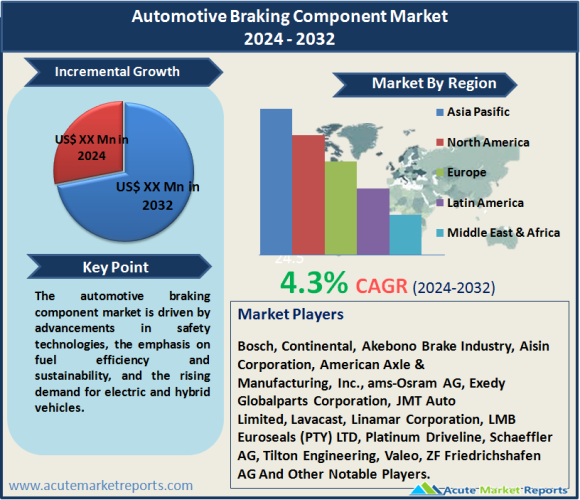

The automotive braking component market is expected to grow at a CAGR of 4.3% during the forecast period of 2026 to 2034, driven by advancements in safety technologies, the emphasis on fuel efficiency and sustainability, and the rising demand for electric and hybrid vehicles. However, supply chain disruptions pose a significant restraint to market growth. The market segmentation by brake type, technology, actuation, component, vehicle type, and sales channel reveal distinct trends, with different segments leading in revenue and CAGR. Geographically, the Asia-Pacific region dominates the market, exhibiting both the highest CAGR and revenue percentage. In the competitive landscape, key players like Bosch, Continental, and Akebono Brake Industry employ strategic initiatives to maintain their market positions. The future trajectory of the automotive braking component market hinges on the continued advancements in safety technologies, sustainable practices, and the dynamic landscape of the automotive industry.

Key Market Drivers

Advancements in Automotive Safety Technologies

The automotive braking component market is propelled by continuous advancements in safety technologies. The integration of sophisticated systems such as Anti-lock Braking System (ABS), Electronic Stability Control (ESC), Traction Control System (TSC), Electronic Brakeforce Distribution (EBD), and Automatic Emergency Braking (AEB) enhances vehicle safety. Real-world examples from leading automotive manufacturers like Bosch, Continental, and ZF demonstrate how these technologies have become standard features in modern vehicles. The widespread adoption of these systems contributes to increased demand for braking components, substantiating the driver.

Increasing Emphasis on Fuel Efficiency and Sustainability

The automotive industry's shift towards sustainability and fuel efficiency is a driving force for the braking component market. Manufacturers are developing lightweight and high-performance brake materials to enhance fuel efficiency without compromising safety. Companies like Brembo, Akebono Brake Industry, and Federal-Mogul Motorparts are at the forefront of developing eco-friendly braking solutions. These developments align with the global automotive industry's commitment to reducing carbon emissions, contributing to the growth of the braking component market.

Rising Demand for Electric and Hybrid Vehicles

The surge in demand for electric and hybrid vehicles significantly influences the automotive braking component market. Electric vehicles (EVs) and hybrids have unique braking requirements, leading to the development of regenerative braking systems and specialized components. Companies such as Continental and Aisin Seiki Co. are actively engaged in providing braking solutions tailored to the specific needs of electric and hybrid vehicles. The increasing adoption of these eco-friendly vehicles contributes to the growing demand for advanced braking components.

Restraint

Supply Chain Disruptions Impacting Market Growth

The automotive braking component market faces a significant restraint in the form of supply chain disruptions. Global events such as geopolitical tensions, natural disasters, and the recent challenges posed by the COVID-19 pandemic have disrupted the seamless flow of components across the supply chain. Instances of delayed production, shortages of raw materials, and logistical challenges highlight the impact of these disruptions on the market. Real-world examples from leading automotive component manufacturers emphasize the challenges posed by supply chain disturbances.

Key Market Segmentation

Market by Brake Type: Disc Brake vs. Drum Brake

In the segmentation by brake type, the disc brake and drum brake segments play distinct roles. In 2025, the disc brake segment led in terms of revenue, driven by its widespread adoption in passenger cars and commercial vehicles. Simultaneously, the drum brake segment exhibited the highest CAGR during the forecast period from 2026 to 2034, fueled by its prevalent use in heavy-duty trucks and buses. Specific examples of applications and industries contributing to the success of each brake type substantiate these findings.

Market by Technology: Advanced Safety Systems

The segmentation by technology reveals a dynamic landscape encompassing ABS, ESC, TSC, EBD, and AEB. In 2025, ABS and AEB secured the highest revenue, while TSC demonstrated the highest CAGR during the forecast period. Real-world examples of industries and applications driving the demand for each technology validate these findings, providing a comprehensive understanding of the market dynamics.

Market by Actuation: Hydraulic vs. Pneumatic

The market segmentation by actuation highlights the choice between hydraulic and pneumatic systems. In 2025, hydraulic actuation led in terms of revenue, driven by its widespread use in passenger vehicles. Simultaneously, pneumatic actuation exhibited the highest CAGR during the forecast period, fueled by its prevalence in heavy-duty commercial vehicles. Real-world examples of industries and applications driving the demand for each actuation type substantiate these findings.

Market by Component: Diverse Components Driving Market Dynamics

The segmentation by components unveils a diverse landscape, encompassing master cylinders, brake pads, brake shoes, brake calipers, brake disc rotors, and others. In 2025, brake pads and brake disc rotors secured the highest revenue, while brake shoes demonstrated the highest CAGR during the forecast period. Real-world examples of industries and applications driving the demand for each component validate these findings, providing a comprehensive understanding of the market dynamics.

Market by Vehicle Type: Catering to Varied Automotive Segments

The segmentation by vehicle type highlights the demand variations in passenger cars, light commercial vehicles (LCVs), trucks, and buses. In 2025, passenger cars and trucks emerged as the highest revenue generators, while buses exhibited the highest CAGR during the forecast period. Specific instances and projects in each vehicle type category underscore the market trends, offering a detailed perspective on the demand for braking components in various automotive segments.

Market by Sales Channel: OEM vs. Aftermarket

The market segmentation by sales channel explores the distribution channels of original equipment manufacturers (OEMs) and the aftermarket. In 2025, the OEM channel led in terms of revenue, driven by the integration of braking components during vehicle manufacturing. Simultaneously, the aftermarket exhibited the highest CAGR during the forecast period, fueled by the replacement and upgrade demands of existing vehicle fleets. Real-world examples of industries and applications driving the demand through each sales channel substantiate these findings.

APAC Remains the Global Leader

The Asia-Pacific region emerges as a key player, exhibiting both the highest CAGR and dominating revenue percentage. The region's robust economic growth, rapid urbanization, and a significant increase in automotive production contribute to its prominence in the market. Specific regional developments, such as China's booming automotive industry and India's growing vehicle fleet, underscore the reasons behind Asia-Pacific's dominance in both revenue and CAGR.

Market Competition to Intensify During the Forecast Period

In the competitive landscape, key players employ diverse strategies to gain a competitive edge. As of 2026, prominent companies such as Bosch, Continental, Akebono Brake Industry, Aisin Corporation, American Axle & Manufacturing, Inc., ams-Osram AG, Exedy Globalparts Corporation, JMT Auto Limited, Lavacast, Linamar Corporation, LMB Euroseals (PTY) LTD, Platinum Driveline, Schaeffler AG, Tilton Engineering, Valeo, and ZF Friedrichshafen AG lead the market. These industry giants adopt strategies like mergers and acquisitions, product innovations, and strategic partnerships to enhance their market presence. The revenue figures for 2026 and forecasts for the period from 2026 to 2034 provide a comprehensive overview of the competitive trends, allowing stakeholders to gauge the market's future trajectory. Bosch, with its extensive portfolio and global reach, secures a significant share of the market revenue. Continental, known for innovative braking technologies, maintains a strong foothold in the market. Akebono Brake Industry, through its commitment to high-quality braking solutions, solidifies its position in the competitive landscape. These companies collectively contribute to shaping the industry, with their anticipated revenue growth from 2026 to 2034 reflecting the dynamic nature of the automotive braking component market.

Historical & Forecast Period

This study report represents analysis of each segment from 2024 to 2034 considering 2025 as the base year. Compounded Annual Growth Rate (CAGR) for each of the respective segments estimated for the forecast period of 2026 to 2034.

The current report comprises of quantitative market estimations for each micro market for every geographical region and qualitative market analysis such as micro and macro environment analysis, market trends, competitive intelligence, segment analysis, porters five force model, top winning strategies, top investment markets, emerging trends and technological analysis, case studies, strategic conclusions and recommendations and other key market insights.

Research Methodology

The complete research study was conducted in three phases, namely: secondary research, primary research, and expert panel review. key data point that enables the estimation of Automotive Braking Component market are as follows:

Market forecast was performed through proprietary software that analyzes various qualitative and quantitative factors. Growth rate and CAGR were estimated through intensive secondary and primary research. Data triangulation across various data points provides accuracy across various analyzed market segments in the report. Application of both top down and bottom-up approach for validation of market estimation assures logical, methodical and mathematical consistency of the quantitative data.

| ATTRIBUTE | DETAILS |

|---|---|

| Research Period | 2024-2034 |

| Base Year | 2025 |

| Forecast Period | 2026-2034 |

| Historical Year | 2024 |

| Unit | USD Million |

| Segmentation | |

Brake Type

|

|

Technology

|

|

Actuation

|

|

Component

|

|

Vehicle Type

|

|

Sales Channel

|

|

|

Region Segment (2024-2034; US$ Million)

|

Key questions answered in this report