnerships to meet consumer demand for advanced AR-HUD systems. The future of the AR-HUD market looks promising, with an evolving focus on safety, convenience, and regulatory compliance.

Enhanced Safety and Convenience

One of the primary drivers of the AR-HUD market is the pursuit of enhanced safety and convenience for drivers. AR-HUD systems project crucial information onto the driver's line of sight, reducing the need to look away from the road. This ensures that drivers can access important data such as speed, navigation directions, and warnings without taking their eyes off the road. In 2025, the demand for AR-HUD systems grew significantly, driven by the increasing emphasis on road safety and the integration of advanced driver-assistance systems (ADAS). As we move into the forecast period from 2026 to 2034, AR-HUD systems are expected to play a pivotal role in promoting safe driving practices. This includes features like Lane Changing Guidance and Pedestrian Warning that are designed to reduce accidents and improve overall road safety.

Rising Consumer Expectations

Consumer expectations for a connected and immersive driving experience have driven the adoption of AR-HUD systems. In 2025, consumers increasingly sought vehicles equipped with advanced technologies, including AR-HUD systems that provide a futuristic and interactive dashboard. The demand for a personalized, high-tech driving environment contributed to the growth of AR-HUD installations. Moreover, the integration of AR-HUD with smartphone connectivity and voice commands provided a seamless and intuitive user experience. As we move into the forecast period from 2026 to 2034, consumer expectations are expected to continue pushing the market forward. The AR-HUD industry will need to focus on further enhancing user interfaces and delivering an increasingly immersive driving experience.

Regulatory and Safety Standards

The enforcement of regulatory and safety standards has become a significant driver for the AR-HUD market. Governments and regulatory bodies are increasingly recognizing the potential of AR-HUD systems to enhance road safety and reduce distractions for drivers. This has led to the establishment of guidelines and standards to ensure the responsible and safe integration of AR-HUD technology. In 2025, these standards started to shape the market, as automakers and technology providers adhered to them, enhancing the credibility and trustworthiness of AR-HUD systems. Moving forward into the forecast period from 2026 to 2034, adherence to these standards is expected to remain a driving force behind the continued growth of AR-HUD adoption.

Restraints

Despite the promising growth, a significant restraint in the AR-HUD market is the high cost of implementation. In 2025, the installation of AR-HUD systems in vehicles often came with a premium price tag, making them a feature in high-end and luxury vehicles. The cost of hardware, software development, and integration posed challenges for widespread adoption, particularly in the mid-range and economy segments. While AR-HUD systems offer significant advantages, the cost remains a constraint for many consumers. However, it is expected that as technology evolves and economies of scale are realized, the cost of AR-HUD systems will gradually decrease, making them more accessible in the coming years.

Market Segmentation by Feature: AR Navigation Dominates the Market

The AR-HUD market can be segmented by feature into AR Navigation, Ultra-wide 13° x 5° FOV, Marked Lane Violation Warning, Pedestrian Warning, Front Vehicle Distance Warning, Lane Changing Guidance, Enhanced Rain-Fog Display, and Others. In 2025, the highest revenue was generated by AR Navigation, which provides drivers with real-time navigation guidance. However, during the forecast period (2026-2034), Marked Lane Violation Warning is expected to exhibit the highest CAGR. This feature is crucial for preventing lane violations and accidents and aligns with the growing focus on road safety.

Market Segmentation by PGU Technology: TFT-LCD technology Dominates the Market

The market can also be segmented by PGU technology into Thin-Film-Transistor Liquid-Crystal Display (TFT-LCD), Digital Light Processing (DLP), Liquid Crystal-on-Silicon (LCOS), and Laser Scanning Projection (LSP). In 2025, TFT-LCD technology generated the highest revenue, driven by its reliability and cost-effectiveness. However, during the forecast period (2026-2034), Laser Scanning Projection (LSP) technology is expected to exhibit the highest CAGR due to its potential for high-quality, large-scale displays.

APAC Promises Significant Opportunities during the Forecast Period

Geographically, the AR-HUD market experiences regional variations. In 2025, North America and Europe accounted for the highest revenue percentage, largely due to their advanced automotive industries and strong consumer demand for cutting-edge vehicle technologies. However, the Asia-Pacific region is expected to witness the highest CAGR during the forecast period. This is driven by the region's growing automotive market, rising disposable incomes, and the increasing preference for high-tech vehicles. The Middle East and Africa region is also showing potential, as luxury car sales and technological adoption increase.

Cutting-Edge Technologies to Enhance the Market Share of Market Players

The AR-HUD market is highly competitive, with top players such as Continental AG, Panasonic Corporation, Visteon Corporation, Nippon Seiki, BAE Systems, Robert Bosch GmbH, Alps Alpine Co., Ltd., Clarion, Denso Corporation, Garmin Ltd., Nokia, Huawei Technologies Co., Ltd., Harman International, LG Display Co., Ltd., FIC Group, Magna International, Marelli Holdings Co., Ltd., Mitsubishi Electric Corporation, Nvidia Corporation, Pioneer Corporation, Texas Instruments, Toshiba Corporation, Valeo SA, Yazaki Corporation, ZF Friedrichshafen AG, and UniMax Electronics Inc. dominating the industry. These companies have invested significantly in research and development to create innovative and high-quality AR-HUD systems. To maintain a competitive edge, companies are expected to continue developing cutting-edge technologies and forming partnerships with automotive manufacturers. In the forecast period from 2026 to 2034, the market is expected to witness increased competition and innovation as companies strive to meet consumer demands for advanced, safe, and immersive driving experiences.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Augmented Reality Head-Up Display (AR-HUD) market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Feature

|

|

PGU Technology

|

|

Display Content

|

|

Vehicle Type

|

|

Sales Channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report